Ai In Investment Banking

Published Date: 24 January 2026 | Report Code: ai-in-investment-banking

Ai In Investment Banking Market Size, Share, Industry Trends and Forecast to 2033

This report covers comprehensive insights into the Ai In Investment Banking market, analyzing market size, growth trends, regional performance, and segmentation details from 2024 to 2033. It provides in-depth industry analysis, technology innovations, and strategic forecasts for investment banking organizations utilizing AI to optimize processes and drive revenue growth in the evolving global financial ecosystem.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

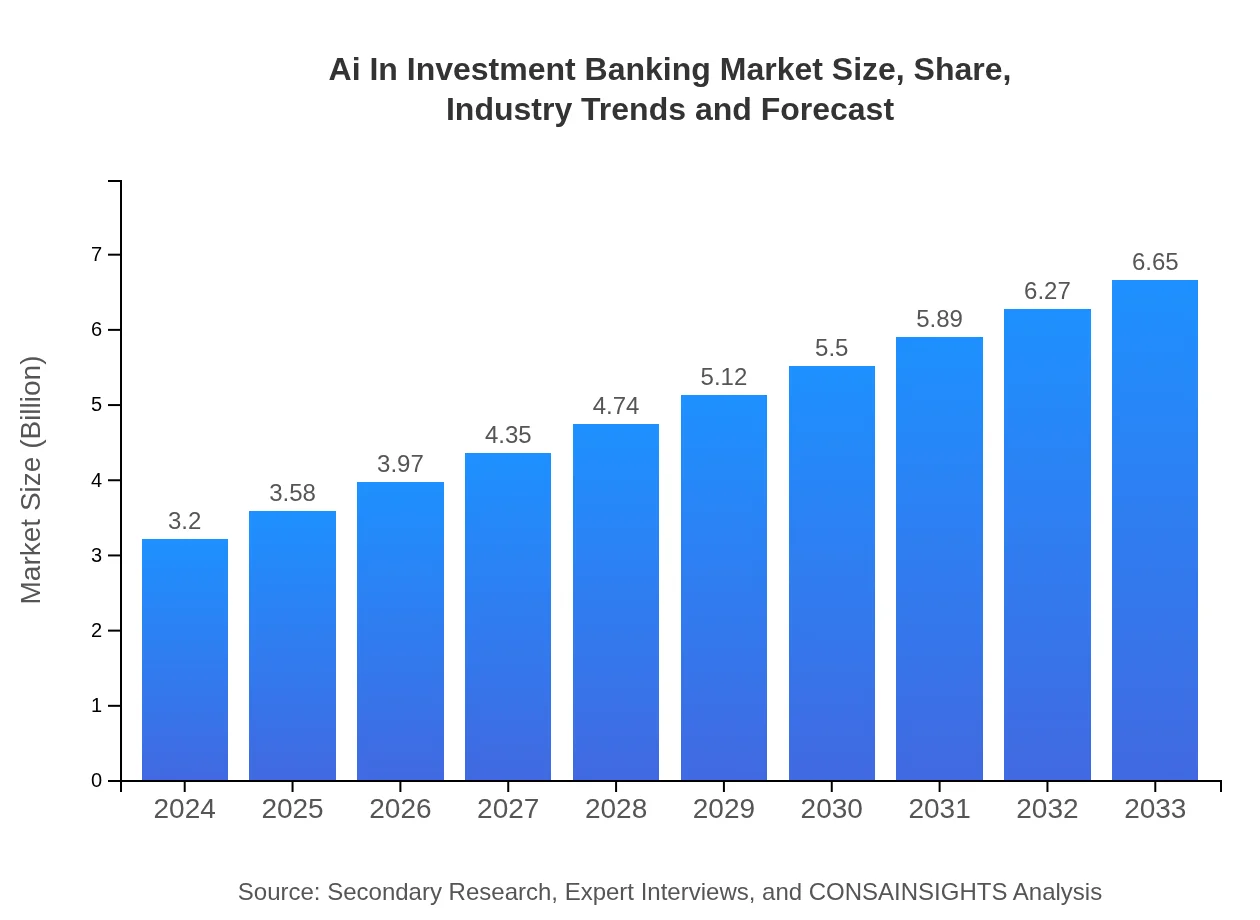

| 2024 Market Size | $3.20 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $6.65 Billion |

| Top Companies | FinTech Innovators Inc., Global Banking Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Investment Banking Market Overview

Customize Ai In Investment Banking market research report

- ✔ Get in-depth analysis of Ai In Investment Banking market size, growth, and forecasts.

- ✔ Understand Ai In Investment Banking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Investment Banking

What is the Market Size & CAGR of Ai In Investment Banking market in 2024?

Ai In Investment Banking Industry Analysis

Ai In Investment Banking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Investment Banking Market Analysis Report by Region

Europe Ai In Investment Banking:

Europe is experiencing a steady uptake of AI in investment banking, with significant emphasis on regulatory compliance and innovation. European financial institutions are collaborating with technology firms to integrate AI solutions that enhance operational efficiency and support data-driven decision making.Asia Pacific Ai In Investment Banking:

In the Asia Pacific region, the market is witnessing strong adoption of AI technologies as banks invest in digital transformation. Growth is supported by increasing capital inflows, supportive government policies, and a rising number of fintech collaborations, which are all contributing to enhanced operational efficiency.North America Ai In Investment Banking:

North America remains a leader in the adoption of AI technologies, with substantial investments in research and development. Banks in the region are leveraging AI to optimize trading, risk assessment, and customer service, paving the way for a more agile and competitive market.South America Ai In Investment Banking:

South America is gradually embracing AI in investment banking, driven by a surge in digital banking and the need to modernize financial services. Regulatory reforms and increased technology investments are laying the foundation for future growth in AI-driven banking solutions.Middle East & Africa Ai In Investment Banking:

The Middle East and Africa are emerging as promising markets for AI in investment banking. Despite challenges, there is a growing recognition of the benefits of AI, particularly in the areas of risk management and customer service, driven by both government initiatives and private sector investments.Tell us your focus area and get a customized research report.

Ai In Investment Banking Market Analysis By Application

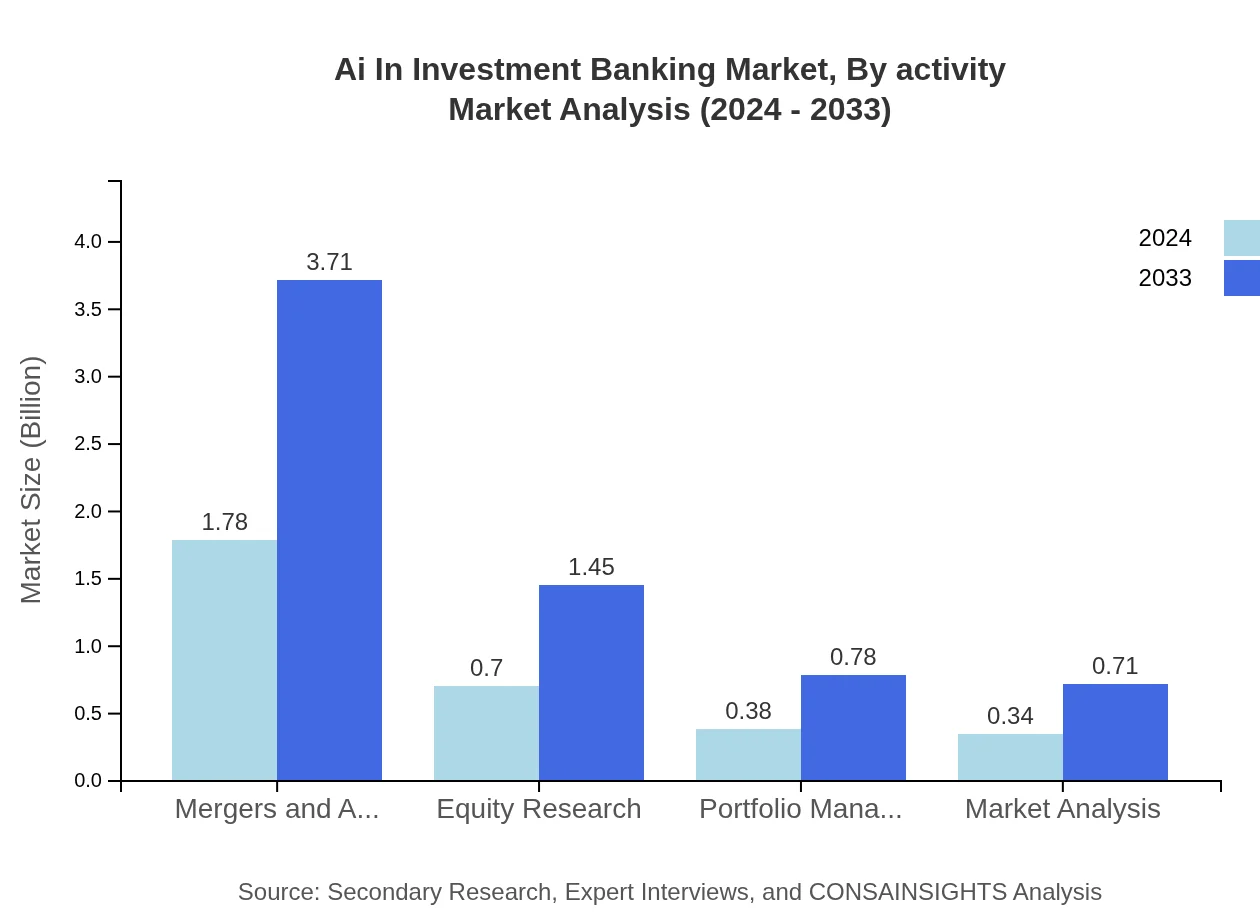

The by-application segment covers key financial activities, including mergers and acquisitions, equity research, portfolio management, market analysis, and risk assessment. This segment demonstrates how AI is effectively streamlining traditional banking operations, improving analysis accuracy, and reducing decision-making time. The integration of advanced algorithms and predictive models offers a reliable roadmap for future growth in these applications.

Ai In Investment Banking Market Analysis By Activity

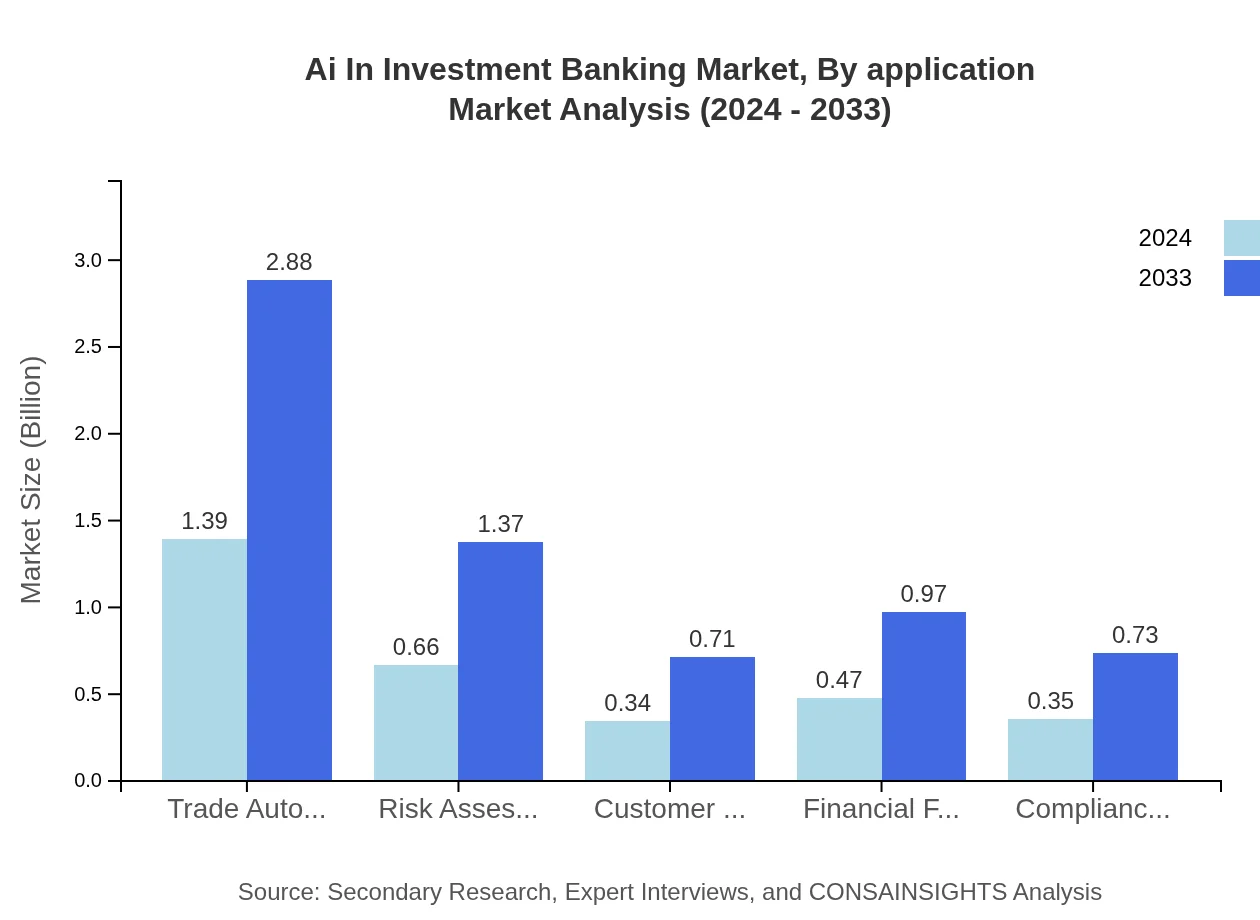

The activity-based analysis focuses on differentiating various tasks within investment banking that benefit from AI implementation. From trade automation to financial forecasting and compliance, AI-driven solutions are redefining operational practices. Enhanced automation and data insights are leading to faster transaction processing and improved risk controls across different banking activities.

Ai In Investment Banking Market Analysis By Technology

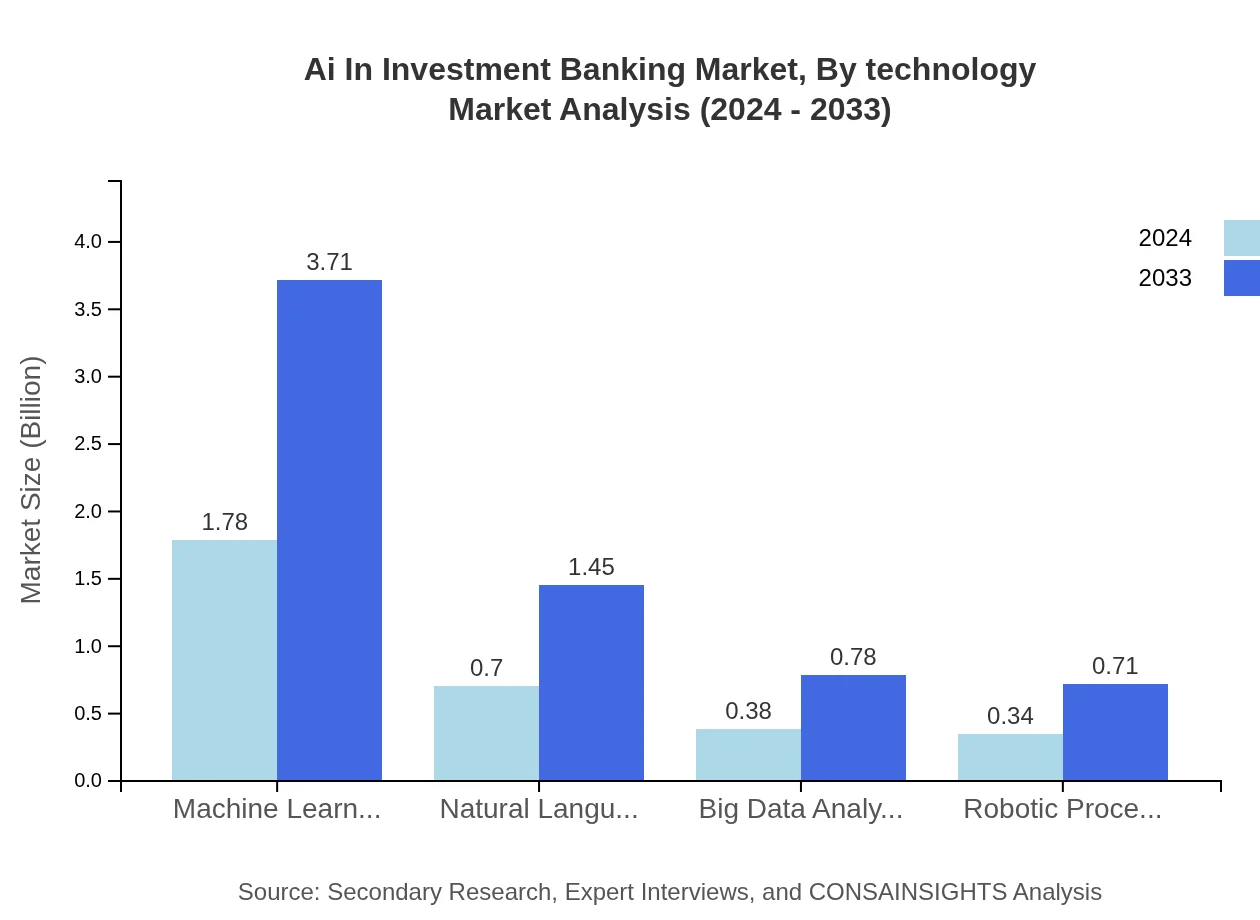

This segment examines the technologies underpinning AI applications in investment banking, including machine learning, natural language processing, big data analytics, and robotic process automation. These technologies are pivotal in extracting valuable insights from large datasets, improving accuracy in decision-making, and fostering innovation across the banking spectrum. Their continued evolution promises further efficiency gains and competitive advantages.

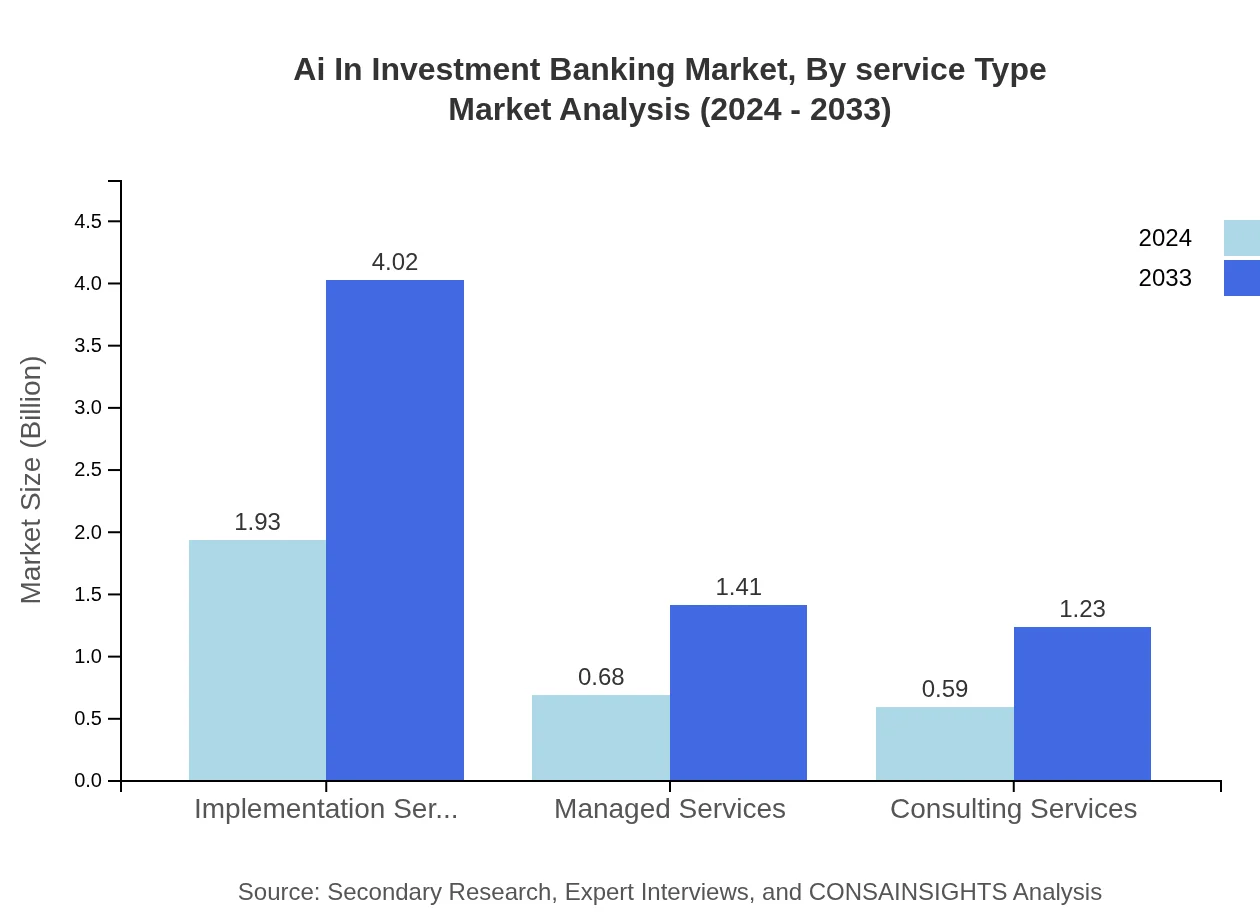

Ai In Investment Banking Market Analysis By Service Type

The by-service-type segment evaluates the variety of services deployed to support AI initiatives, such as implementation, managed, and consulting services. These services assist financial institutions in transitioning smoothly to AI-enabled operations, providing expertise, technical support, and continuous improvement frameworks that ensure robust integration and maximum value extraction from AI investments.

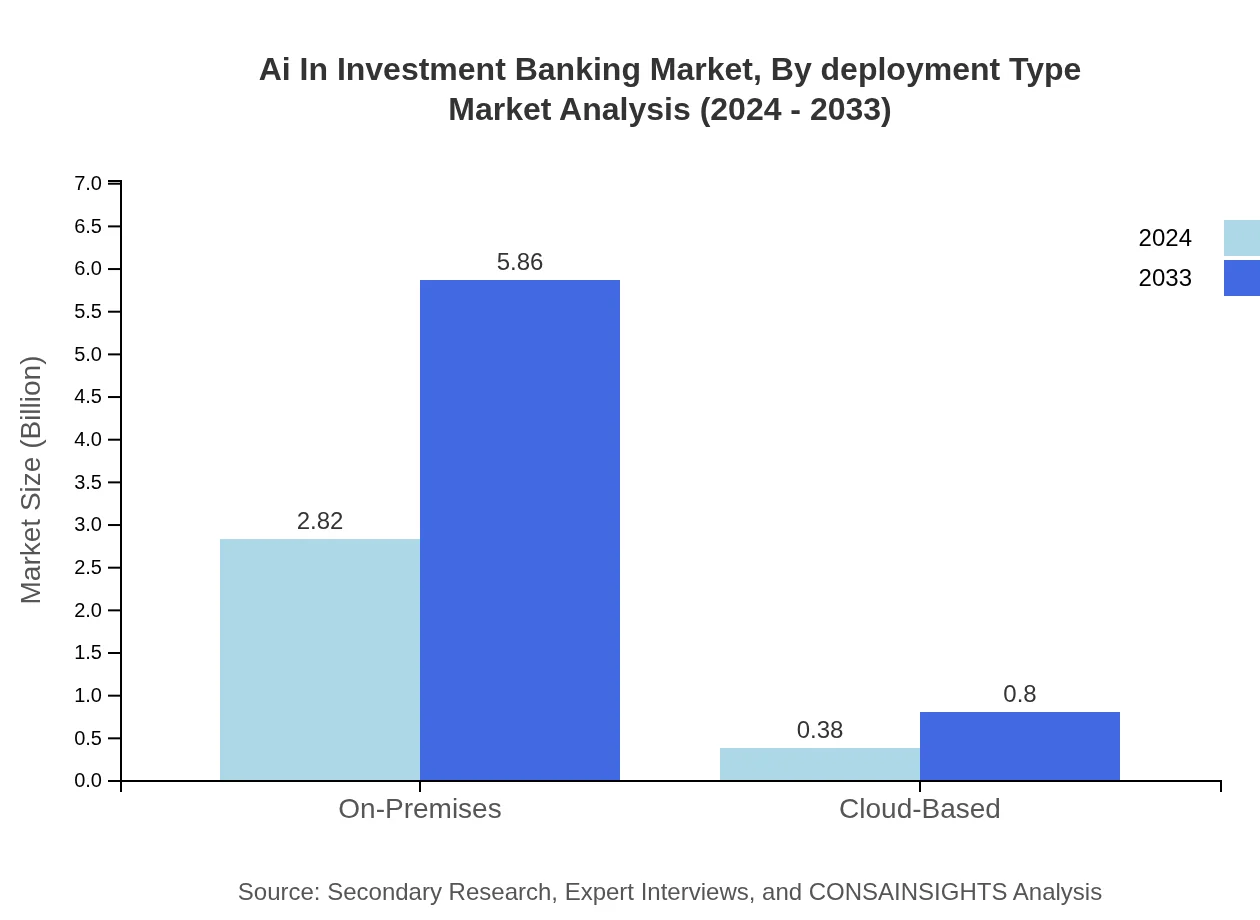

Ai In Investment Banking Market Analysis By Deployment Type

Focusing on deployment methods, this segment differentiates between on-premises and cloud-based solutions. On-premises deployments offer enhanced security and control, while cloud-based solutions provide scalability, flexibility, and cost efficiency. Financial institutions are carefully selecting deployment models based on their specific operational needs and risk management considerations, ensuring that AI integration is both secure and innovative.

Ai In Investment Banking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Investment Banking Industry

FinTech Innovators Inc.:

FinTech Innovators Inc. stands at the forefront of integrating AI with traditional investment banking, offering cutting-edge solutions that modernize financial services. The company’s robust AI platform enhances risk assessment, optimizes trading strategies, and streamlines regulatory compliance. Their continuous investment in research and development has enabled a series of breakthroughs that transform operational efficiency and decision-making processes on a global scale.Global Banking Solutions:

Global Banking Solutions has established itself as a key player in the AI-driven transformation of investment banking. The firm leverages advanced machine learning, big data analytics, and cloud-based technologies to deliver comprehensive financial solutions. Their integrated approach not only improves transactional efficiency but also empowers banks with real-time insights and predictive analytics, thereby reinforcing their competitive advantage in the dynamic financial services landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Investment Banking?

The AI in Investment Banking market is projected to grow to $3.2 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 8.2% from 2024. This growth signifies an increased reliance on AI technologies to optimize services and reduce operational costs.

What are the key market players or companies in this ai In Investment Banking industry?

Key players in the AI in Investment Banking market include major financial firms leveraging AI for trading, compliance, and risk assessments. Noteworthy companies may include Microsoft, IBM, and various fintech startups pioneering AI-driven solutions in banking.

What are the primary factors driving the growth in the ai In Investment Banking industry?

Key growth drivers in the AI in Investment Banking industry include increased efficiency through automation, the burgeoning need for advanced data analytics, and enhanced customer service capabilities. Furthermore, regulatory compliance demands are also compelling banks to adopt AI technologies.

Which region is the fastest Growing in the ai In Investment Banking?

The North American region is the fastest-growing in the AI in Investment Banking sector, anticipated to reach a market size of $2.15 billion by 2033. The adoption of modern financial technologies drives this growth, alongside advancements in cloud computing and data analytics.

Does ConsaInsights provide customized market report data for the ai In Investment Banking industry?

Yes, ConsaInsights offers customized market report data specifically tailored for the AI in Investment Banking industry, allowing clients to receive insights that align with their strategic goals, competitive landscape analysis, and targeted market trends.

What deliverables can I expect from this ai In Investment Banking market research project?

Expect comprehensive deliverables including market size data, trend analysis, competitive insights, and forecasts. Additionally, reports may contain segmented data by applications like mergers and acquisitions, and geographical insights across various regions.

What are the market trends of ai In Investment Banking?

Significant trends in the AI in Investment Banking market include increased adoption of machine learning for predictive analytics and automation of trade processes. Enhanced focus on regulatory compliance through automated solutions and rising investments in digital transformation reflect ongoing industry evolution.