Ai In Financial Technology

Published Date: 24 January 2026 | Report Code: ai-in-financial-technology

Ai In Financial Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ai In Financial Technology market, focusing on the period from 2024 to 2033. It covers market size, growth trends, regional and segment analysis, technological innovations, and key market players. The insights presented herein aim to guide stakeholders in making informed decisions within this rapidly evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

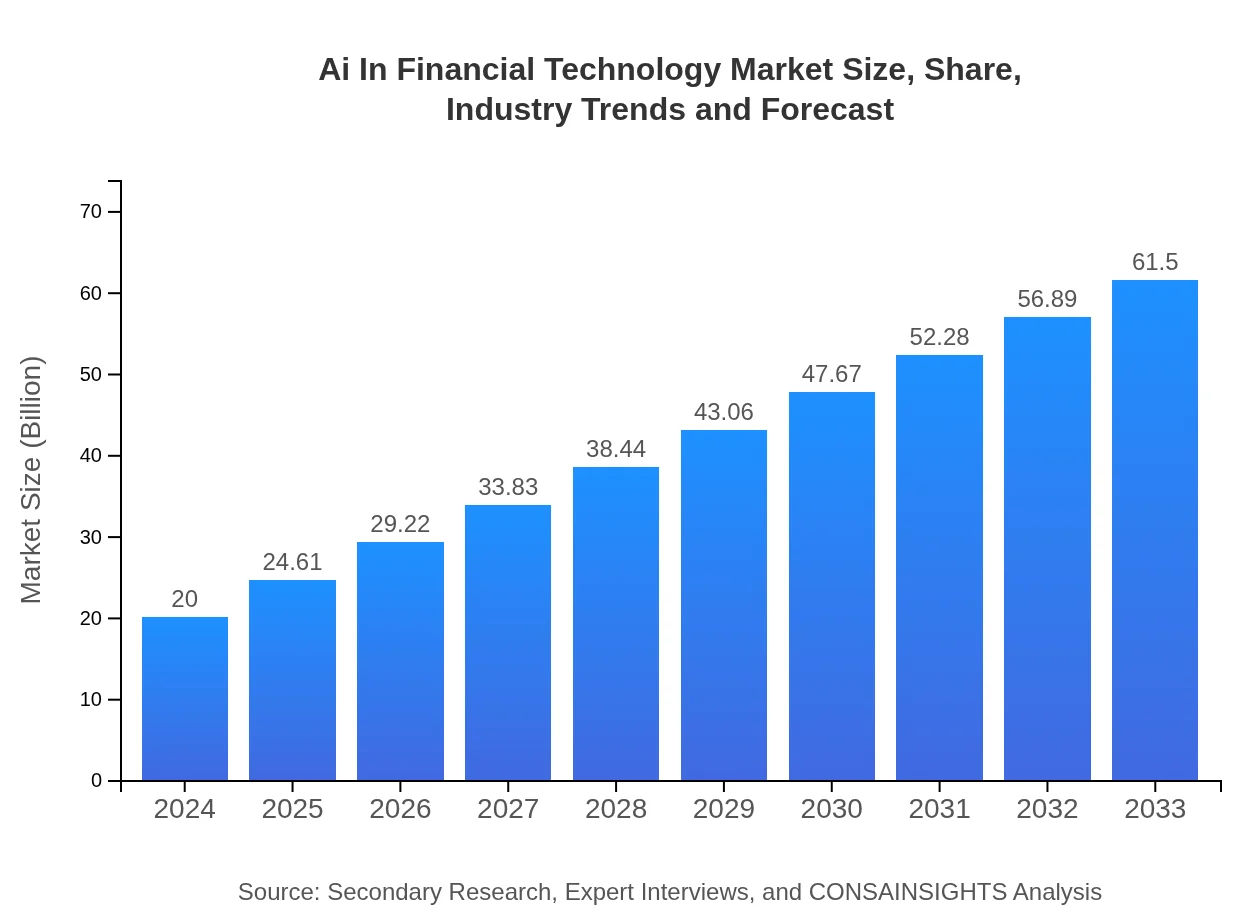

| 2024 Market Size | $20.00 Billion |

| CAGR (2024-2033) | 12.7% |

| 2033 Market Size | $61.50 Billion |

| Top Companies | FinTech Innovators Inc., AI Financial Solutions Ltd. |

| Last Modified Date | 24 January 2026 |

Ai In Financial Technology Market Overview

Customize Ai In Financial Technology market research report

- ✔ Get in-depth analysis of Ai In Financial Technology market size, growth, and forecasts.

- ✔ Understand Ai In Financial Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Financial Technology

What is the Market Size & CAGR of Ai In Financial Technology market in 2024?

Ai In Financial Technology Industry Analysis

Ai In Financial Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Financial Technology Market Analysis Report by Region

Europe Ai In Financial Technology:

Europe exhibits robust growth and high adoption rates of AI across the financial landscape. With a market size of 6.87 in 2024 and substantial growth projected to 21.14 by 2033, European financial institutions are integrating AI to enhance compliance, streamline operations, and optimize customer service. Government initiatives and strict regulatory measures also ensure a balanced growth environment that encourages innovation while protecting consumer interests.Asia Pacific Ai In Financial Technology:

In the Asia Pacific region, the AI in Financial Technology market is witnessing accelerated growth driven by rapid digital transformation and increasing investments by both government and private sectors. In 2024, the market was valued at approximately 3.36, and projections indicate it will reach around 10.33 by 2033. The region benefits from a large consumer base, progressive regulatory reforms, and a surge of tech startups focusing on AI innovations in finance.North America Ai In Financial Technology:

North America remains one of the most mature markets for Ai In Financial Technology, with strong technological infrastructure and advanced digital ecosystems. Valued at 6.77 in 2024 and forecasted to grow significantly to 20.82 by 2033, this region continues to lead in research, development, and adoption of AI-driven technologies in financial services. Innovation hubs in the United States and Canada foster dynamic growth and consistent investments in AI applications.South America Ai In Financial Technology:

The South American market is emerging as a notable segment, with a modest base market value of 1.31 in 2024 and an expected growth to 4.02 by 2033. Financial institutions in this region are progressively adopting AI solutions to handle credit risk, fraud detection, and customer interactions. Despite slower overall growth compared to other regions, the market is gaining momentum through localized technology solutions and supportive public policies.Middle East & Africa Ai In Financial Technology:

The Middle East and Africa region, though smaller in scale with a market value of 1.69 in 2024, is rapidly evolving with expectations to reach around 5.19 by 2033. Increasing investment in digital infrastructure and the implementation of AI-driven solutions in risk management and fraud detection are significantly influencing market dynamics. Both regions are leveraging technology to overcome traditional barriers in the financial services industry, setting the stage for steady future growth.Tell us your focus area and get a customized research report.

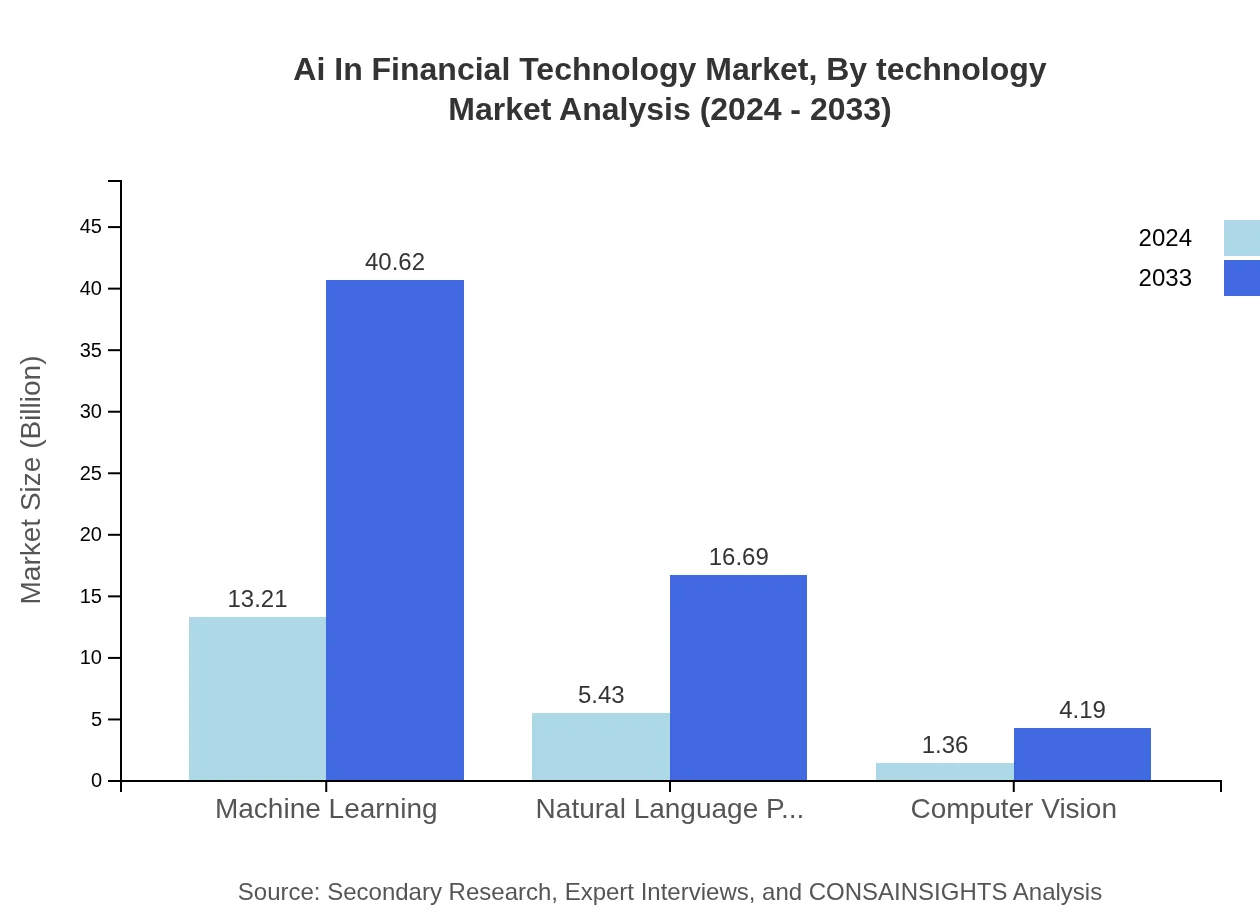

Ai In Financial Technology Market Analysis By Technology

The technological segment in the AI in Financial Technology market is predominantly driven by innovations in machine learning, natural language processing, and computer vision. For instance, machine learning shows a promising expansion from a size of 13.21 in 2024 to 40.62 in 2033, maintaining a dominant market share. Such technologies offer advanced predictive analytics, enhance decision-making processes, and streamline operations across financial services. The continuous evolution of these technologies ensures that financial institutions can adapt to complex market dynamics while staying ahead of competitive challenges.

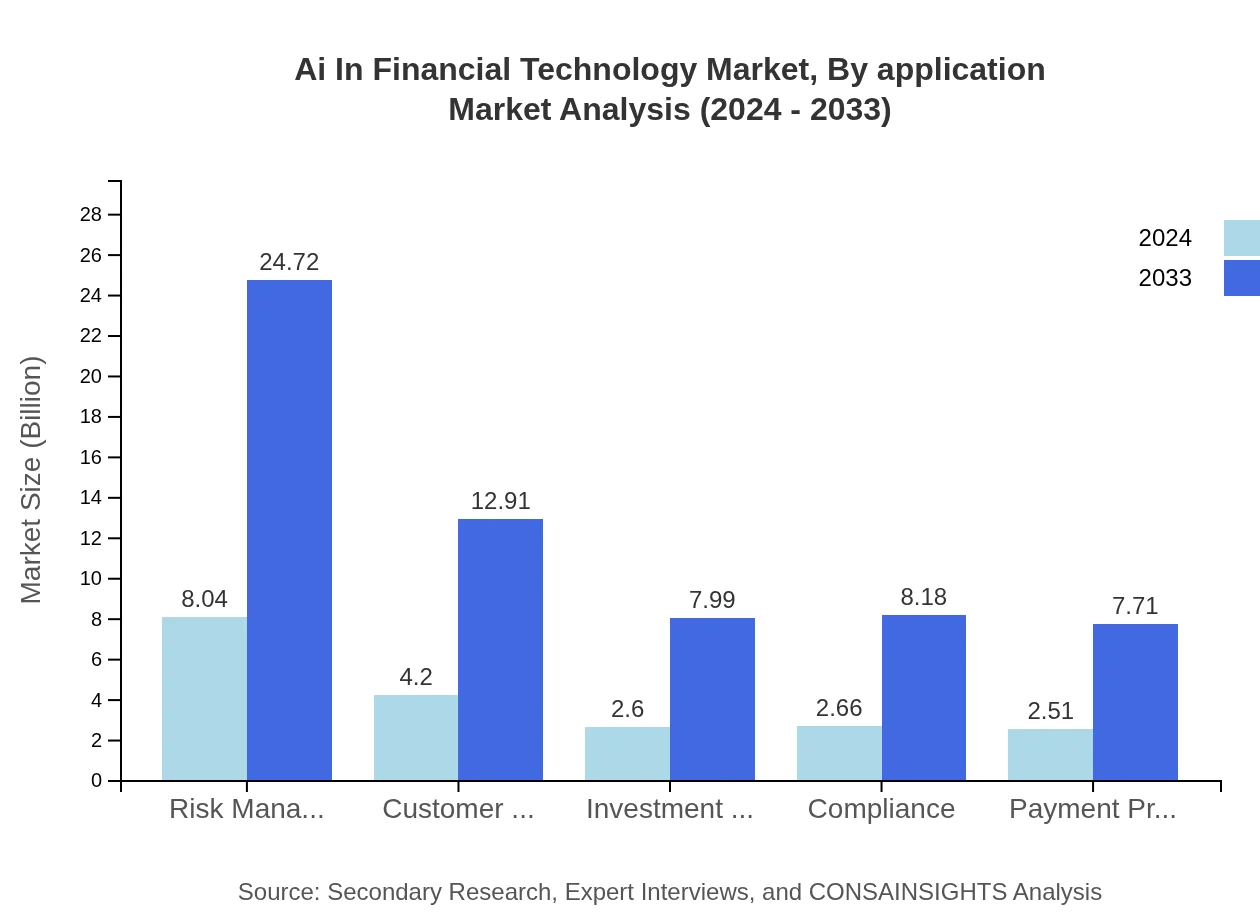

Ai In Financial Technology Market Analysis By Application

The application segment covers a wide array of uses including risk management, customer service, investment advisory, payment processing, and more. Each application plays a crucial role in enhancing operational efficiency and regulatory compliance. For example, the risk management segment is expected to grow from a size of 8.04 in 2024 to 24.72 by 2033, reinforcing its importance in mitigating losses and ensuring stability in financial operations. Customer service solutions, investment advisory tools, and payment processing systems are similarly undergoing transformative improvements, making the application segment a cornerstone of market growth.

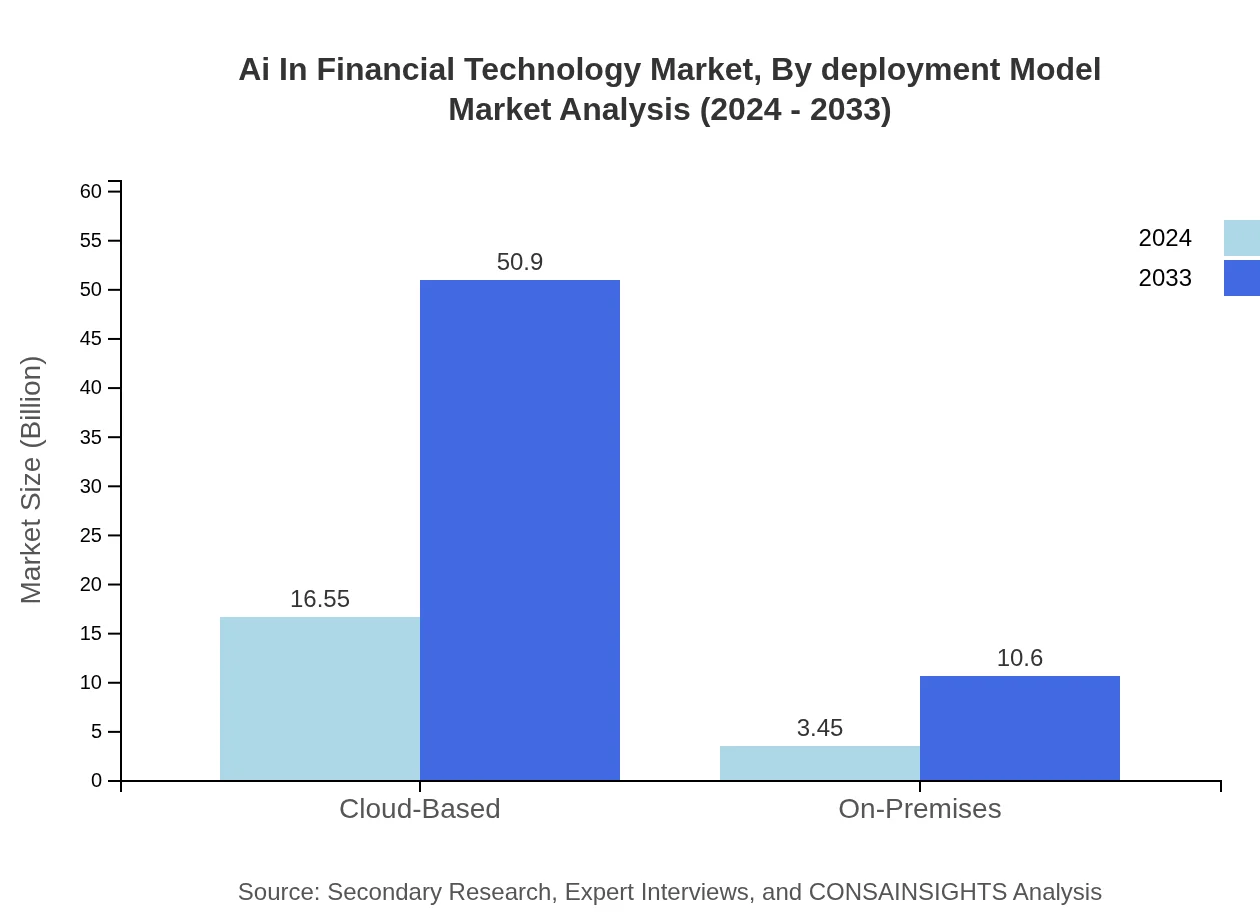

Ai In Financial Technology Market Analysis By Deployment Model

Deployment models in the AI in Financial Technology market are categorized mainly into cloud-based and on-premises solutions. Cloud-based deployment offers scalability, cost efficiency, and ease of integration. In 2024, the cloud-based market is estimated at a size of 16.55, with expectations to reach 50.90 by 2033, capturing a commanding share of 82.77%. On the other hand, on-premises models, though smaller in scale with a size of 3.45 in 2024 and 10.60 in 2033, provide a secure environment for sensitive data. This segmentation demonstrates how deployment choices significantly influence overall market dynamics.

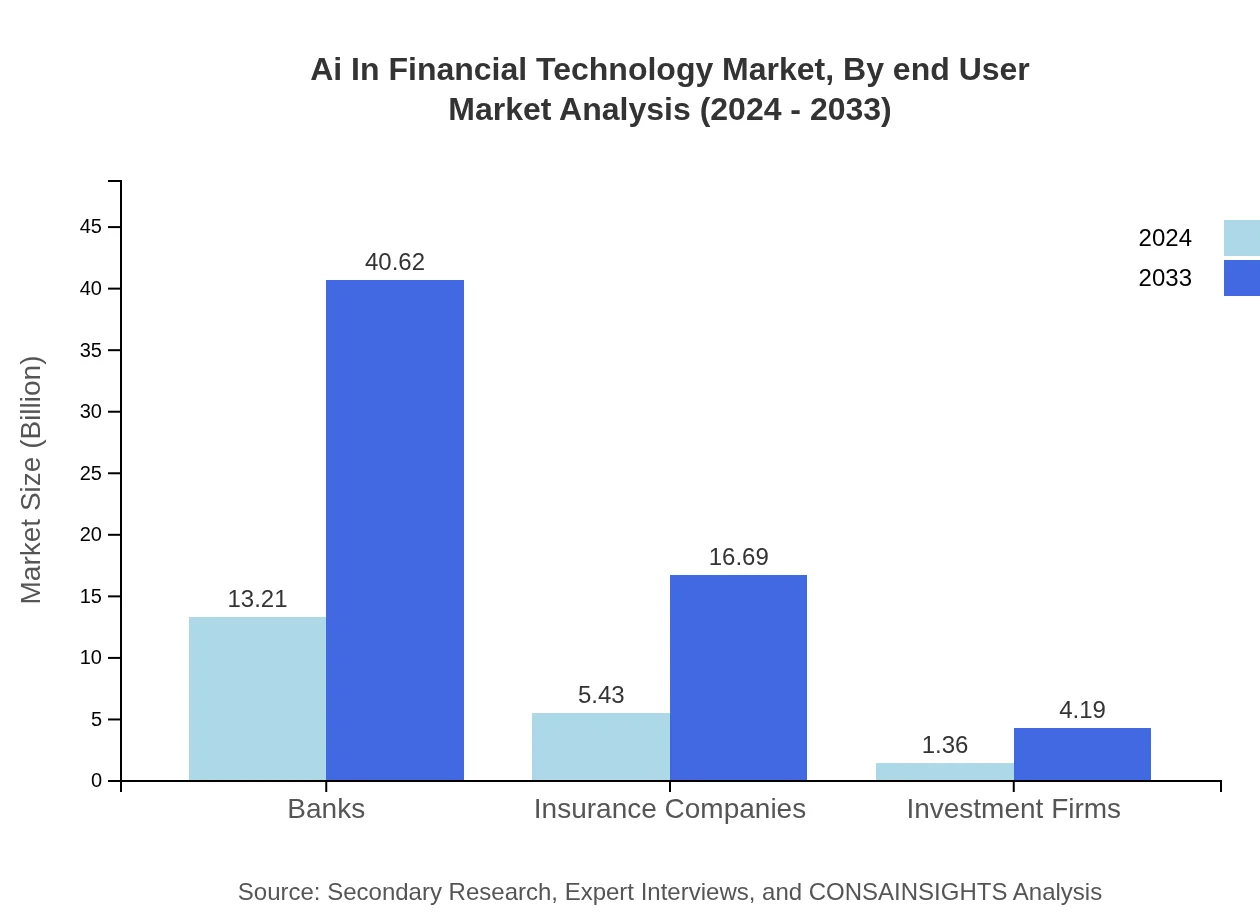

Ai In Financial Technology Market Analysis By End User

The end-user segment includes banks, insurance companies, and investment firms, which are the primary beneficiaries of advanced AI solutions. Banks, for instance, foresee growth from a market size of 13.21 in 2024 to 40.62 by 2033, dominating with a constant market share of 66.05%. Insurance companies and investment firms are also strong adopters, leveraging AI for claims processing, fraud detection, and customer analytics. By integrating AI, these end-users are better positioned to optimize resource allocation and improve service delivery, thereby bolstering market growth.

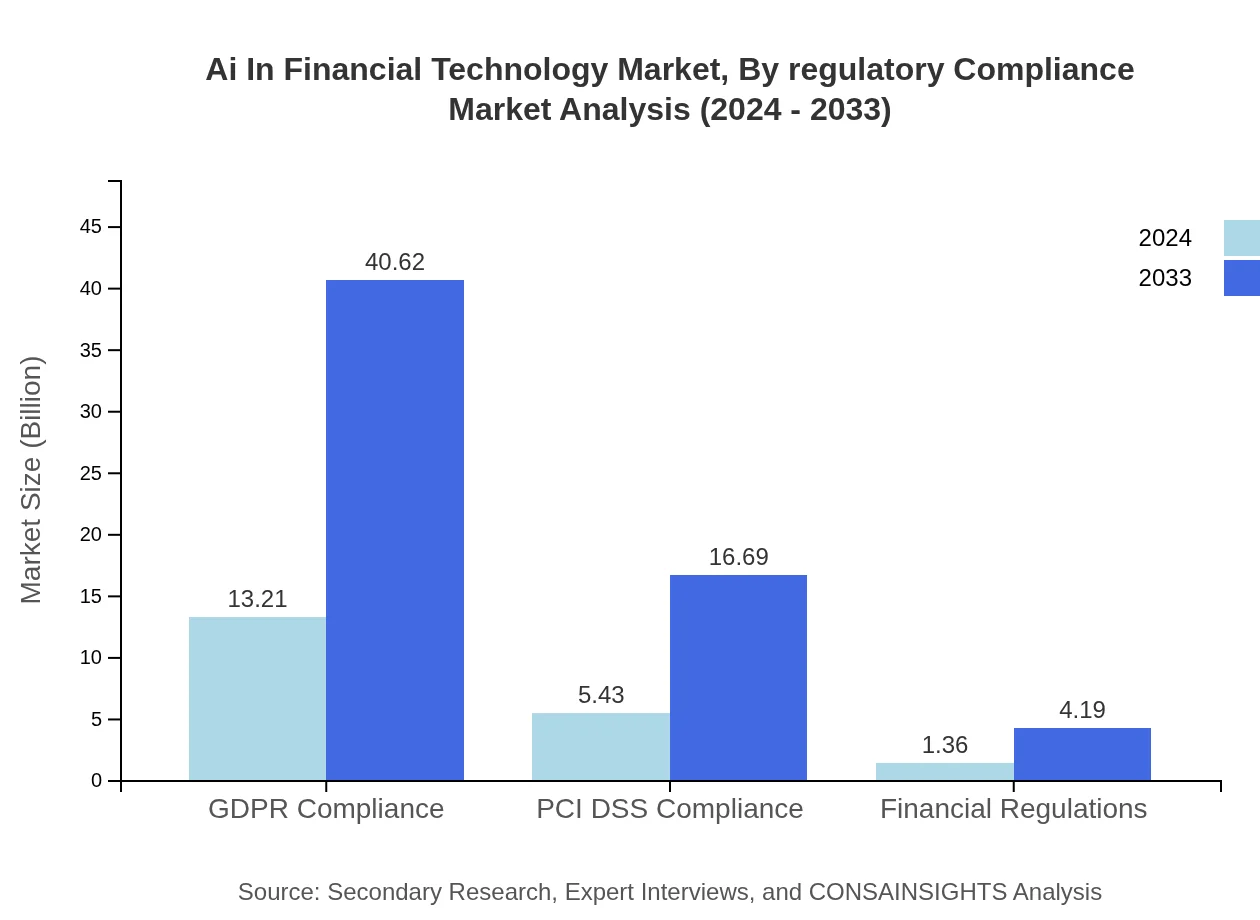

Ai In Financial Technology Market Analysis By Regulatory Compliance

The regulatory compliance segment is critical in ensuring that the rapid adoption of AI does not compromise data security and privacy. With frameworks such as GDPR and PCI DSS, the market for compliance is becoming increasingly robust. For example, GDPR Compliance shows a market size expansion from 13.21 in 2024 to 40.62 in 2033, maintaining a strong market share, while PCI DSS Compliance follows a similar trend. This segment not only supports the operational integrity of financial institutions but also fosters consumer trust and enhances the overall attractiveness of AI-driven solutions.

Ai In Financial Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Financial Technology Industry

FinTech Innovators Inc.:

A leading company at the intersection of finance and technology, FinTech Innovators Inc. offers a wide range of AI-driven solutions that enhance risk management, customer service, and operational efficiency. Their cutting-edge platforms are widely adopted by banks and insurance companies across the globe.AI Financial Solutions Ltd.:

AI Financial Solutions Ltd. specializes in integrating advanced machine learning and natural language processing systems into financial services. Their innovative products have set new benchmarks in regulatory compliance and fraud prevention, making them a trusted partner for many financial institutions.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Financial Technology?

The AI in Financial Technology market is projected to reach $20 billion by 2033, growing at a CAGR of 12.7% from 2024. This signifies significant growth as financial institutions increasingly adopt AI to enhance services and reduce operational costs.

What are the key market players or companies in this ai In Financial Technology industry?

Leading companies in the AI in Financial Technology market include giants such as IBM, Google, and Microsoft, along with emerging fintech startups. These players drive innovations in algorithm development and AI-integrated financial services, enhancing the overall market landscape.

What are the primary factors driving the growth in the ai In Financial Technology industry?

Key factors driving growth include rising demand for automated services in banking, advancements in AI technologies like machine learning, and the necessity for enhanced fraud detection and risk management. The shift towards digital finance also accelerates this growth.

Which region is the fastest Growing in the ai In Financial Technology?

The fastest-growing region in the AI in Financial Technology market is Europe, projected to grow from $6.87 billion in 2024 to $21.14 billion by 2033. North America follows closely, showcasing strong adoption in AI applications within financial services.

Does ConsaInsights provide customized market report data for the ai In Financial Technology industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the AI in Financial Technology sector. This includes detailed analyses based on market segments, regional insights, and emerging trends relevant to clients.

What deliverables can I expect from this ai In Financial Technology market research project?

Expect comprehensive insights including market size estimates, segmented analyses, regional growth forecasts, and competitive landscape overviews. Reports will provide actionable data to inform strategy and investment decisions in the AI and fintech domains.

What are the market trends of ai In Financial Technology?

Current trends include increased investment in AI-driven risk management solutions, a surge in regulatory compliance tools leveraging AI, and the growing adoption of cloud-based financial services. Companies aim for enhanced customer experiences through personalized AI applications.