Ai In Forex Trading

Published Date: 24 January 2026 | Report Code: ai-in-forex-trading

Ai In Forex Trading Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the transformative impact of Artificial Intelligence in Forex Trading, providing valuable insights into market dynamics, technological innovations, and evolving investor strategies. Covering data-driven analyses, industry trends, segmentation insights, and regional breakdowns, the report spans the forecast period from 2024 to 2033, aiming to inform investors, brokers, and tech innovators about future growth prospects.

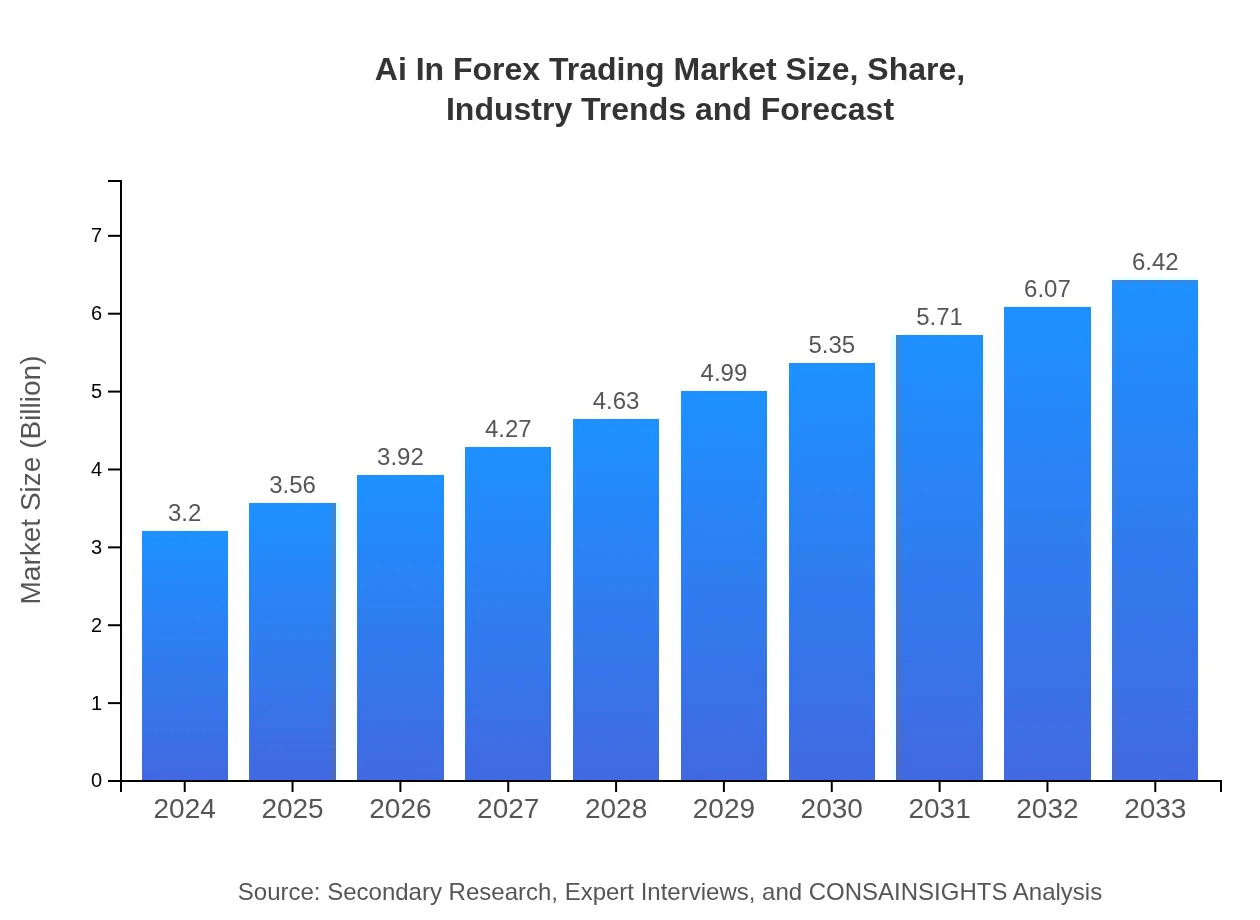

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.20 Billion |

| CAGR (2024-2033) | 7.8% |

| 2033 Market Size | $6.42 Billion |

| Top Companies | Alpha Trading Inc., Beta Forex Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Forex Trading Market Overview

Customize Ai In Forex Trading market research report

- ✔ Get in-depth analysis of Ai In Forex Trading market size, growth, and forecasts.

- ✔ Understand Ai In Forex Trading's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Forex Trading

What is the Market Size & CAGR of Ai In Forex Trading market in 2024?

Ai In Forex Trading Industry Analysis

Ai In Forex Trading Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Forex Trading Market Analysis Report by Region

Europe Ai In Forex Trading:

Europe is poised for steady growth in the Ai In Forex Trading sector, with market values expected to increase from 1.03 in 2024 to 2.07 in 2033. The region benefits from a balanced mix of technological innovation and stringent regulatory oversight, which works to protect investor interests while promoting advancements in AI. European markets are increasingly incorporating AI tools to enhance trade execution and risk management.Asia Pacific Ai In Forex Trading:

In the Asia Pacific region, the Ai In Forex Trading market is experiencing significant growth driven by increasing digitization in emerging economies and rapid adaptation of advanced trading technologies among financial institutions. With market values projected to rise from 0.55 in 2024 to 1.10 in 2033, the region represents a vibrant ecosystem marked by robust regulatory reforms and increasing investor interest in AI-driven strategies.North America Ai In Forex Trading:

North America continues to be a significant market force in the Ai In Forex Trading domain, driven by advanced financial infrastructures, high adoption rates of innovative technologies, and strong investments in research and development. Market projections indicate a growth from 1.15 in 2024 to 2.31 in 2033. The mature market environment coupled with rigorous regulatory frameworks is fostering an atmosphere conducive to sophisticated AI integrations.South America Ai In Forex Trading:

South America, often reflected in the Latin America market analysis, is observing gradual yet promising growth. With market figures expected to move from 0.24 in 2024 to 0.49 in 2033, the region's growth is spurred by improving financial market infrastructures and a growing base of tech-savvy retail traders. The integration of AI is beginning to reshape trading behaviors, particularly in countries that are increasingly embracing digital transformation.Middle East & Africa Ai In Forex Trading:

The Middle East and Africa region, though smaller in market size, is experiencing transformative growth in the Ai In Forex Trading sector, with figures anticipated to rise from 0.23 in 2024 to 0.46 in 2033. With an increasing focus on digital transformation and investment in new financial technologies, this region is gradually building a foundation for broader acceptance and utilization of AI-driven trading platforms.Tell us your focus area and get a customized research report.

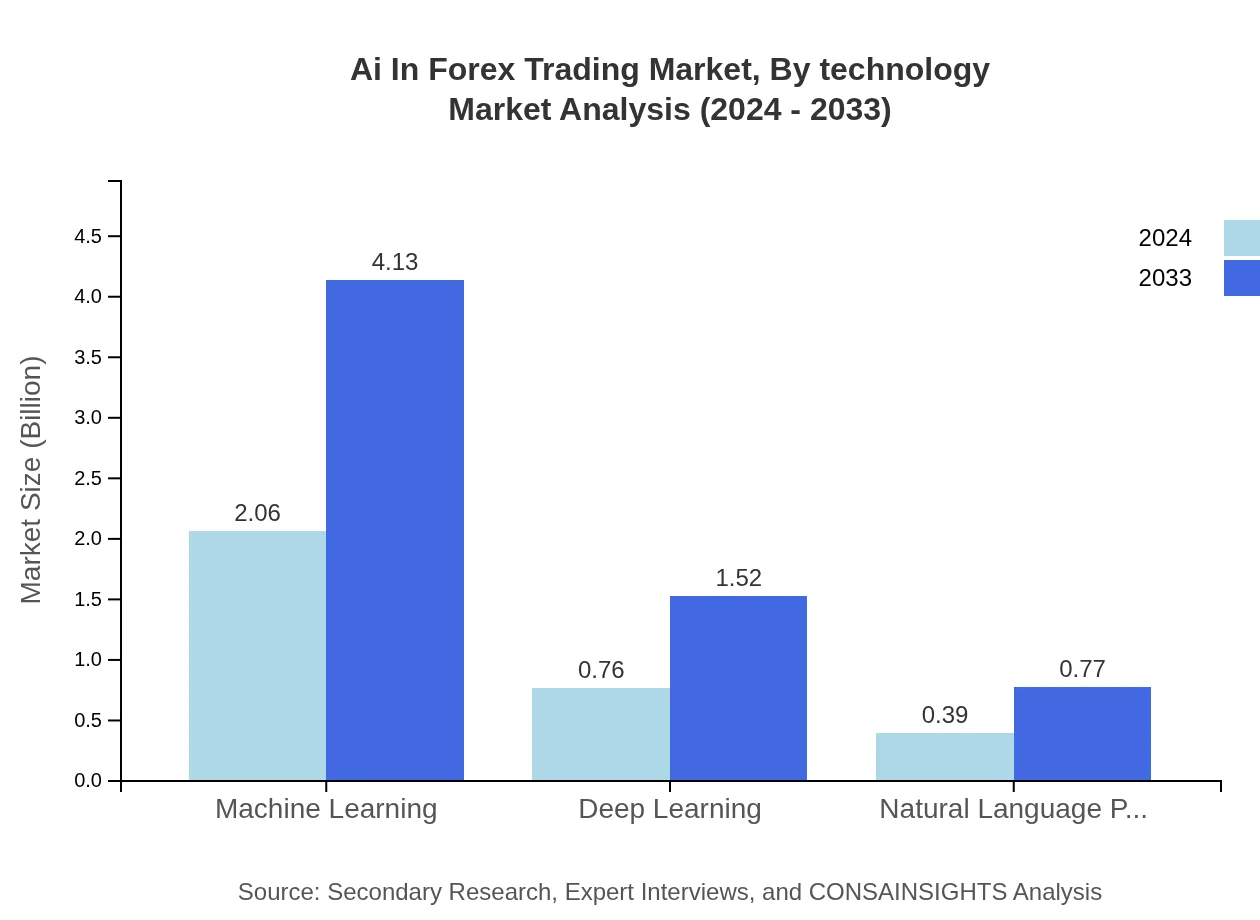

Ai In Forex Trading Market Analysis By Technology

The technological segmentation within the Ai In Forex Trading market is characterized by rapid advancements in AI algorithms and machine learning models. Key technology segments include algorithmic trading, machine learning, deep learning, and natural language processing. These technologies have significantly improved trade execution and risk analysis across the board. For example, algorithmic trading systems now operate with increased speed and efficiency, thanks to the integration of deep learning capabilities. Meanwhile, machine learning frameworks are being employed to analyze past market data and forecast future trends with remarkable accuracy. Cloud-based services also contribute to faster deployment of these solutions by offering scalable infrastructure for real-time data processing, while on-premises solutions provide enhanced security for proprietary trading algorithms. With the continuous evolution of these technologies, the market is poised for innovation that leads to improved predictive analytics, better customer engagement, and streamlined regulatory compliance. The synergy between advanced technology and trading strategies is expected to drive further market penetration and redefine industry standards.

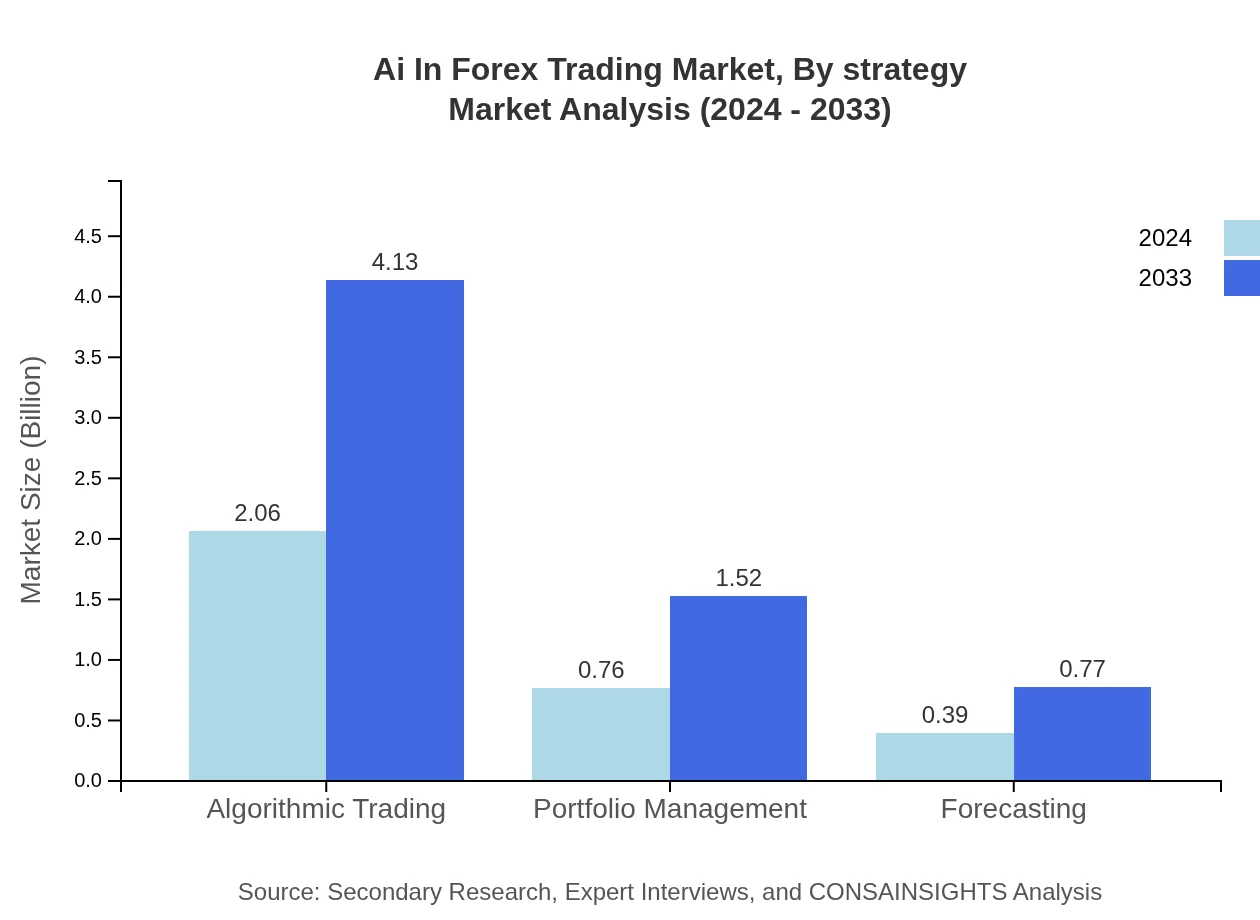

Ai In Forex Trading Market Analysis By Strategy

Strategy segmentation in the Ai In Forex Trading market focuses largely on different trading approaches adopted by market participants. Retail traders, institutional investors, and brokerages each bring unique objectives and risk profiles to the table. Retail traders often lean on algorithmic solutions to leverage high-frequency trading with an emphasis on speed and efficiency. Institutional investors, on the other hand, utilize complex analytical models and portfolio management techniques to manage substantial assets and mitigate risks. Brokerages integrate AI to enhance customer experiences and streamline transaction processes. Detailed segmentation data reveals that retail trading commands a major share, with metrics indicating strong performance both in market size and overall share. Meanwhile, institutional strategies, reinforced by superior technological capabilities, are carving niche segments by capitalizing on advanced risk assessment tools. This strategy-focused segmentation helps market participants tailor their trading approaches, factor in market volatility more accurately, and achieve a balanced approach between risk management and profit optimization.

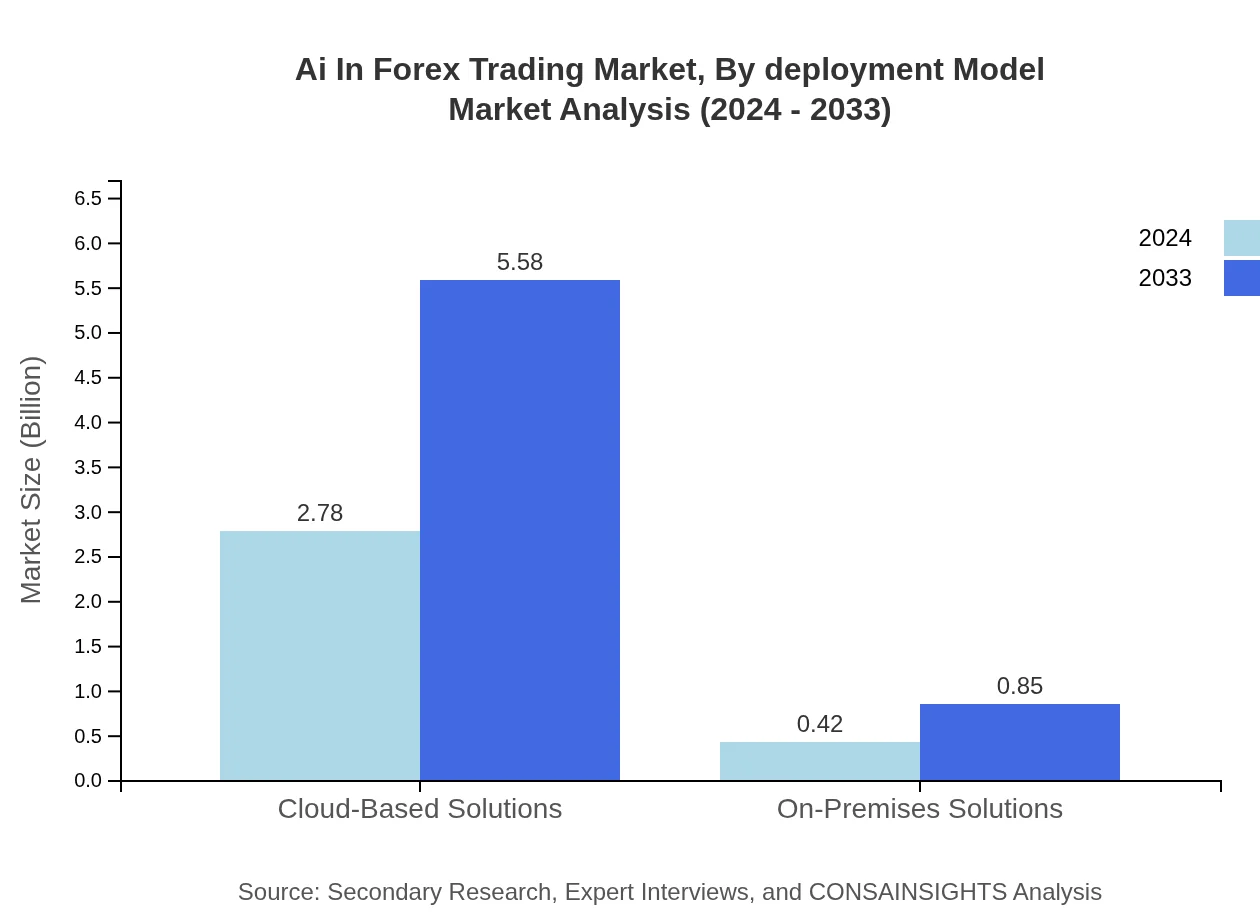

Ai In Forex Trading Market Analysis By Deployment Model

Deployment models in the Ai In Forex Trading market are largely classified into cloud-based solutions and on-premises setups. Cloud-based solutions have gained traction due to their scalability, lower upfront costs, and rapid deployment capabilities. They enable traders to access sophisticated AI tools without heavy investments in infrastructure, offering real-time data processing and dynamic updates. In contrast, on-premises solutions cater to organizations that require tighter control over data security and system customization. Despite higher initial setup costs, on-premises models offer enhanced privacy and are often preferred by institutions handling sensitive information. The segmentation analysis indicates that cloud-based solutions today match a significant share of the market, supported by growth in overall adoption rates, while on-premises solutions continue to hold a vital niche among high-security firms. The deployment model analysis elucidates how various institutions balance these factors to meet their unique operational and security requirements.

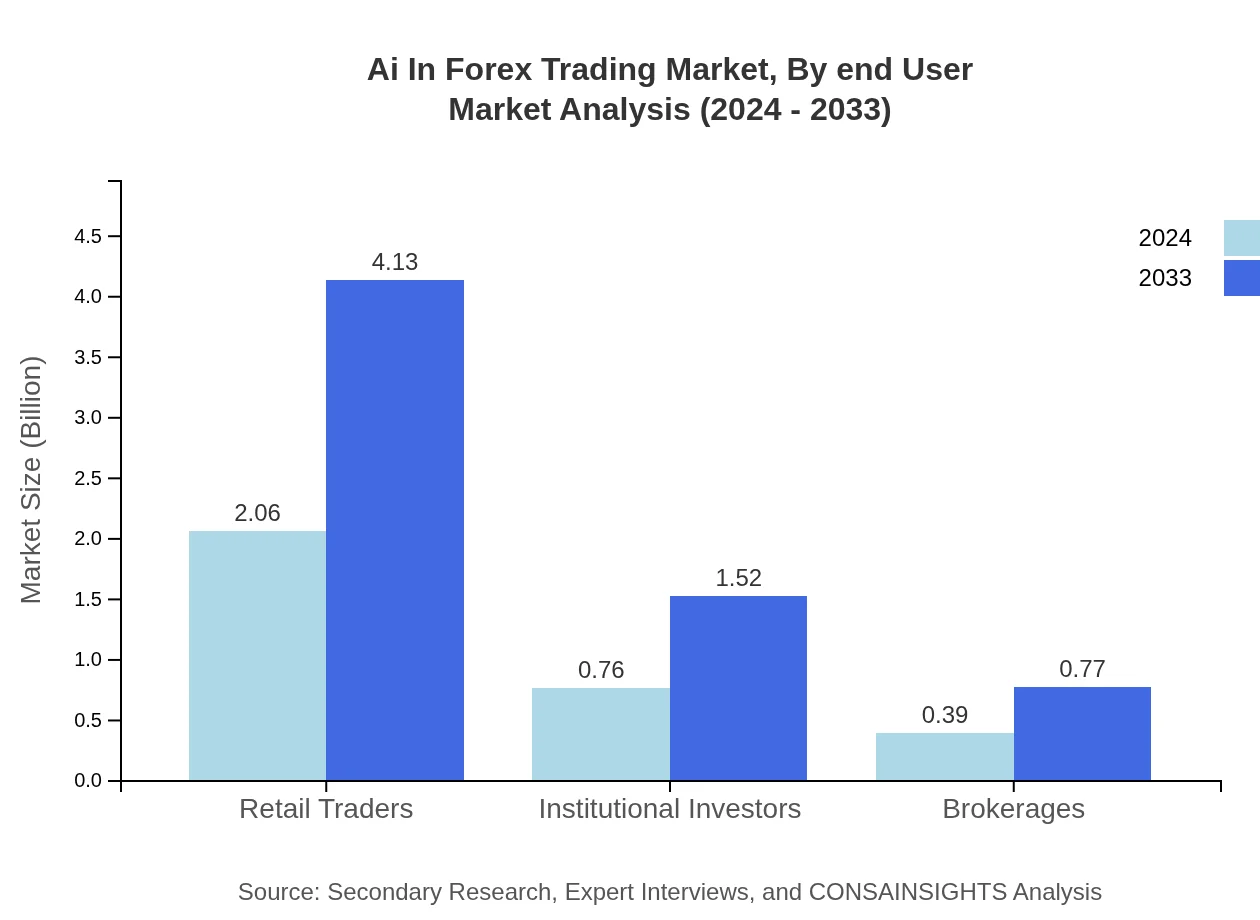

Ai In Forex Trading Market Analysis By End User

End-user segmentation within the Ai In Forex Trading market encompasses diverse groups including retail traders, institutional investors, and brokerages. Retail traders benefit from user-friendly interfaces and real-time predictive analytics that can drive immediate trading decisions, reflected in substantial market share figures. Institutional investors rely on robust analytics and comprehensive risk management tools to handle large volumes of transactions, ensuring high operational efficiency. Brokerages, meanwhile, utilize AI to optimize customer service, personalize trading experiences, and maintain competitive market positioning. Detailed data metrics show that retail participation remains dominant, while institutional and brokerage segments enjoy steady growth supported by continual investments in AI technologies. This segmentation not only helps in tailoring specific solutions for each end-user group but also informs the development of specialized tools and services that address the distinct challenges encountered by end-users in the dynamic world of forex trading.

Ai In Forex Trading Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Forex Trading Industry

Alpha Trading Inc.:

Alpha Trading Inc. is a pioneer in leveraging AI to streamline forex trading. With a commitment to innovative algorithm development and robust risk management, the company has set new standards in automated trading solutions, attracting a diverse clientele of retail and institutional investors.Beta Forex Solutions:

Beta Forex Solutions specializes in integrating state-of-the-art machine learning technologies within its trading platforms. Their cutting-edge solutions optimize trade execution and enhance market forecasting, contributing significantly to the evolution of the AI-driven forex trading landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Forex Trading?

The AI in Forex Trading market is valued at $3.2 billion and is projected to grow at a CAGR of 7.8% from 2024 to 2033. This growth is indicative of rising technology adoption in the trading industry.

What are the key market players or companies in this AI in Forex Trading industry?

Key players in the AI in Forex trading industry include major financial institutions, technology firms, and trading platforms that integrate AI solutions for algorithmic trading, risk management, and analytics.

What are the primary factors driving the growth in the AI in Forex Trading industry?

Driving factors include increased demand for automated trading solutions, growing reliance on data analytics for trading decisions, and advancements in AI technologies enhancing trading efficiency and accuracy.

Which region is the fastest Growing in the AI in Forex Trading?

The North America region is the fastest-growing, expected to reach $2.31 billion by 2033, followed by Europe and Asia Pacific, indicating strong technological investments in Forex trading solutions.

Does ConsaInsights provide customized market report data for the AI in Forex Trading industry?

Yes, ConsaInsights offers tailored market report data for the AI in Forex Trading sector, adapting insights and analytics to meet specific client needs, ensuring relevant and actionable information.

What deliverables can I expect from this AI in Forex Trading market research project?

Deliverables include comprehensive market analysis reports, segment breakdowns, predictive insights, competitive landscape assessments, and personalized recommendations based on specific business requirements.

What are the market trends of AI in Forex Trading?

Current trends involve the growing adoption of cloud-based solutions, machine learning models enhancing predictive capabilities, and increased integration of AI-driven tools for real-time decision-making in trading.