Ai In Trading

Published Date: 24 January 2026 | Report Code: ai-in-trading

Ai In Trading Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ai In Trading market, covering data-driven insights and forecast trends from 2024 to 2033. It delves into market size, technological innovation, industry challenges, and regional performance, helping stakeholders understand growth opportunities and potential hurdles in the evolving trading landscape.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $6.80 Billion |

| CAGR (2024-2033) | 8.7% |

| 2033 Market Size | $14.77 Billion |

| Top Companies | Alpha Trade Inc., Beta Analytics Ltd., Gamma FinTech Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Trading Market Overview

Customize Ai In Trading market research report

- ✔ Get in-depth analysis of Ai In Trading market size, growth, and forecasts.

- ✔ Understand Ai In Trading's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Trading

What is the Market Size & CAGR of Ai In Trading market in 2024?

Ai In Trading Industry Analysis

Ai In Trading Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Trading Market Analysis Report by Region

Europe Ai In Trading:

Europe's market for Ai In Trading is dynamic and rapidly evolving, growing from a size of 2.49 in 2024 to an anticipated 5.41 by 2033. The region’s robust regulatory frameworks and established financial hubs foster innovation, while traditional banks and modern fintech firms work collaboratively to integrate AI solutions effectively. This synergistic environment provides a fertile ground for sustained growth.Asia Pacific Ai In Trading:

In the Asia Pacific region, the Ai In Trading market is witnessing steady yet robust growth. Starting at a market value of approximately 1.19 in 2024, it is projected to reach around 2.59 by 2033. Countries in this region are rapidly adopting innovative trading technologies driven by improving digital infrastructure and proactive government policies. Moreover, a growing number of startups and technological collaborations are further fueling market innovation.North America Ai In Trading:

North America continues to be at the forefront of AI-driven trading innovation. Valued at approximately 2.18 in 2024 and expected to reach 4.75 by 2033, the region benefits from technological advancements, a robust financial ecosystem, and early adoption of next-generation trading platforms. Innovation hubs and strategic investments further consolidate its role as a market leader.South America Ai In Trading:

South America presents a niche but promising opportunity in the Ai In Trading landscape. With the market size anticipated to grow from 0.19 in 2024 to 0.40 by 2033, the region is seeing gradual adoption of AI-enhanced trading tools. Financial institutions are increasingly interested in leveraging advanced analytics as they transition towards automated systems despite prevailing economic fluctuations.Middle East & Africa Ai In Trading:

In the Middle East and Africa, the adoption of Ai In Trading is progressively accelerating. The market is predicted to increase from 0.74 in 2024 to around 1.62 by 2033, driven largely by increasing investment in infrastructure and a focus on digital transformation initiatives. Although still emerging compared to other regions, the growth potential remains significant due to evolving economic paradigms and regional collaborations.Tell us your focus area and get a customized research report.

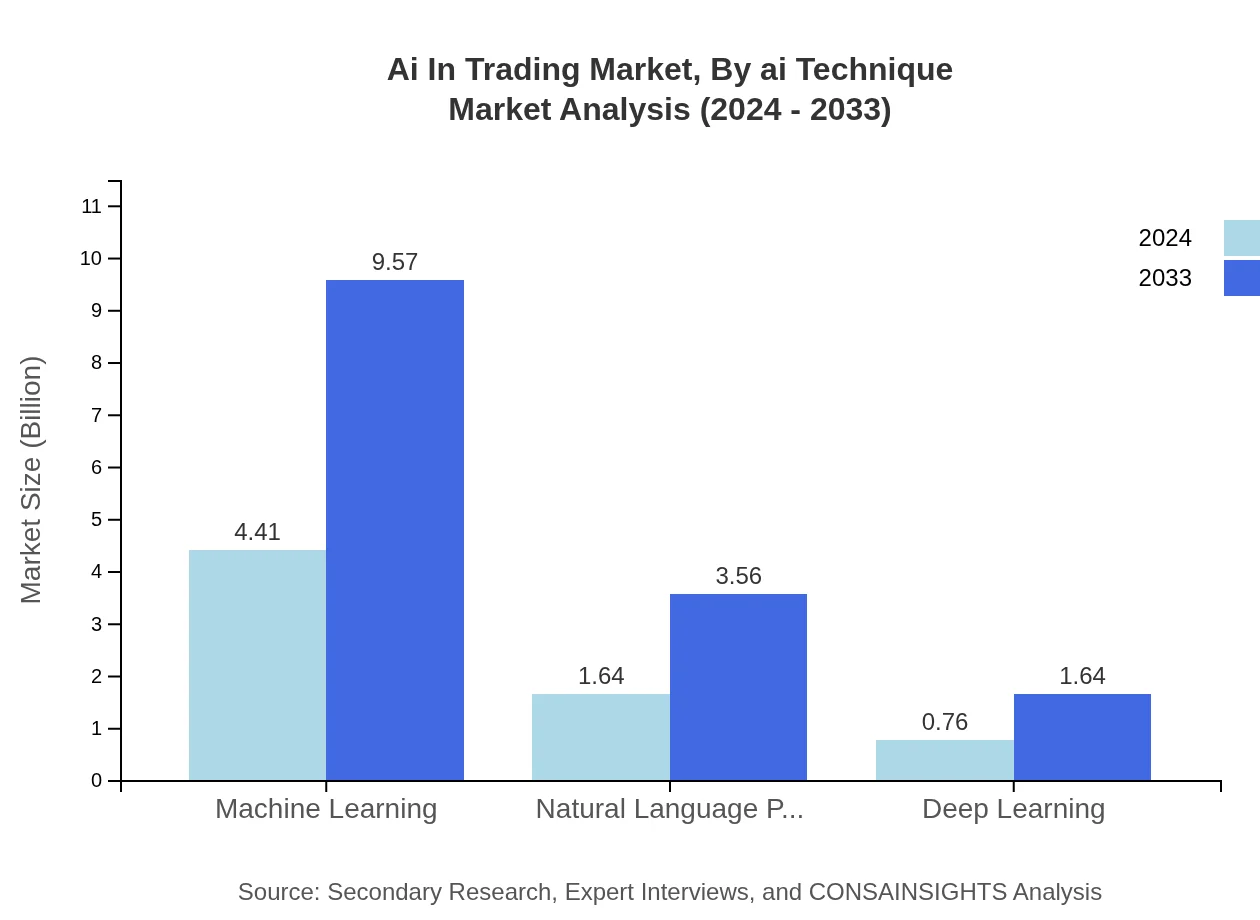

Ai In Trading Market Analysis By Ai Technique

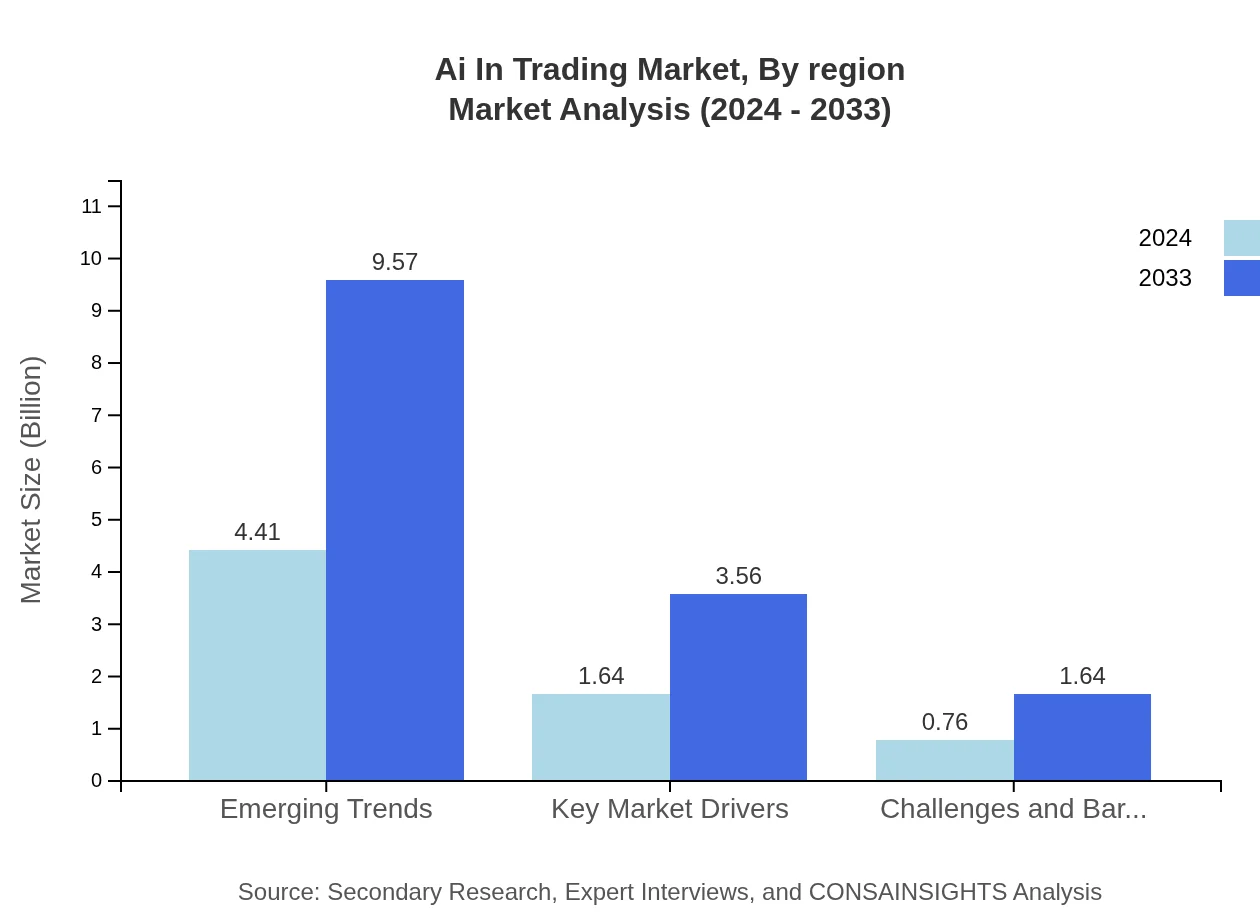

The technique segment is characterized by rapid innovation in emerging trends and algorithmic trading technologies. Data-driven analysis shows that emerging trends are expected to grow significantly, with size values estimated to rise from 4.41 in 2024 to 9.57 by 2033 while maintaining a consistent share in the overall landscape. Algorithmic trading, supported by robust computational models, further reinforces the evolution of trade execution mechanisms. Complementary segments such as market forecasting and risk management are also paving the way for optimized trading strategies. Their sustained growth underpins the crucial role that AI techniques play in transforming trading operations.

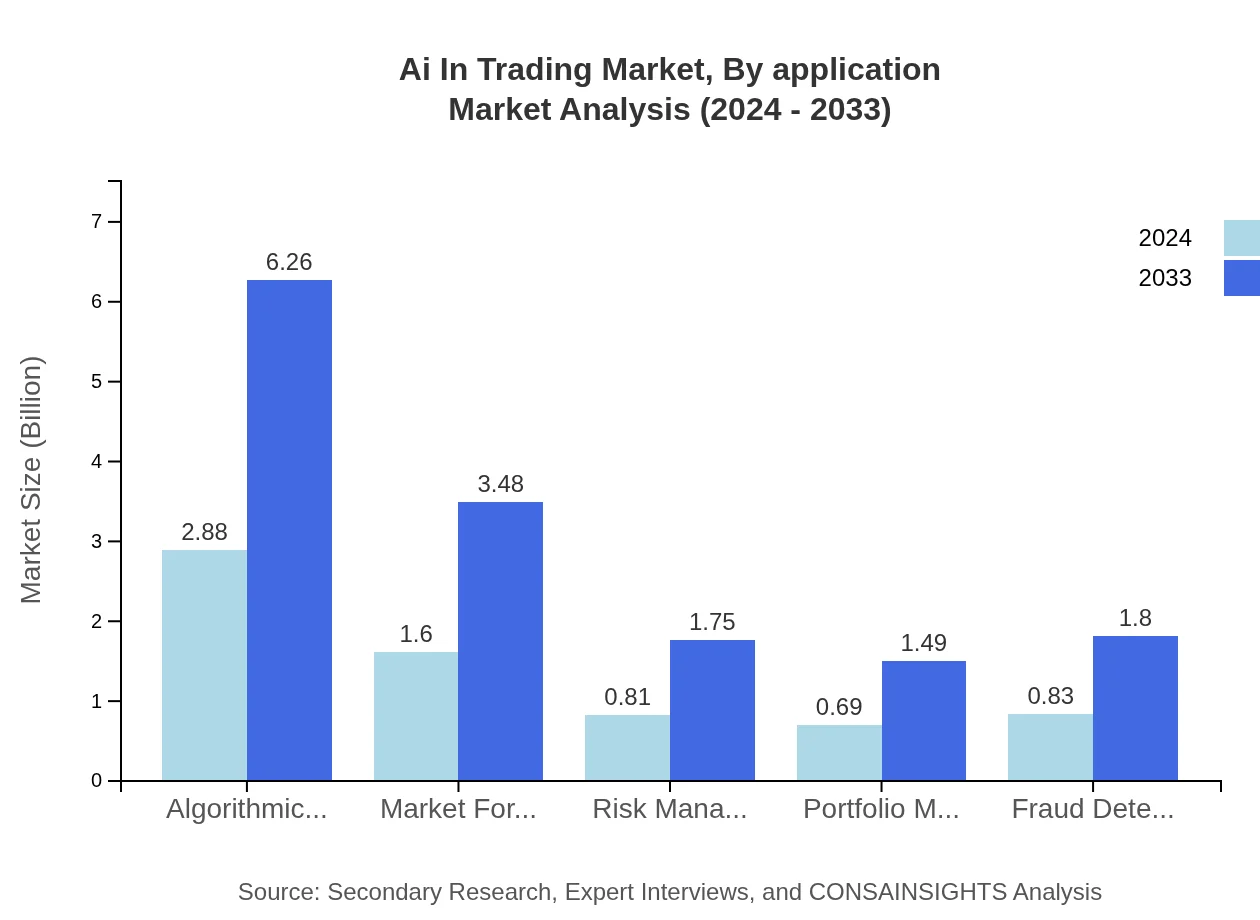

Ai In Trading Market Analysis By Application

Within the application segment, technologies like machine learning, natural language processing, and deep learning are becoming indispensable tools. The machine learning segment, with a projected growth from 4.41 to 9.57 in size over the decade, continues to capture a substantial market share at 64.78%. Natural language processing and deep learning further contribute by refining predictive analytics and enhancing automated decision-making processes. These applications address complexities in financial data and improve trade precision, ensuring that the market remains agile and responsive to global trends.

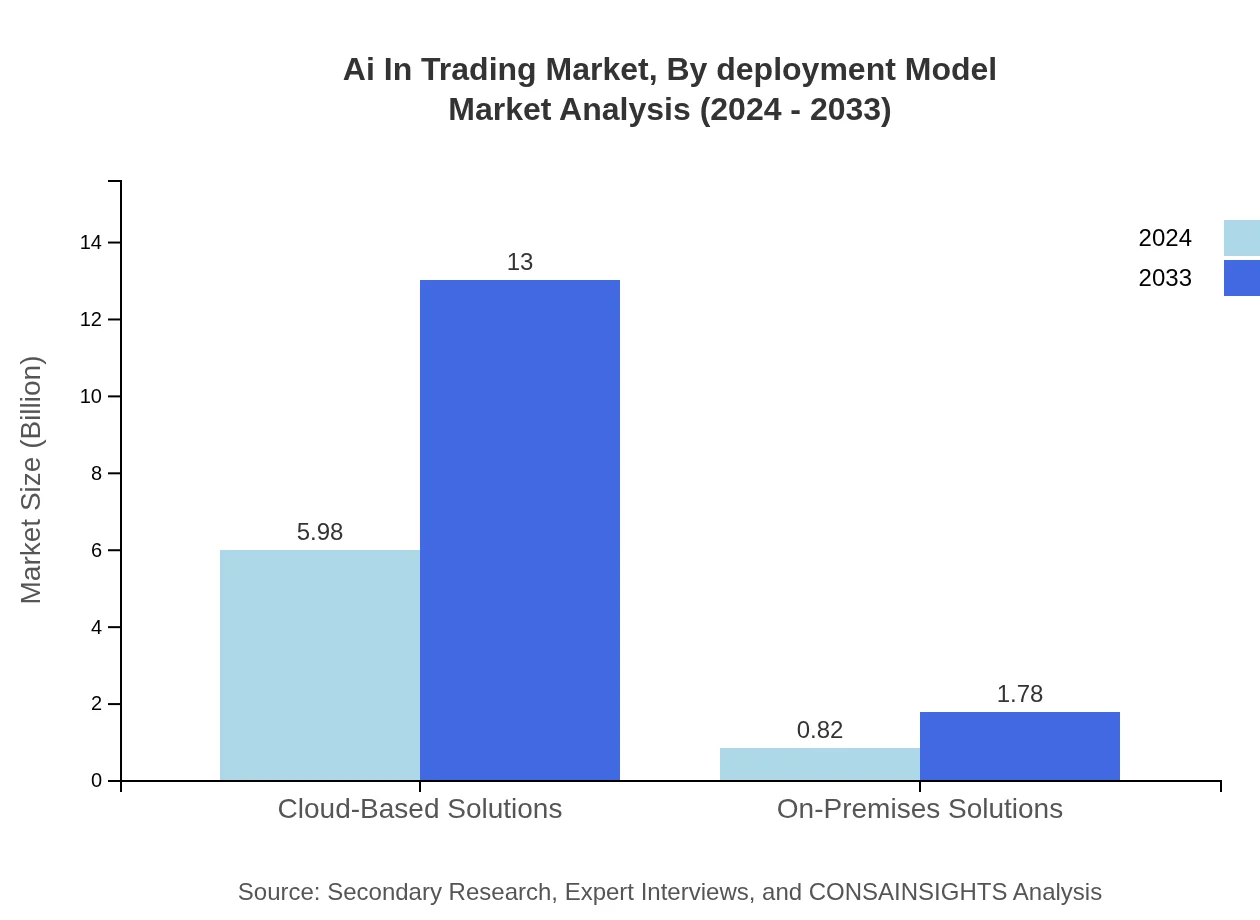

Ai In Trading Market Analysis By Deployment Model

Deployment models in the Ai In Trading market are split between cloud-based solutions and on-premises solutions. Cloud-based platforms have experienced significant adoption due to their scalability, efficiency, and lower upfront costs, with projections indicating a growth in market size from 5.98 to 13.00 and a dominant share nearing 87.98%. On-premises solutions, while representing a smaller fraction of the market—growing from 0.82 to 1.78—remain critical for institutions with stringent security requirements. The dual deployment approach ensures that both operational flexibility and strict compliance standards are met.

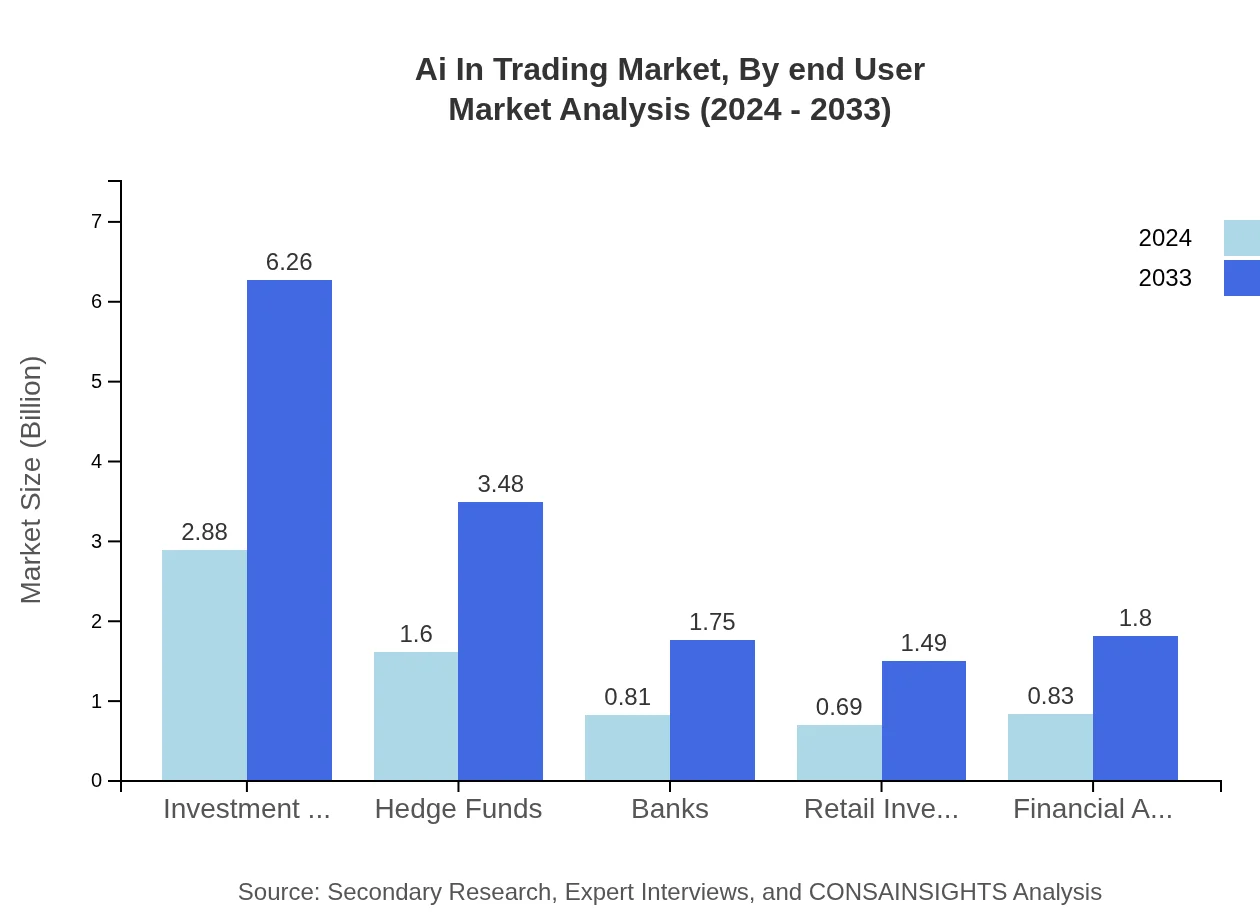

Ai In Trading Market Analysis By End User

The end-user segmentation of the market features investment firms, hedge funds, banks, retail investors, and financial advisors. Investment firms lead the way, showing notable growth: market size for these entities is forecasted to increase from 2.88 to 6.26, accompanied by a strong share of 42.37%. Hedge funds, banks, and retail investors also contribute significantly, with each segment demonstrating steady growth. Financial advisors are incorporating AI-driven insights to guide strategy and enhance client portfolios. Collectively, these end-user categories underscore the market’s expansion, with tailored AI solutions meeting diverse operational demands and strategic goals.

Ai In Trading Market Analysis By Region

Regional analysis reveals varied growth trajectories across global markets. North America and Europe exhibit the strongest adoption and highest market valuations, driven by substantial investment in tech infrastructure and well-established financial institutions. Meanwhile, Asia Pacific and Middle East & Africa regions display steady growth with unique local adaptations. The cumulative insights from regional performance indicate that while the market approaches maturity in developed regions, emerging economies continue to offer lucrative opportunities for expansion, thereby fostering a balanced global market dynamic.

Ai In Trading Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Trading Industry

Alpha Trade Inc.:

Alpha Trade Inc. is a pioneer in integrating AI technologies within trading platforms. The company is renowned for its innovative algorithmic trading solutions and advanced data analytics, which have set industry benchmarks. Their continuous investment in R&D positions them as a key driver of market innovation.Beta Analytics Ltd.:

Beta Analytics Ltd. has established itself as a major player in the Ai In Trading domain by offering cutting-edge machine learning and natural language processing tools. Their strategic partnerships with global financial institutions enable them to deliver robust, scalable trading solutions, making them a market leader.Gamma FinTech Solutions:

Gamma FinTech Solutions specializes in cloud-based trading systems and real-time risk management platforms. Their ability to rapidly deploy and integrate innovative AI features has garnered them recognition as a key influencer in transforming traditional trading methodologies.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Trading?

The ai-in-trading market is projected to reach approximately $6.8 billion by 2033, growing at a CAGR of 8.7%. This indicates a significant increase from its current size, reflecting strong adoption in various segments within the trading industry.

What are the key market players or companies in the ai In Trading industry?

Key players in the ai-in-trading sector include major technology firms, investment companies, hedge funds, and specialized algorithmic trading services. These companies leverage AI technologies to enhance trading strategies, risk management, and market analysis.

What are the primary factors driving the growth in the ai In Trading industry?

Growth in the ai-in-trading industry is driven by advancements in AI technologies, increasing demand for automation in trading processes, and the need for improved market forecasting and risk assessment capabilities among traders and financial institutions.

Which region is the fastest Growing in the ai In Trading?

The fastest-growing region in the ai-in-trading market is Europe, expected to grow from $2.49 billion in 2024 to $5.41 billion by 2033. North America follows closely, projected to reach $4.75 billion, driven by robust investment and technological integration.

Does ConsaInsights provide customized market report data for the ai In Trading industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the ai-in-trading industry. This enables clients to gain insights aligned with their unique objectives, whether analyzing regional trends or specific market segments.

What deliverables can I expect from this ai In Trading market research project?

From the ai-in-trading market research project, you can expect detailed reports that include market size data, growth forecasts, segment analysis, key player insights, and trends affecting the industry, all designed to support strategic decision-making.

What are the market trends of ai In Trading?

Current trends in the ai-in-trading market include increased reliance on machine learning for predictive analysis, a rise in algorithmic trading platforms, and growing adoption of cloud-based solutions. These trends indicate a shift towards more sophisticated and data-driven trading strategies.