Ai In Lending

Published Date: 24 January 2026 | Report Code: ai-in-lending

Ai In Lending Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers an in-depth analysis of the Ai In Lending market, forecasting trends and growth from 2024 to 2033. It provides valuable insights including market overview, size and CAGR, industry dynamics, segmentation, regional performance, technology innovations, product performance, and a review of global leaders. Readers will gain a detailed understanding to support strategic decisions.

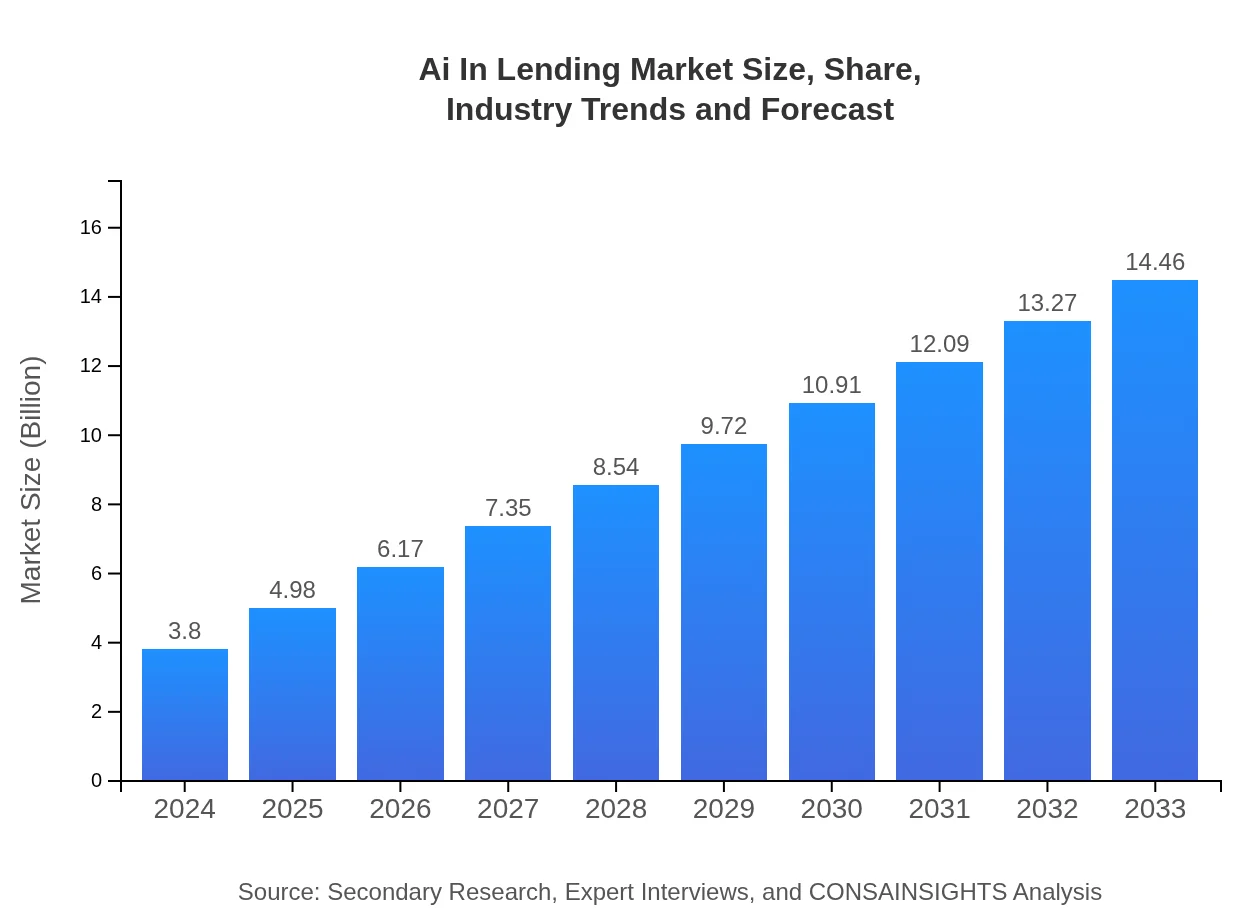

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.80 Billion |

| CAGR (2024-2033) | 15.2% |

| 2033 Market Size | $14.46 Billion |

| Top Companies | FinTech Innovators Inc., LendTech Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Lending Market Overview

Customize Ai In Lending market research report

- ✔ Get in-depth analysis of Ai In Lending market size, growth, and forecasts.

- ✔ Understand Ai In Lending's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Lending

What is the Market Size & CAGR of Ai In Lending market in 2024?

Ai In Lending Industry Analysis

Ai In Lending Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Lending Market Analysis Report by Region

Europe Ai In Lending:

Europe’s Ai In Lending market is experiencing steady growth, reflected by an expansion from 1.28 in 2024 to 4.88 in 2033. The region's mature regulatory environment, coupled with investments in technological upgrades, is creating a favorable landscape for AI-driven lending solutions.Asia Pacific Ai In Lending:

In the Asia Pacific region, the Ai In Lending market is set for significant growth with market size expected to increase from 0.69 in 2024 to 2.64 in 2033. Advancements in mobile technology and digital banking have accelerated AI adoption, fostering innovation in risk assessment and customer service.North America Ai In Lending:

North America maintains a dominant position with a market size increasing from 1.28 in 2024 to 4.86 in 2033. The region benefits from well-established fintech ecosystems, high digital literacy, and strong collaboration between tech innovators and traditional banks.South America Ai In Lending:

South America, represented by Latin America data, shows modest growth with the market expanding from 0.03 in 2024 to 0.12 in 2033. The gradual adoption of digital financial solutions and increasing regulatory support is expected to boost AI initiatives in lending.Middle East & Africa Ai In Lending:

The Middle East and Africa region is poised for impressive growth, with the market expected to scale from 0.52 in 2024 to 1.97 in 2033. Increasing smartphone penetration and a rising demand for accessible financial services are key drivers in the adoption of AI in lending.Tell us your focus area and get a customized research report.

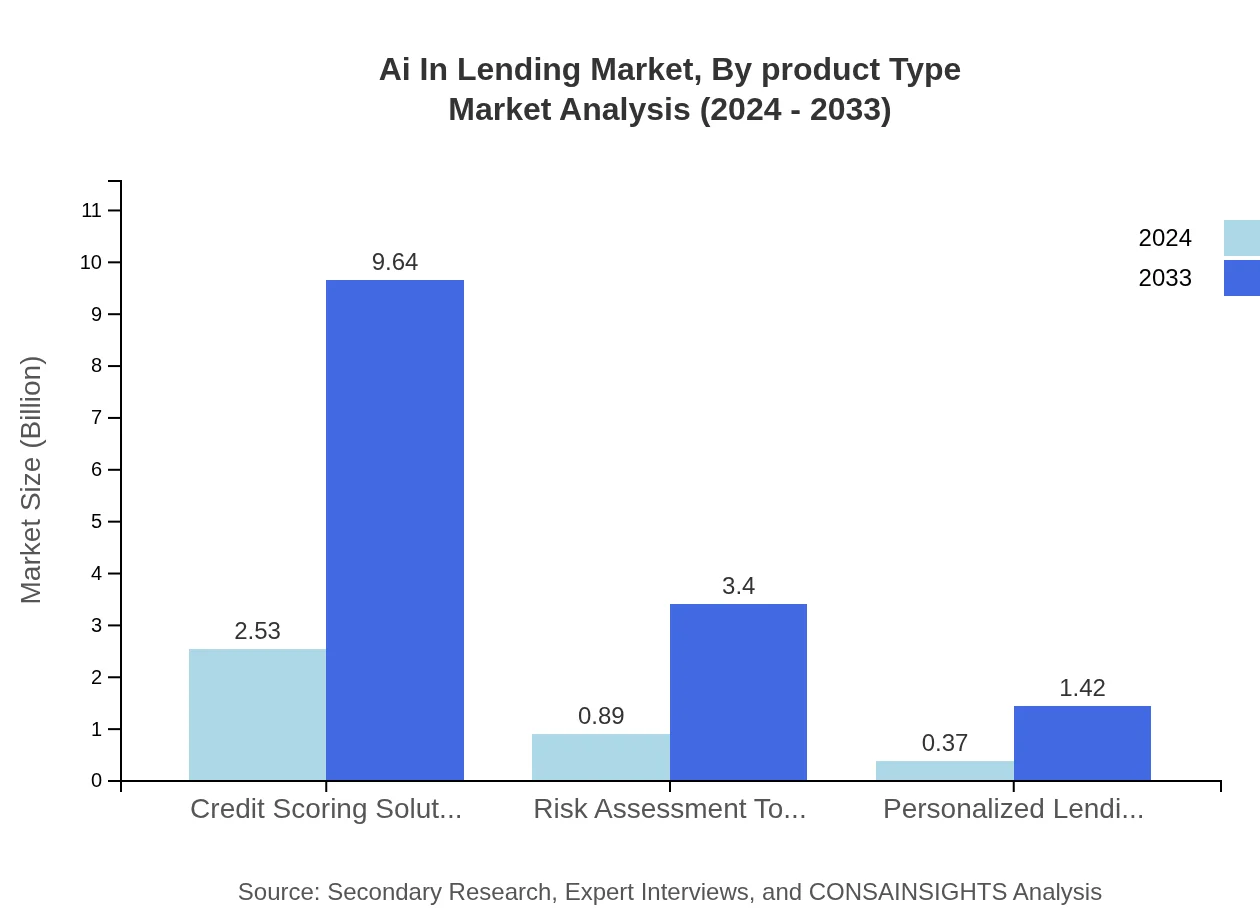

Ai In Lending Market Analysis By Product Type

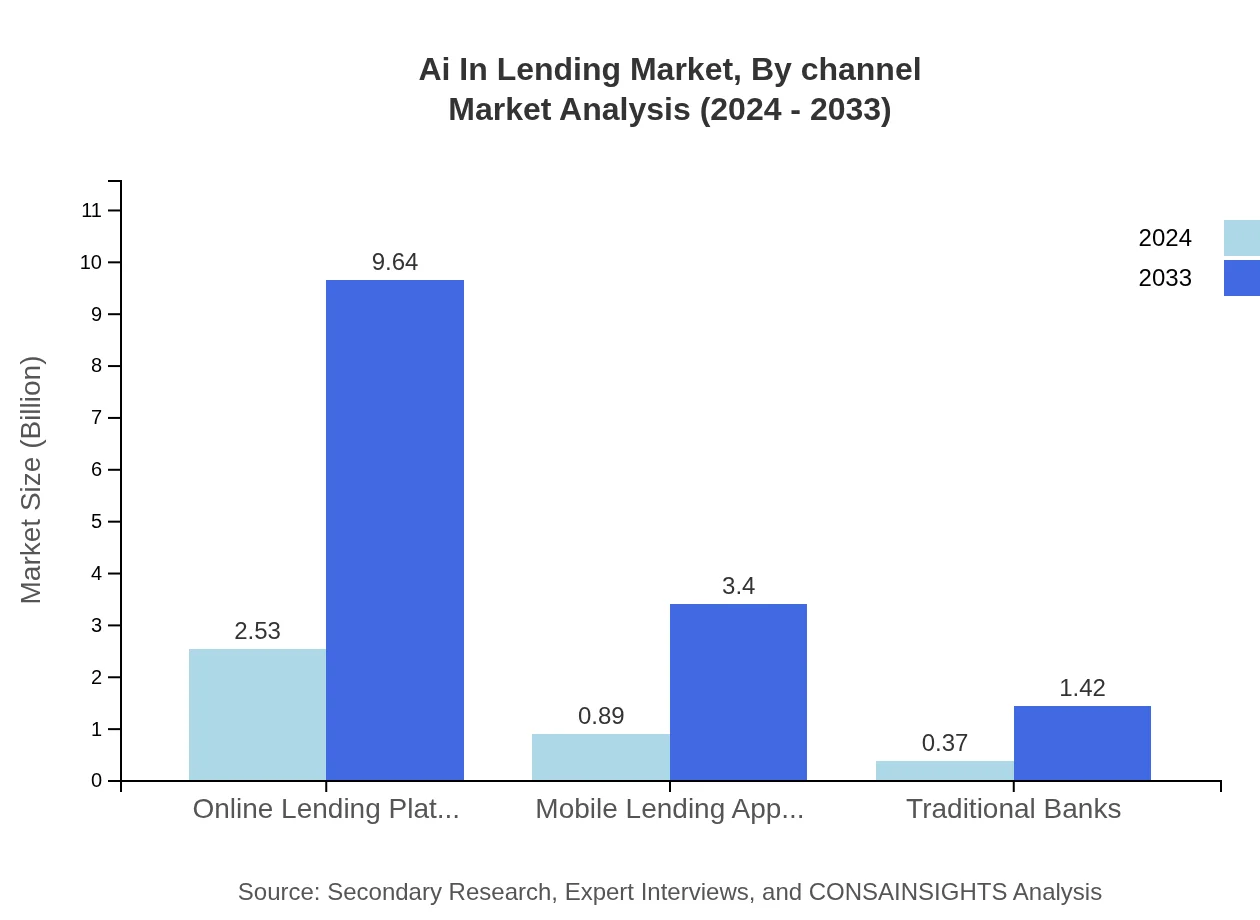

The product type segment of the Ai In Lending market is predominantly driven by online lending platforms and mobile lending applications. Online lending platforms lead the segment with substantial market size growth from 2.53 in 2024 to 9.64 in 2033 and a stable market share of 66.69%. Mobile lending applications, although smaller in total size, contribute significantly by enhancing accessibility with an increase in market size from 0.89 to 3.40 while maintaining a 23.49% share. Traditional banks, though conservative in their digital transformation, exhibit steady growth from 0.37 in 2024 to 1.42 in 2033, reflecting cautious adaptation. The integration of fintech innovations into traditional banking further bolsters this segment, making it an important area of focus for financial institutions seeking to retain their customer base while leveraging new technologies.

Ai In Lending Market Analysis By Application Area

The application area segment in the Ai In Lending market focuses on the integration of advanced analytics into core lending functions such as risk assessment, credit scoring, and personalized lending offers. Credit scoring solutions and risk assessment tools remain pivotal, with credit scoring expanding from 2.53 in 2024 to 9.64 in 2033, constituting a dominant 66.69% share, and risk assessment tools showing a similar trend. Personalized lending offers, though representing a smaller slice with a size growth from 0.37 to 1.42 and a share of 9.82%, are pivotal in enhancing customer-centric loan products. This segmentation underscores the importance of data-driven decision making, where lenders harness machine learning algorithms to tailor products according to individual risk profiles and financial behaviors, ultimately fostering a more inclusive credit ecosystem.

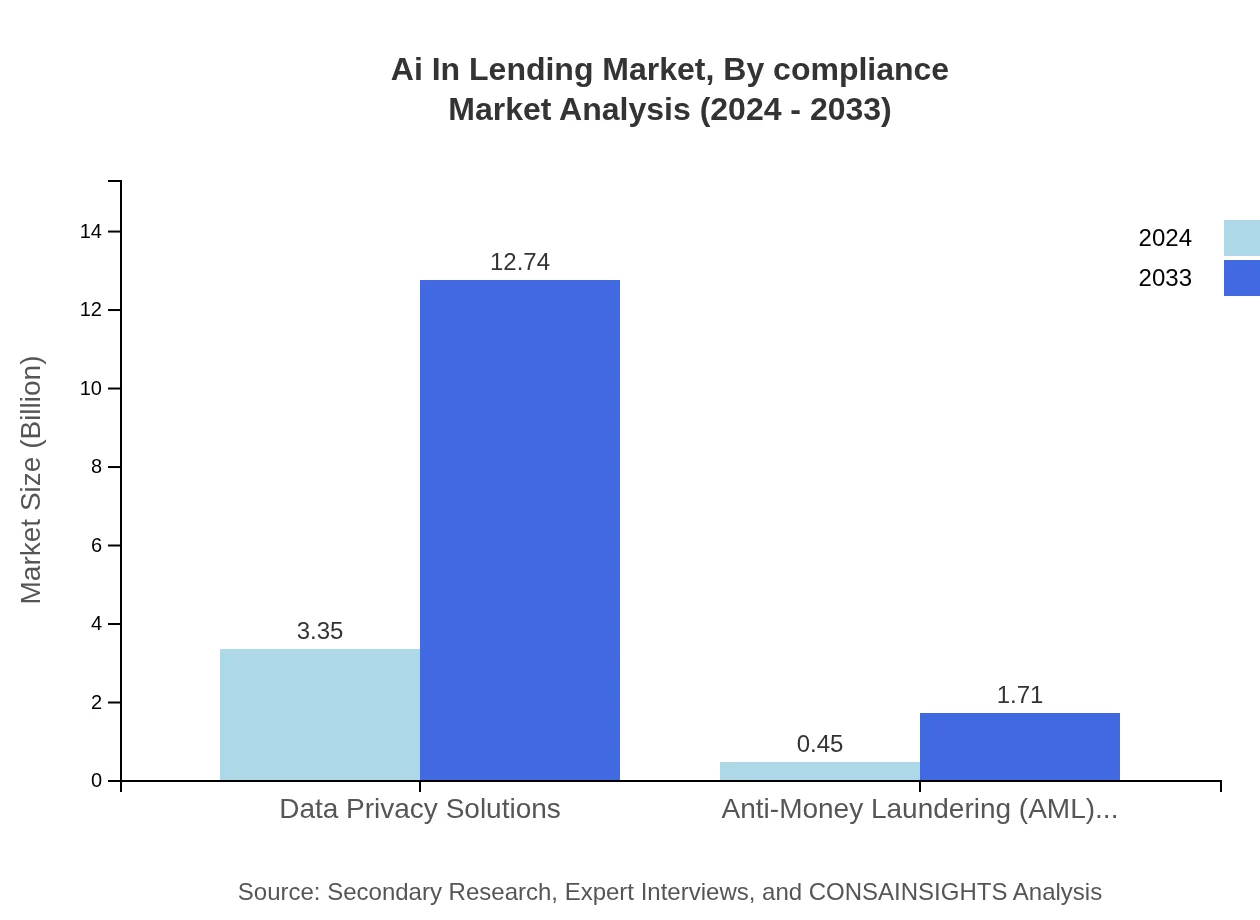

Ai In Lending Market Analysis By Compliance

Compliance and regulation in the Ai In Lending market are centered on ensuring robust measures against fraud and financial crime. Key solutions include Data Privacy, Anti-Money Laundering (AML) Solutions, and Credit Scoring Solutions. Data privacy solutions demonstrate significant growth with market size escalating from 3.35 in 2024 to 12.74 in 2033 while maintaining an exceptional share of 88.14%. AML solutions similarly grow from 0.45 to 1.71 with a steady share of 11.86%. These innovations not only mitigate potential risks but also ensure that lenders remain compliant with global data protection standards. The effective implementation of these solutions is essential in building consumer trust and enhancing the overall security framework in digital lending operations.

Ai In Lending Market Analysis By Channel

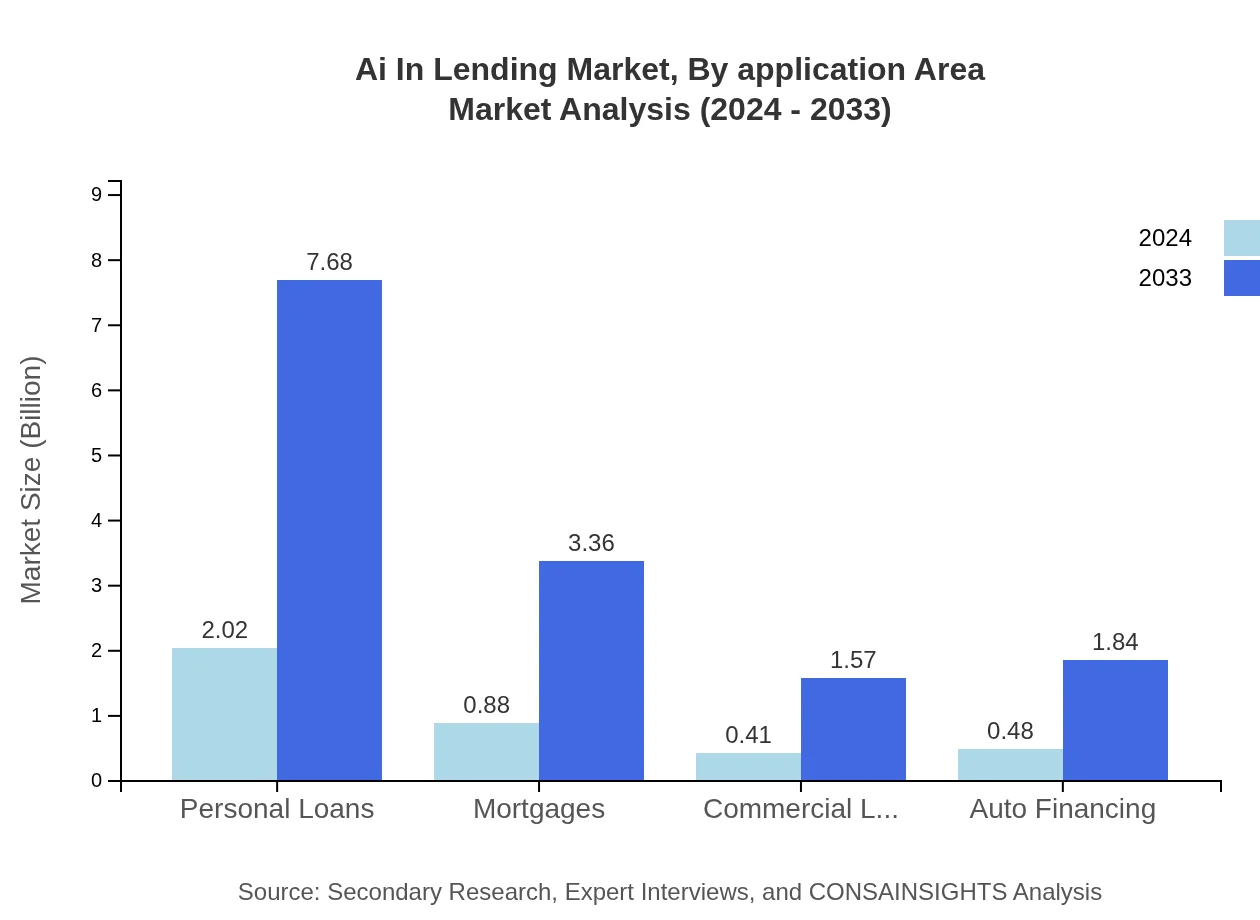

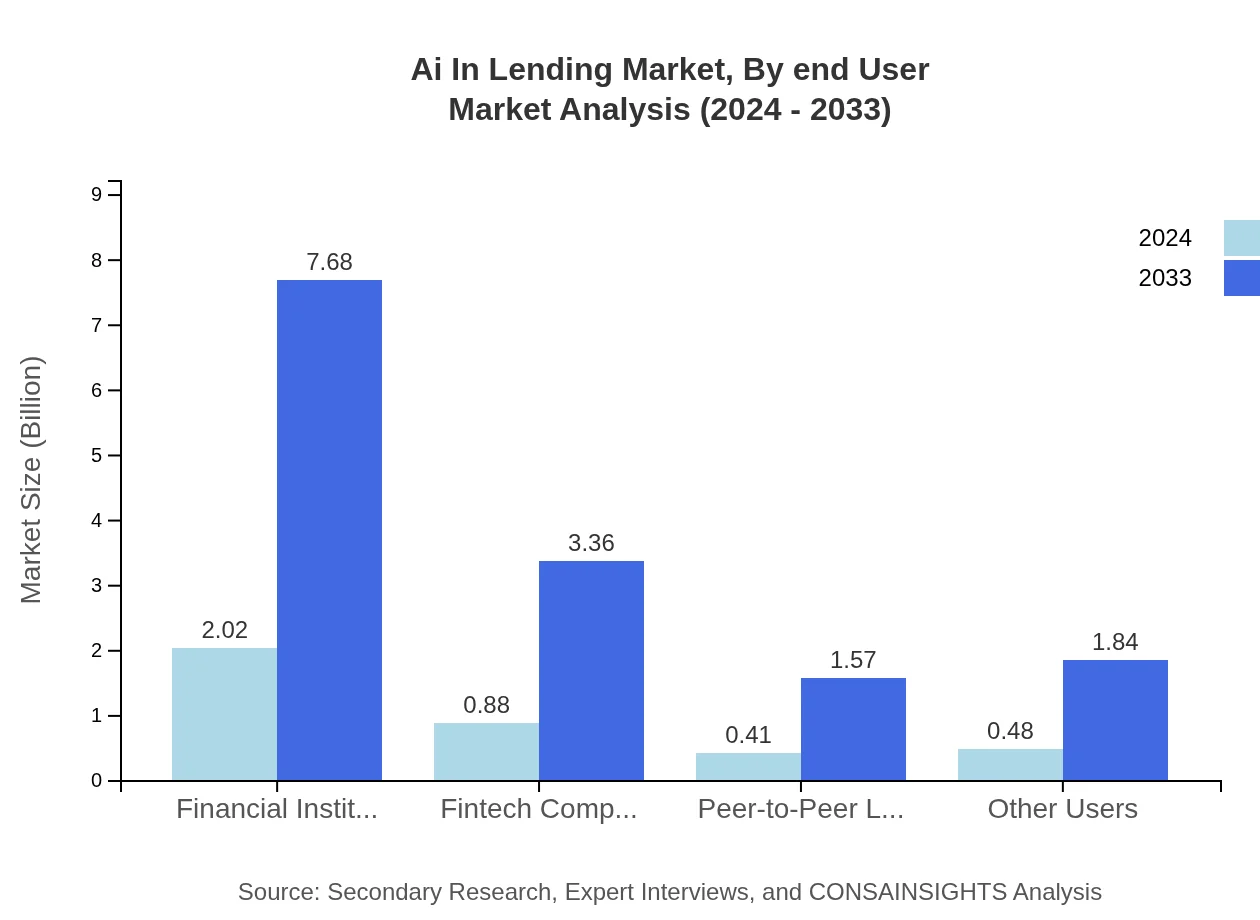

The channel segment in the Ai In Lending market illustrates the distribution and operational methods through which AI technologies are delivered. Traditional financial institutions and fintech companies vie for market leadership through varying channels. Financial institutions report a market size increase from 2.02 in 2024 to 7.68 in 2033 while maintaining a dominant share of 53.12%, highlighting their robust infrastructure and established customer networks. Fintech companies, on the other hand, are characterized by rapid innovation and agile business models, with market size growing from 0.88 to 3.36 and retaining a 23.25% share. This dual-channel strategy facilitates efficient market penetration and broader customer outreach, playing a crucial role in accelerating the adoption of AI-driven lending solutions across diverse customer bases.

Ai In Lending Market Analysis By End User

The end-user segment of the Ai In Lending market is segmented into various borrowing categories including personal loans, mortgages, commercial lending, and auto financing. Personal loans record substantial market traction with growth from 2.02 in 2024 to 7.68 in 2033 and a dominant share of 53.12%. Mortgages and commercial lending, registering market sizes of 0.88 and 0.41 in 2024 respectively, are expected to grow in parallel with digital transformation trends and improved risk management capabilities. Auto financing also shows promising prospects with market size increasing from 0.48 to 1.84 and a share of 12.74%. This segmentation highlights the tailored approach adopted by financial institutions, aiming to meet the diverse needs of individual and corporate borrowers through AI-powered customized lending solutions.

Ai In Lending Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Lending Industry

FinTech Innovators Inc.:

A leader in AI-driven lending solutions, FinTech Innovators Inc. utilizes advanced analytics and machine learning algorithms to streamline credit scoring and risk management, setting industry benchmarks in innovation and customer experience.LendTech Solutions:

LendTech Solutions offers robust digital lending platforms that integrate cutting-edge artificial intelligence, ensuring rapid loan processing, enhanced security, and superior compliance with global financial regulations.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Lending?

The AI in Lending market is projected to reach approximately $3.8 billion by 2024, with an impressive compound annual growth rate (CAGR) of 15.2% from 2024 to 2033. This signifies robust expansion and promising opportunities in the lending sector.

What are the key market players or companies in the ai In Lending industry?

Key players in the AI in Lending industry include a mix of traditional banks and innovative fintech companies. Noteworthy names include major financial institutions, online lending platforms, and specialized companies focusing on AI-driven lending solutions that enhance customer experience.

What are the primary factors driving the growth in the ai In Lending industry?

Growth in the AI in Lending industry is primarily driven by technological advancements, increased demand for efficient loan processing, adoption of predictive analytics, and the necessity for improved customer experience and risk management solutions in financial sectors.

Which region is the fastest Growing in the ai In Lending?

The fastest-growing region in the AI in Lending market is Europe, expected to expand from $1.28 billion in 2024 to $4.88 billion by 2033. Other growing regions include North America and Asia-Pacific, showcasing significant advancements and investments.

Does ConsaInsights provide customized market report data for the ai In Lending industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the AI in Lending industry, delivering insights that help businesses make informed strategic decisions and capitalize on market opportunities.

What deliverables can I expect from this ai In Lending market research project?

From this AI in Lending market research project, expect comprehensive reports detailing market size, growth forecasts, segment analysis, competitive landscape evaluations, and regional insights that can aid strategic planning and investment directives.

What are the market trends of ai In Lending?

Emerging trends in the AI in Lending market include increasing integration of machine learning in credit scoring models, automation of loan processing, enhanced data privacy measures, and the growing importance of personalized lending solutions to better meet customer needs.