Ai In Accounts Receivable

Published Date: 24 January 2026 | Report Code: ai-in-accounts-receivable

Ai In Accounts Receivable Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on AI in Accounts Receivable delivers in‐depth insights spanning market trends, addressable market size, competitive analysis, and regional breakdowns from 2024 to 2033. It provides a clear understanding of technological innovations, industry segmentation, and forecasted growth rates, helping stakeholders make informed decisions based on robust data and strategic market forecasts.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

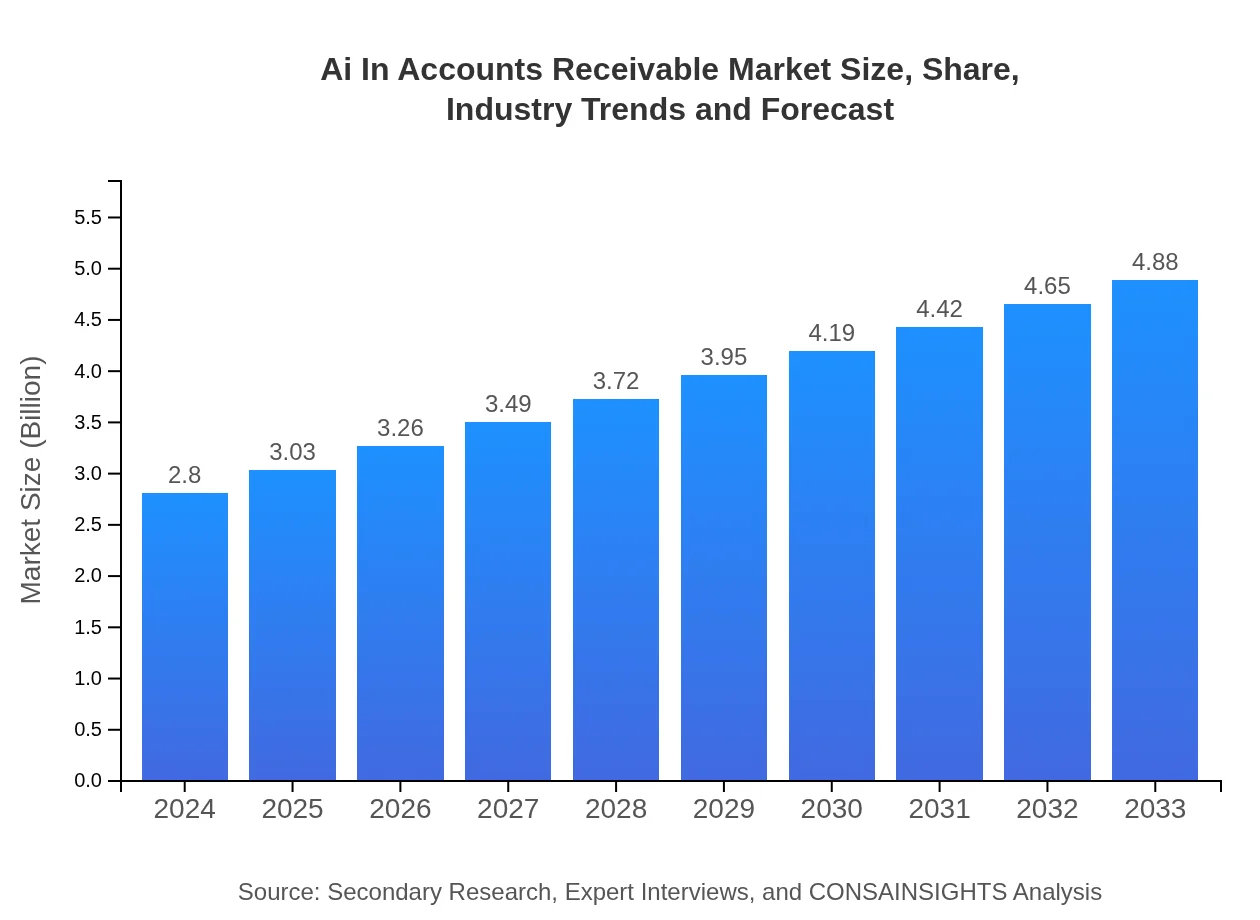

| 2024 Market Size | $2.80 Billion |

| CAGR (2024-2033) | 6.2% |

| 2033 Market Size | $4.88 Billion |

| Top Companies | Innovate Financial Solutions, TechAdvantage Global, SmartReceivables Inc. |

| Last Modified Date | 24 January 2026 |

Ai In Accounts Receivable Market Overview

Customize Ai In Accounts Receivable market research report

- ✔ Get in-depth analysis of Ai In Accounts Receivable market size, growth, and forecasts.

- ✔ Understand Ai In Accounts Receivable's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Accounts Receivable

What is the Market Size & CAGR of Ai In Accounts Receivable market in 2024?

Ai In Accounts Receivable Industry Analysis

Ai In Accounts Receivable Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Accounts Receivable Market Analysis Report by Region

Europe Ai In Accounts Receivable:

Europe is experiencing significant growth in the AI in Accounts Receivable space, with market size projections rising from 0.69 billion in 2024 to 1.20 billion by 2033. The region benefits from strong regulatory frameworks, high digital penetration, and a mature IT ecosystem that supports advanced technological adoption in financial operations.Asia Pacific Ai In Accounts Receivable:

In the Asia Pacific region, market growth is driven by rapid digital adoption and increasing investments in AI-powered financial solutions. Economic progress and favorable government policies have accelerated AI integration in receivables management. Companies in this region are experimenting with scalable cloud-based solutions to improve operational efficiency and reduce processing errors.North America Ai In Accounts Receivable:

North America continues to be a frontrunner in adopting AI technologies in accounts receivable. With the largest market size, enterprises are rapidly transitioning from conventional practices to innovative AI solutions to tackle complexities in billing, collections, and compliance. Advanced analytics and real-time processing capabilities are key factors driving market expansion in this region.South America Ai In Accounts Receivable:

South America, represented by Latin America in market data, is witnessing gradual adoption of AI in financial operations. Despite some infrastructural challenges, businesses are increasingly recognizing the value of automated receivables management for cost reduction and improved cash flow. Investment in digital transformation remains a priority as firms strive to enhance efficiency.Middle East & Africa Ai In Accounts Receivable:

In the Middle East and Africa, the market is gradually gaining momentum as more companies look to modernize their financial operations using AI. Although the current market size is relatively modest, increasing digital investments and a focus on improving operational efficiencies suggest robust growth potential in the coming years.Tell us your focus area and get a customized research report.

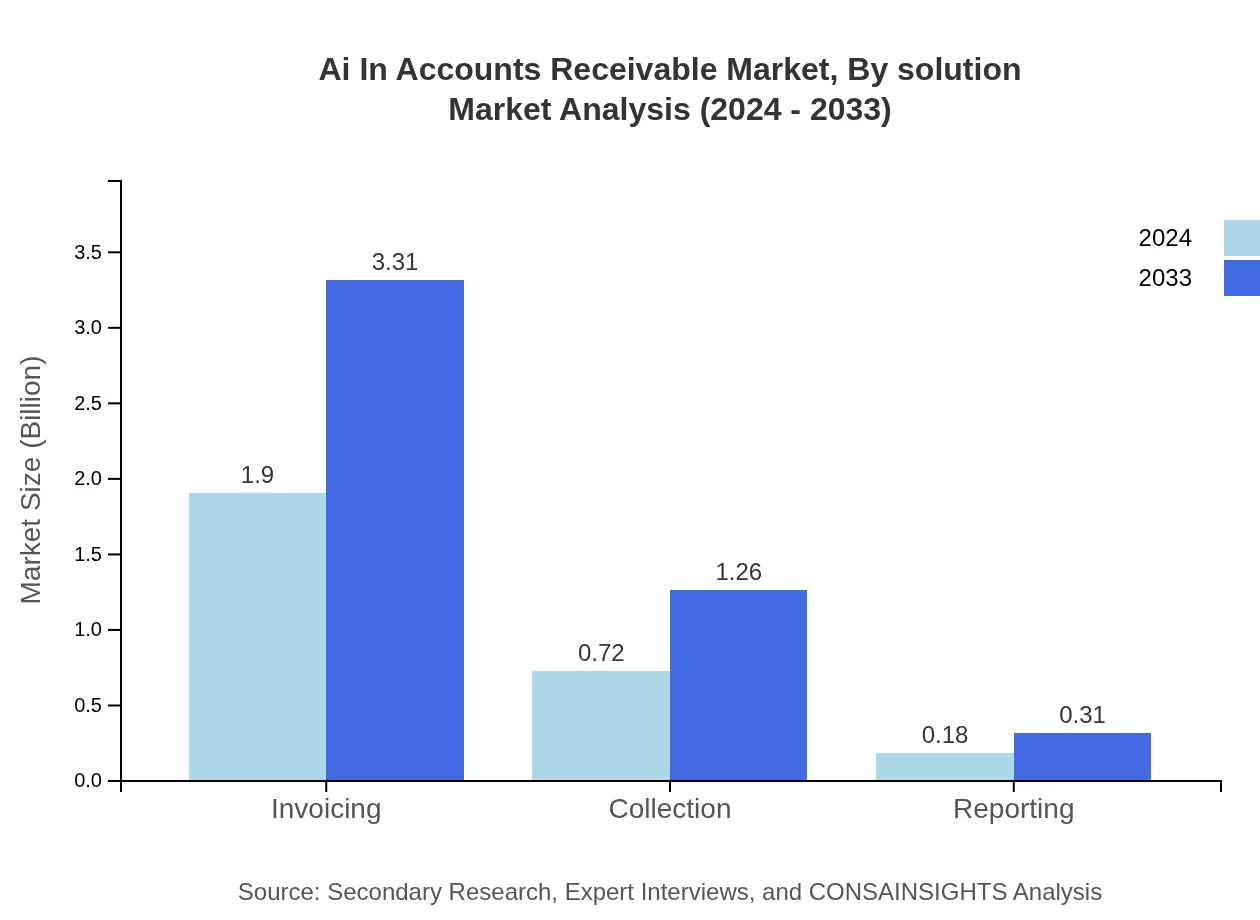

Ai In Accounts Receivable Market Analysis By Solution

The by-solution segment focuses on critical financial functionalities such as invoicing, collection, and reporting. Invoicing dominates the segment with a market share of 67.75% and size growth from 1.90 billion in 2024 to 3.31 billion in 2033. Collection and reporting, with shares of 25.88% and 6.37% respectively, contribute significantly by streamlining billing operations and enhancing cash recovery processes. These solutions are increasingly being integrated into automated systems to reduce human error and accelerate transaction cycles.

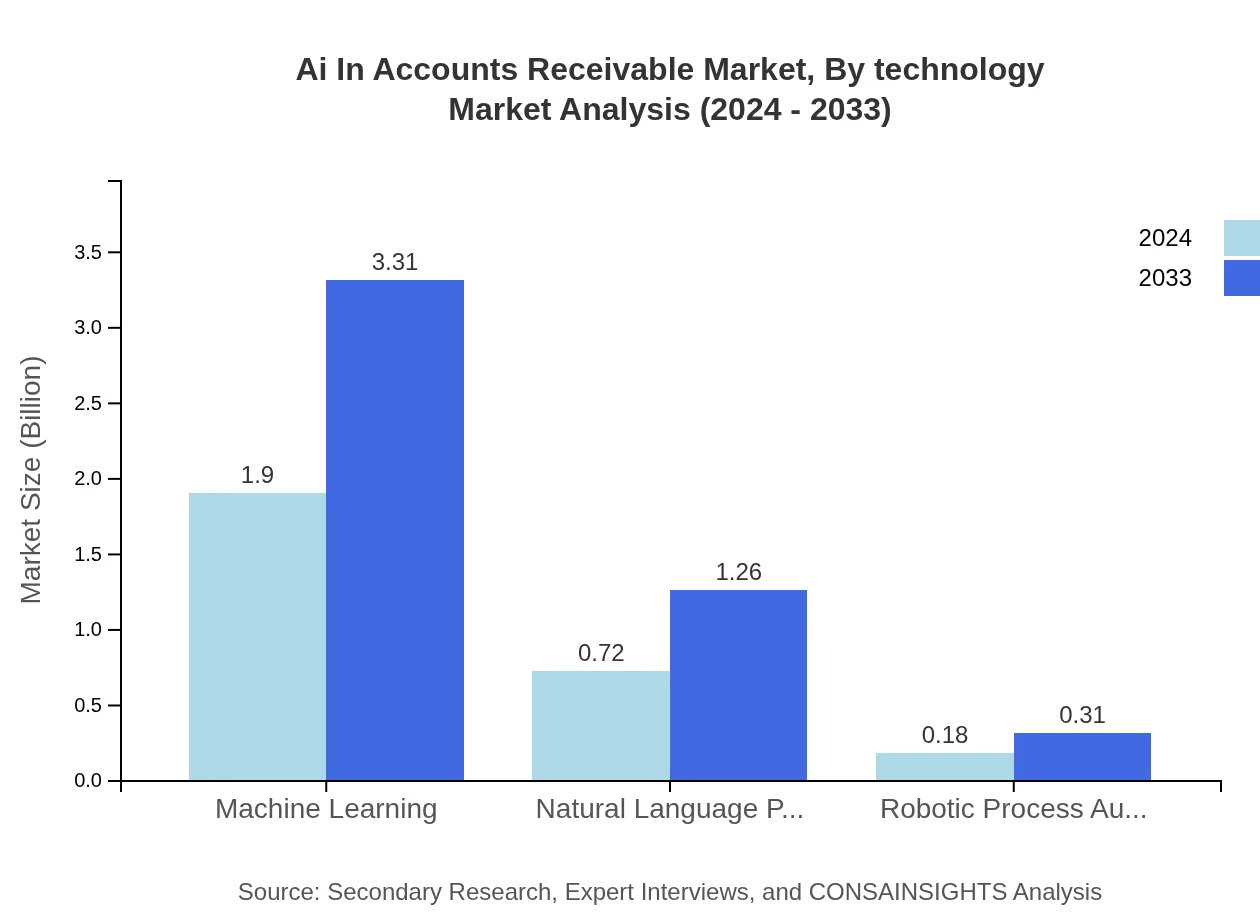

Ai In Accounts Receivable Market Analysis By Technology

The technology segment encompasses machine learning, natural language processing, and robotic process automation. Machine learning leads the charge with a 67.75% market share and mirrored size growth as seen in core solution offerings. Natural language processing and robotic process automation, each holding a 25.88% and 6.37% share respectively, enhance data interpretation and process efficiency. These technologies work in tandem to provide smart automation and predictive analysis, which are essential for optimizing receivables management and minimizing processing inaccuracies.

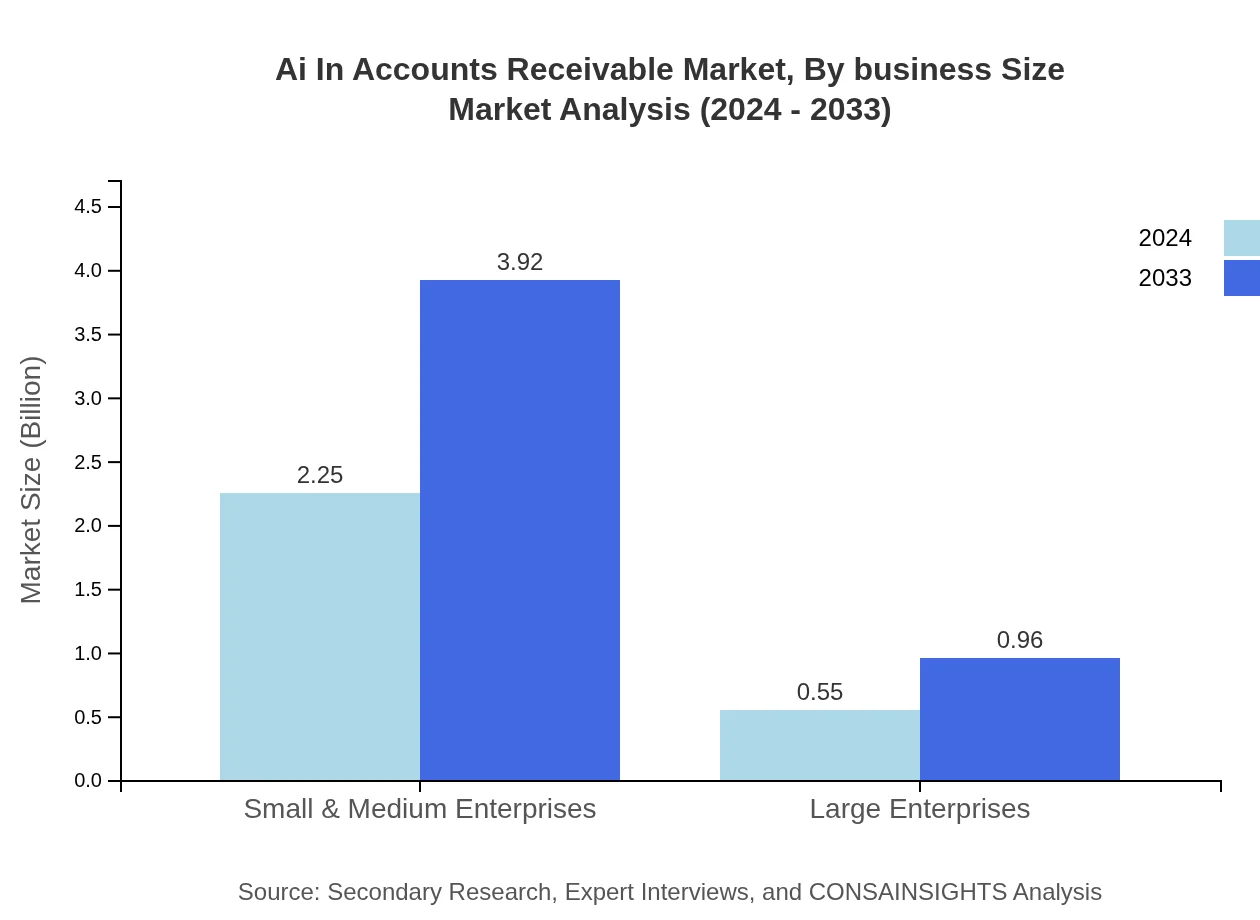

Ai In Accounts Receivable Market Analysis By Business Size

Business size segmentation distinguishes between small & medium enterprises (SMEs) and large enterprises. SMEs command a dominant share of 80.31%, with market sizes growing from 2.25 billion to 3.92 billion, driven by rapid adoption and scalability of AI solutions. In contrast, large enterprises represent 19.69% of the market share with modest growth from 0.55 billion to 0.96 billion. The disparity reflects the agility and broader application of AI in smaller organizations compared to the more complex, legacy systems present in larger corporations.

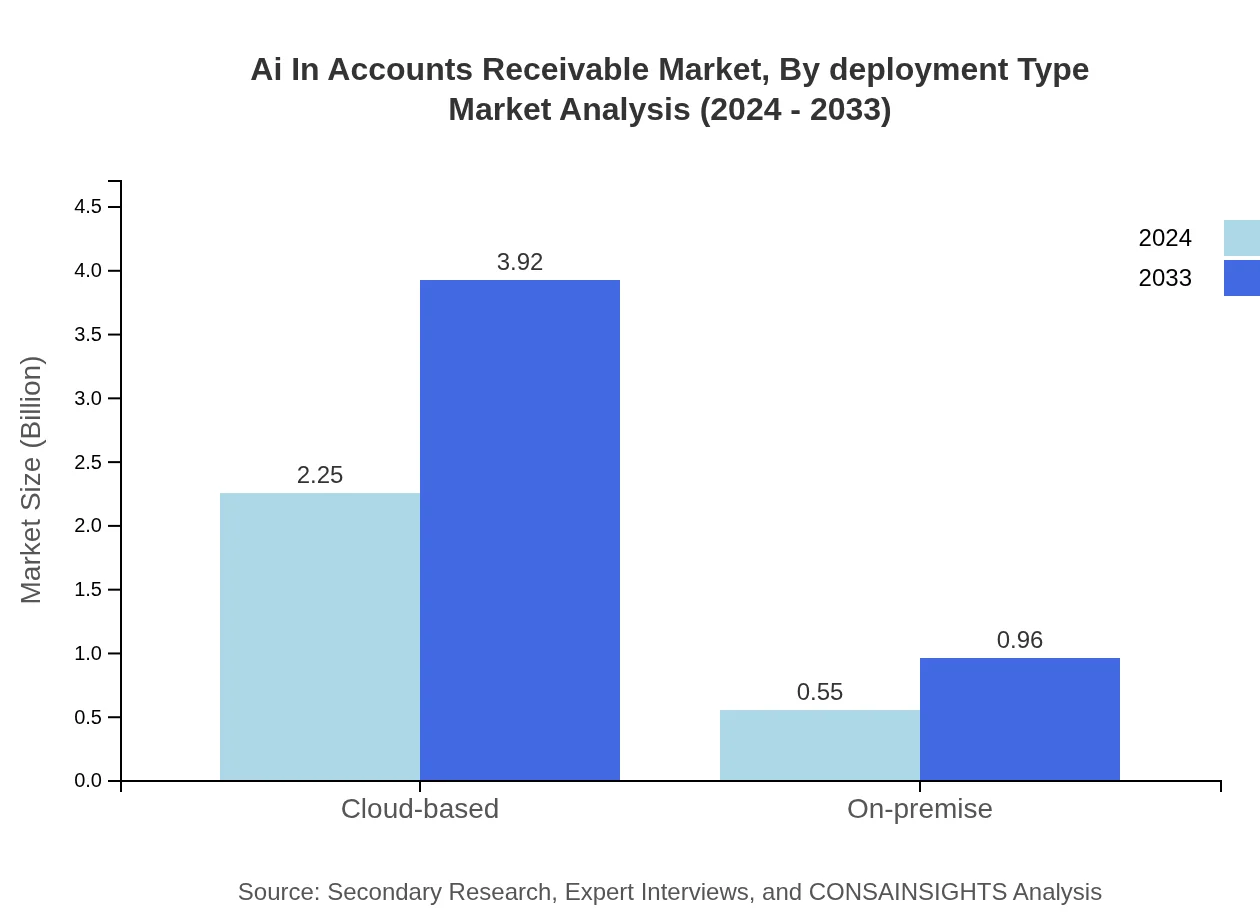

Ai In Accounts Receivable Market Analysis By Deployment Type

Deployment type analysis highlights two primary models: cloud-based and on-premise systems. Cloud-based solutions dominate, capturing 80.31% of the market share and expanding from 2.25 billion in 2024 to 3.92 billion in 2033. This trend is driven by the flexibility, scalability, and cost-effectiveness these solutions offer. On-premise systems, though less prevalent with a 19.69% share and growth from 0.55 billion to 0.96 billion, remain important for organizations with strict data security requirements and regulatory considerations.

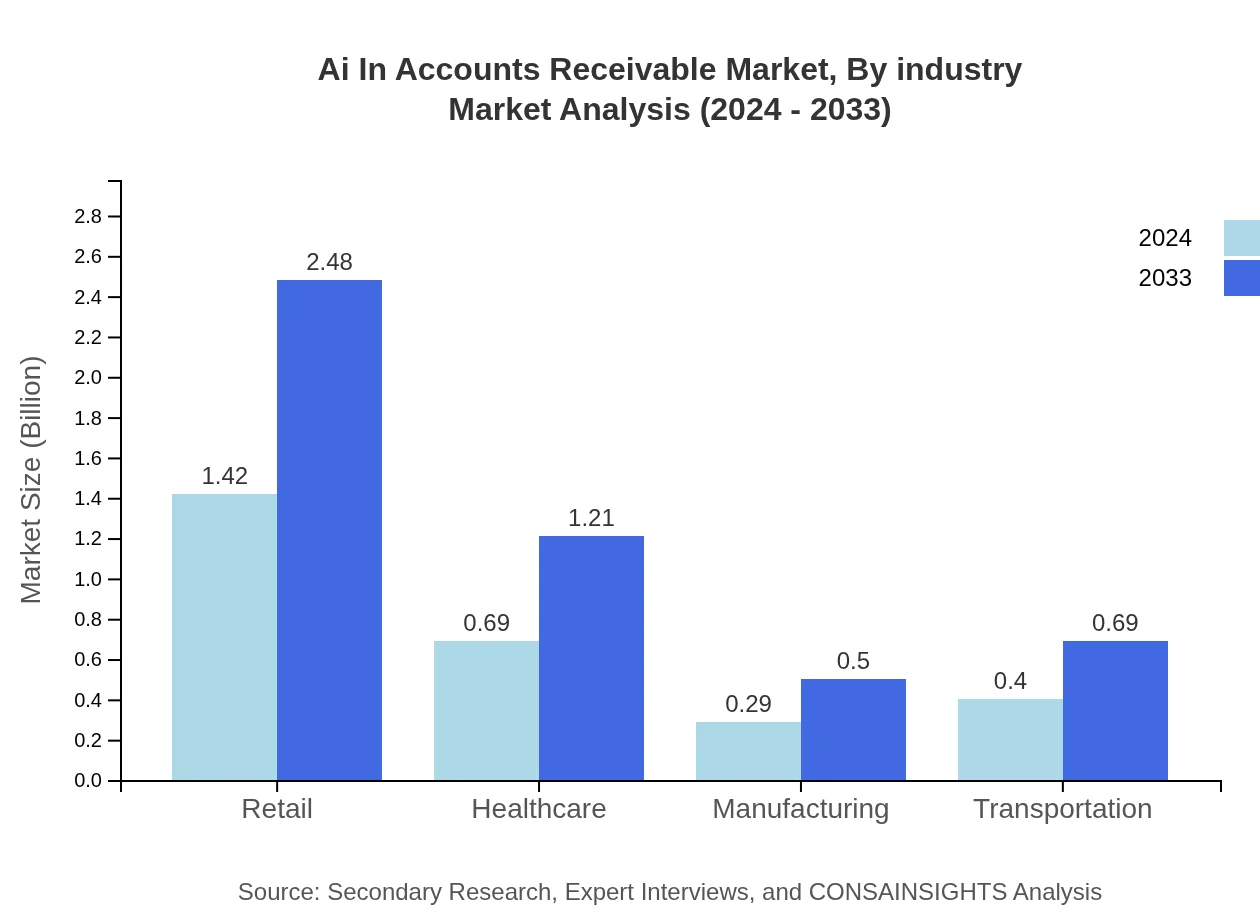

Ai In Accounts Receivable Market Analysis By Industry

The industry segmentation reveals distinct performance across sectors. Retail leads with a 50.88% share and an increase from 1.42 billion to 2.48 billion, driven by high-volume transactions. Healthcare follows with a 24.7% share, growing from 0.69 billion to 1.21 billion, as organizations focus on reducing billing errors. Manufacturing and transportation hold 10.29% and 14.13% shares respectively, benefitting from streamlined accounts management processes. These insights underscore the versatile application of AI solutions across diverse industry verticals to enhance revenue cycle performance.

Ai In Accounts Receivable Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Accounts Receivable Industry

Innovate Financial Solutions:

A leader in integrating advanced AI technologies with financial operations, Innovate Financial Solutions offers cutting-edge automation tools that enhance accuracy and efficiency in receivables management.TechAdvantage Global:

TechAdvantage Global pioneers the development of cloud-based AI platforms for accounts receivable, ensuring streamlined billing, improved cash flow, and regulatory compliance across diverse industries.SmartReceivables Inc.:

SmartReceivables Inc. specializes in deploying machine learning and NLP technologies, enabling real-time analytics and process automation that significantly reduce manual intervention and operational costs.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Accounts Receivable?

The AI in Accounts Receivable market was valued at approximately $2.8 billion in 2024, and it is projected to grow at a CAGR of 6.2% throughout the forecast period. By 2033, the market size is expected to significantly increase, driven by technological advancements.

What are the key market players or companies in the AI in Accounts Receivable industry?

Key companies in the AI in Accounts Receivable industry include leading technology firms and software providers that specialize in financial automation, AI solutions, and data analytics. They play a crucial role in shaping market dynamics and driving innovation.

What are the primary factors driving the growth in the AI in Accounts Receivable industry?

Growth in the AI in Accounts Receivable sector is primarily fueled by the need for automated solutions to enhance operational efficiency, reduce human error, and improve cash flow management. Additionally, increased adoption of AI technologies across various industries catalyzes market expansion.

Which region is the fastest Growing in the AI in Accounts Receivable?

The Asia Pacific region is the fastest-growing market for AI in Accounts Receivable, with an expected market size growth from $0.59 billion in 2024 to $1.04 billion by 2033. This growth is driven by rapid digital transformation and increasing investments in AI technologies.

Does ConsaInsights provide customized market report data for the AI in Accounts Receivable industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to the specific needs of clients within the AI in Accounts Receivable sector. This enables stakeholders to make informed decisions based on in-depth market analyses.

What deliverables can I expect from this AI in Accounts Receivable market research project?

From this market research project, you can expect detailed reports containing market size, growth projections, competitive landscape analysis, and insights into consumer behavior, regulatory factors, and technological advancements within the AI in Accounts Receivable industry.

What are the market trends of AI in Accounts Receivable?

Current market trends in AI in Accounts Receivable include increased utilization of machine learning for predictive analytics, growth in cloud-based solutions, and rising demand for integration with existing financial systems, all enhancing the efficiency of accounts receivables processes.