Ai In Payments

Published Date: 24 January 2026 | Report Code: ai-in-payments

Ai In Payments Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ai In Payments market, offering detailed insights on market size, growth forecasts, industry trends, and segmentation. Covering the forecast period from 2024 to 2033, the report examines technological advancements, regional performance, and strategic initiatives undertaken by key market players, enabling stakeholders to make informed decisions in a dynamic environment.

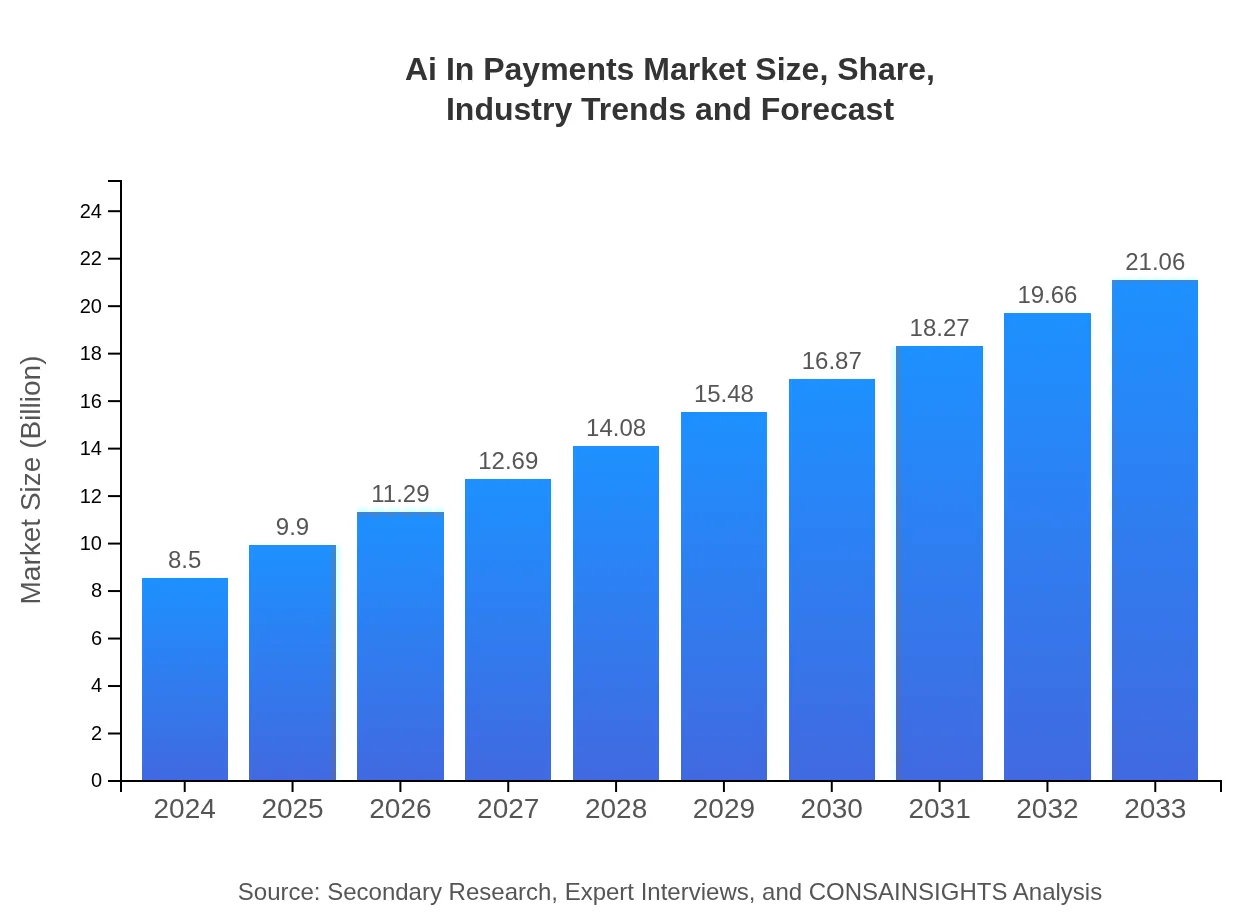

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $8.50 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $21.06 Billion |

| Top Companies | InnovatePay Solutions, AI Fintech Corp |

| Last Modified Date | 24 January 2026 |

Ai In Payments Market Overview

Customize Ai In Payments market research report

- ✔ Get in-depth analysis of Ai In Payments market size, growth, and forecasts.

- ✔ Understand Ai In Payments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Payments

What is the Market Size & CAGR of Ai In Payments market in 2024?

Ai In Payments Industry Analysis

Ai In Payments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Payments Market Analysis Report by Region

Europe Ai In Payments:

Europe shows promising potential with market figures increasing from 2.12 in 2024 to 5.25 by 2033. Stable regulatory environments, integrated financial infrastructures, and innovative payment systems support the steady growth of AI-driven payments.Asia Pacific Ai In Payments:

In the Asia Pacific region, the market is expected to grow significantly from a 2024 size of 1.87 units to 4.62 units by 2033. This growth is driven by rapid digital adoption, support from government initiatives, and the increasing presence of fintech startups that embrace AI technologies to improve payment processing efficiency.North America Ai In Payments:

North America remains a strong market with high technological investments, expanding from 3.16 in 2024 to 7.82 units by 2033. Enhanced cybersecurity measures and strong consumer demand for digital payment solutions contribute to robust market expansion.South America Ai In Payments:

South America is witnessing a gradual transformation, with market size projections rising from 0.62 in 2024 to 1.55 by 2033. The region benefits from a surge in mobile banking and a focus on boosting financial inclusion, which collectively drive the adoption of AI in payments.Middle East & Africa Ai In Payments:

The Middle East and Africa region is marked by emerging opportunities, with market size growing from 0.73 in 2024 to 1.82 by 2033. Efforts to improve digital connectivity, along with investments in modern financial technology, are key factors driving this region’s expansion.Tell us your focus area and get a customized research report.

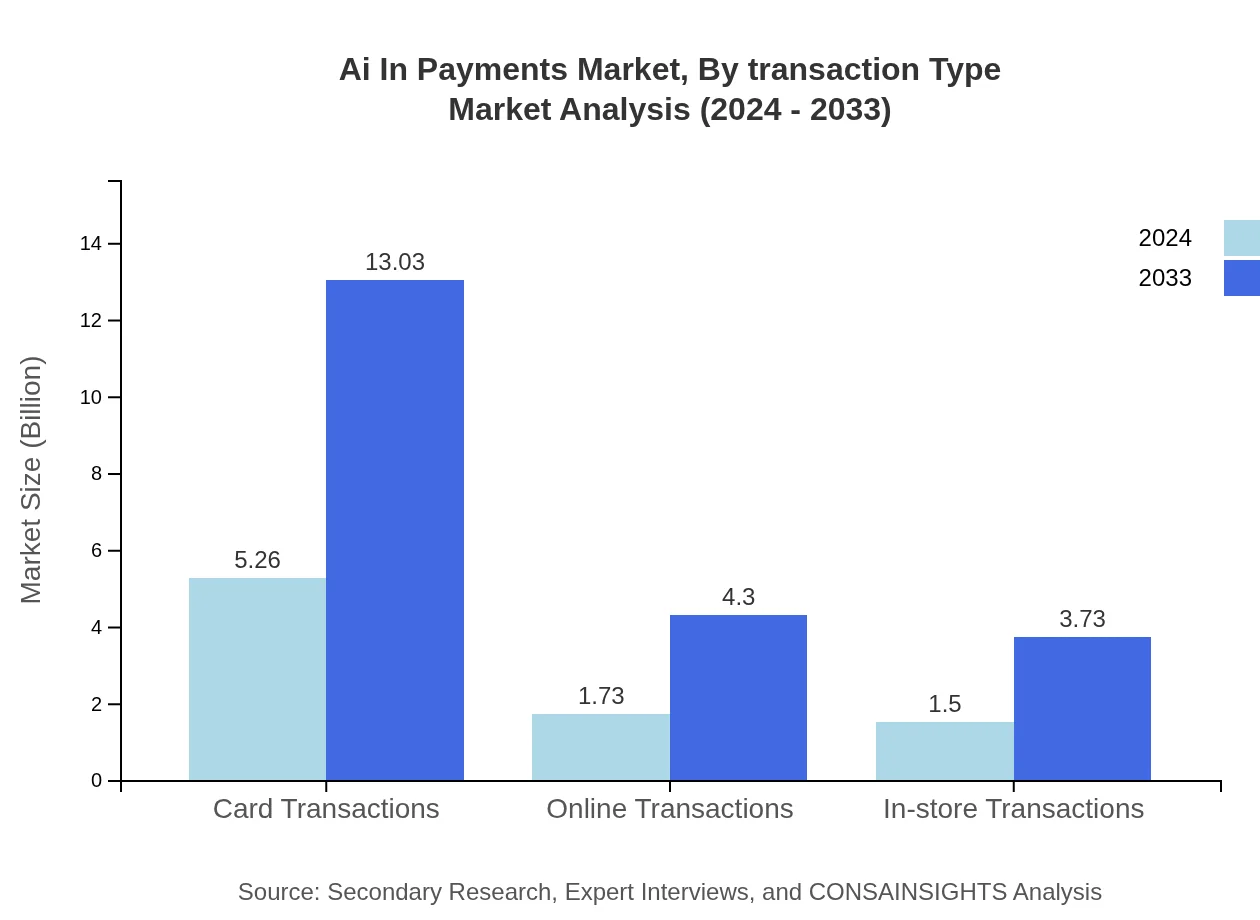

Ai In Payments Market Analysis By Transaction Type

The analysis by transaction type focuses on key areas such as card, online, and in-store transactions. Card transactions remain dominant with significant market sizes and share, driven by consumer convenience and widespread acceptance. Online transactions are rapidly growing as e-commerce expands, while in-store transactions continue to adapt through enhanced digital interfaces. The evolution within this segment underscores a shift towards integrated payment systems that combine speed, security, and real-time validation to meet the demands of modern consumers.

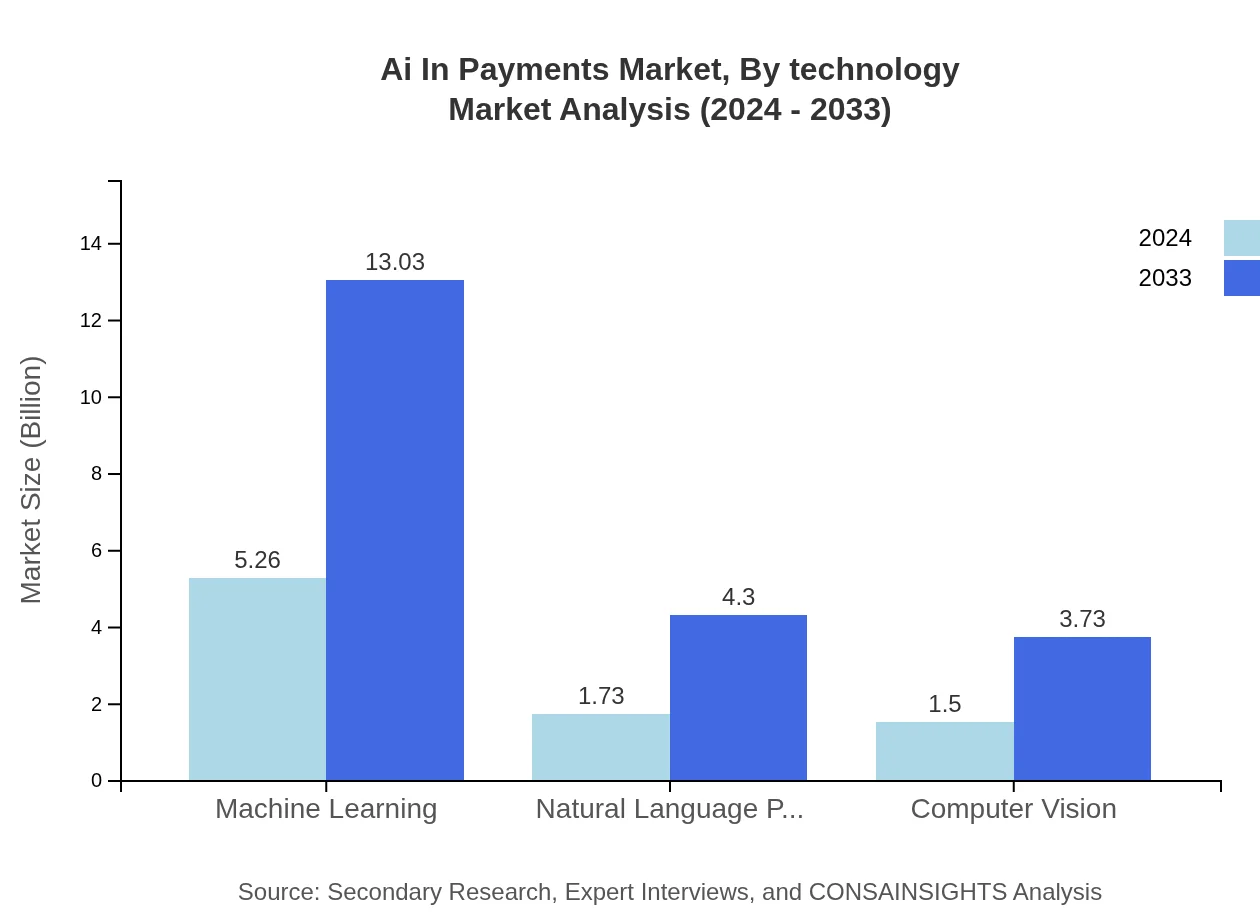

Ai In Payments Market Analysis By Technology

Technological innovations form the backbone of the market with advancements in machine learning, natural language processing, and computer vision. Machine learning leads the way by offering predictive analytics for fraud detection and personalized user experiences. Natural language processing is enhancing user interfaces and customer interactions, while computer vision plays a role in biometric verification and transaction security. These technologies collectively drive improvements in processing efficiency, reliability, and overall effectiveness of payment solutions.

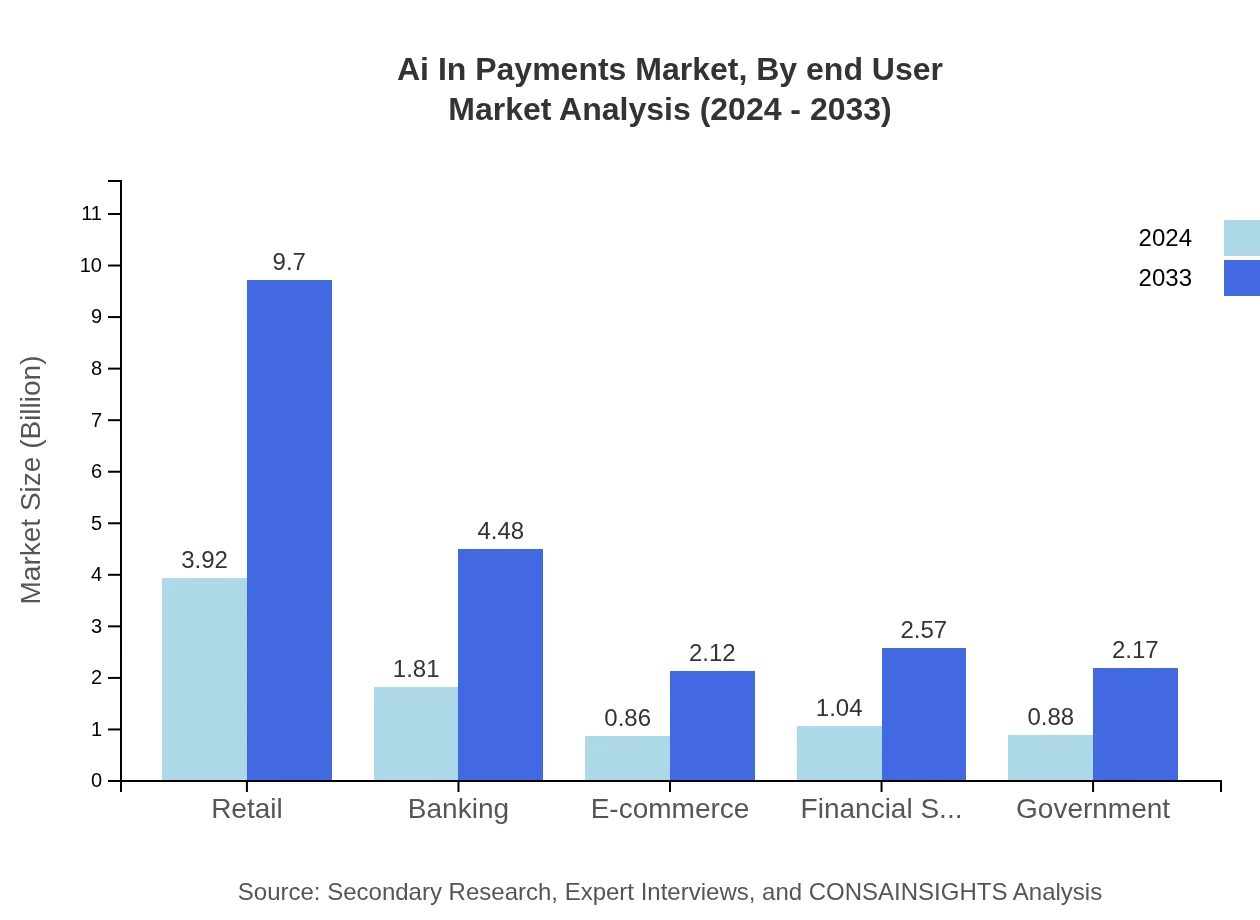

Ai In Payments Market Analysis By End User

End-user segmentation highlights diverse applications of AI in payments across retail, banking, e-commerce, financial services, and government agencies. Retail sectors leverage AI to optimize customer service and inventory management, while banks integrate intelligent systems for risk assessment and fraud detection. E-commerce platforms benefit from streamlined transactions and personalized recommendations, and government bodies exploit AI to enhance regulatory compliance and public service efficiency. This diverse end-user adoption fosters robust market growth and drives innovation tailored to specific operational needs.

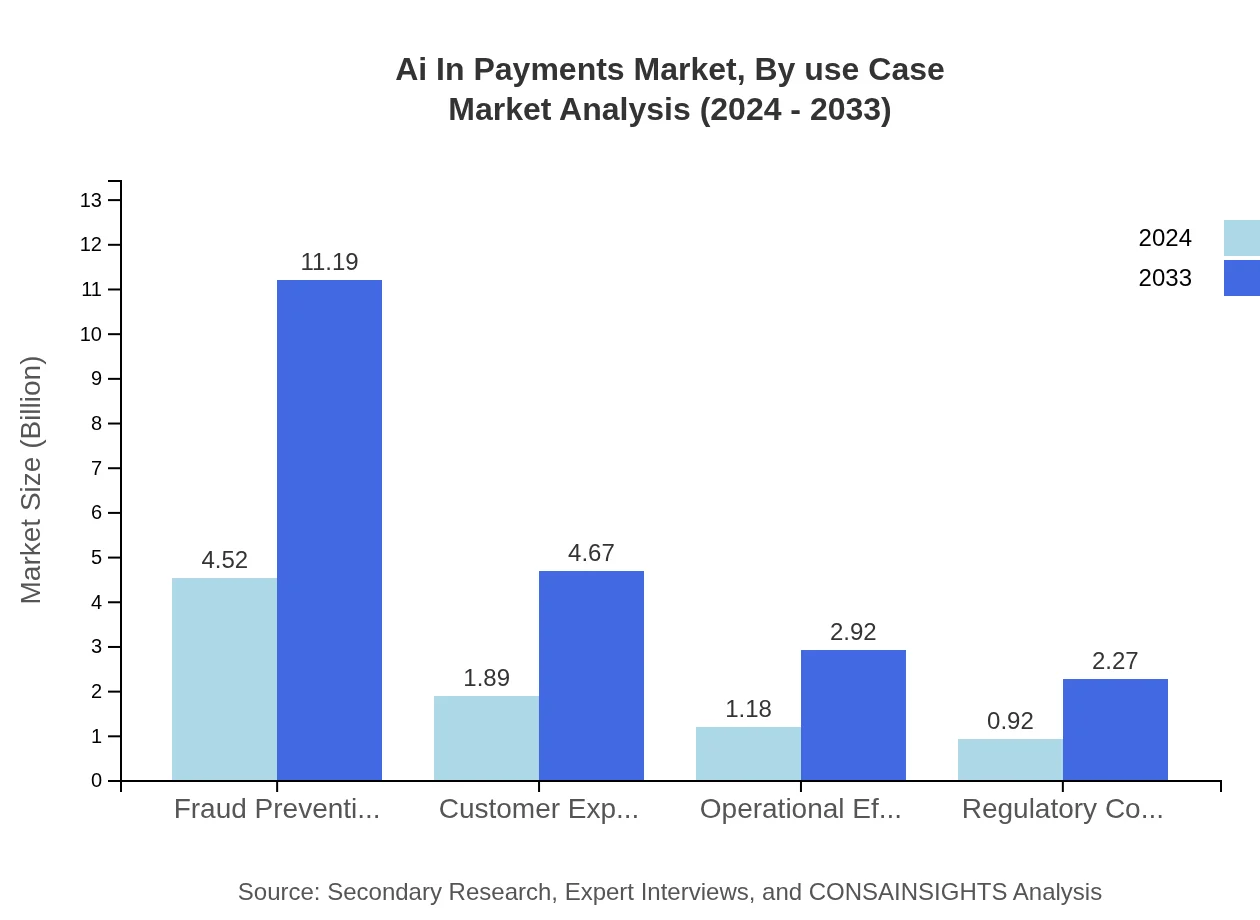

Ai In Payments Market Analysis By Use Case

The use-case analysis extends across vital functions such as fraud prevention, customer experience enhancement, operational efficiency, and regulatory compliance. Fraud prevention remains critical, utilizing advanced algorithms to identify suspicious patterns and secure transactions. Enhancing customer experience through real-time support and personalized interactions is a key focus area, while operational efficiency benefits from automation and streamlined workflows. Additionally, ensuring adherence to regulatory standards via AI-driven monitoring is increasingly important as markets evolve and compliance demands intensify.

Ai In Payments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Payments Industry

InnovatePay Solutions:

A pioneer in integrating AI with payment systems, InnovatePay Solutions consistently drives technological advancements in fraud detection and transaction processing, making significant contributions to industry standards.AI Fintech Corp:

Known for its innovative approaches and network of strategic partnerships, AI Fintech Corp offers cutting-edge solutions that have redefined customer engagement and efficiency in payment systems.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Payments?

The global AI in Payments market is projected to reach approximately $8.5 billion by 2024, with a compound annual growth rate (CAGR) of 10.2% from 2024 to 2033.

What are the key market players or companies in this ai In Payments industry?

Key market players in the AI in Payments industry include major financial institutions, technology providers, and fintech companies that integrate AI solutions to enhance payment systems, fraud detection, and customer services.

What are the primary factors driving the growth in the ai In Payments industry?

The growth of the AI in Payments industry is driven by increasing demand for enhanced fraud prevention, improved customer experiences, operational efficiencies, and the adoption of machine learning and algorithms in payment processing.

Which region is the fastest Growing in the ai In Payments?

North America is the fastest-growing region in the AI in Payments market, expected to grow from $3.16 billion in 2024 to $7.82 billion by 2033, leveraging advanced technology trends and investment.

Does ConsaInsights provide customized market report data for the ai In Payments industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs, allowing businesses to gain insights into the AI in Payments industry that reflect their operational context and market position.

What deliverables can I expect from this ai In Payments market research project?

Deliverables include comprehensive reports, market forecasts, trend analyses, competitive landscape assessments, and actionable insights that cater to strategic decision-making in the AI in Payments sector.

What are the market trends of ai In Payments?

Current trends in the AI in Payments sector include the use of machine learning for transaction analysis, adoption of natural language processing for customer service, and increasing reliance on data analytics to streamline operations.