Ai In Stock Market

Published Date: 24 January 2026 | Report Code: ai-in-stock-market

Ai In Stock Market Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the Ai In Stock Market provides thorough insights into the market’s current standing and future trajectory from 2024 to 2033. It covers detailed analyses on market size, growth rates, segmentation, regional performance, technological innovations, and product performance, offering industry professionals and investors valuable data and forecast insights.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

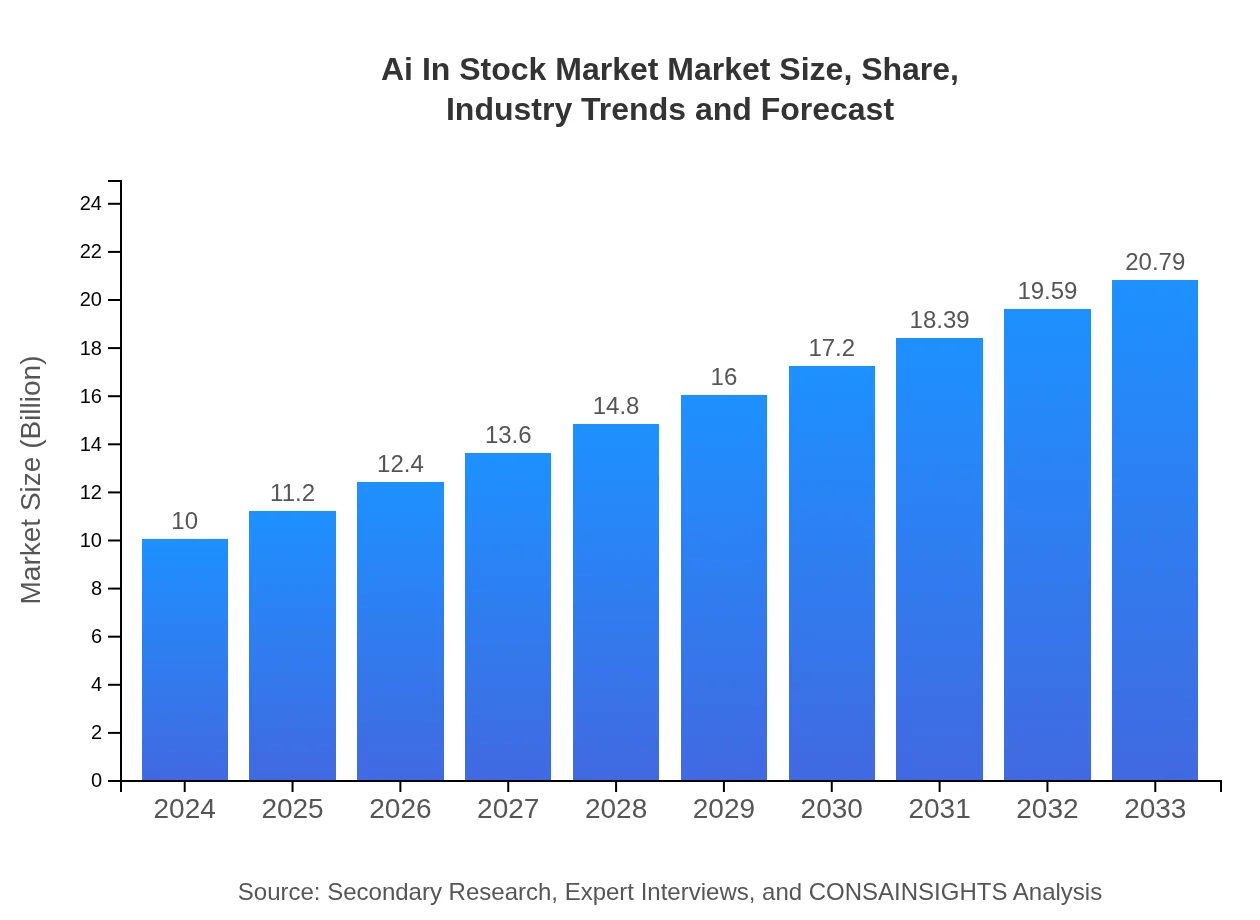

| 2024 Market Size | $10.00 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $20.79 Billion |

| Top Companies | AlphaTrade Innovations, Beta Analytics Group, Quantum FinTech Solutions, Neural Capital Advisors |

| Last Modified Date | 24 January 2026 |

Ai In Stock Market Market Overview

Customize Ai In Stock Market market research report

- ✔ Get in-depth analysis of Ai In Stock Market market size, growth, and forecasts.

- ✔ Understand Ai In Stock Market's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Stock Market

What is the Market Size & CAGR of Ai In Stock Market market in 2024?

Ai In Stock Market Industry Analysis

Ai In Stock Market Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Stock Market Market Analysis Report by Region

Europe Ai In Stock Market:

Europe has shown steady progress in adapting AI technologies within the financial markets. With a market size of 2.51 recorded in 2024 and an anticipated rise to 5.22 by 2033, the region is experiencing methodical growth driven by stringent regulatory frameworks that promote fair practices. The European market benefits from a balanced mix of established financial institutions and tech startups, ensuring that AI-driven models are both innovative and compliant with regional standards.Asia Pacific Ai In Stock Market:

In the Asia Pacific region, the market is witnessing a substantial upward trajectory with 2024 figures marking a market size of 2.15, expected to nearly double to 4.47 by 2033. The region benefits from rapid technological adoption, substantial investments in AI infrastructure, and a growing number of fintech startups. Countries in this region are increasingly integrating advanced AI systems, which are being adopted by both traditional financial institutions and emerging digital trading platforms.North America Ai In Stock Market:

North America remains a dominant force in the Ai In Stock Market segment with a strong market size of 3.83 in 2024, expected to expand to 7.95 by 2033. A mature financial ecosystem, combined with advanced technological infrastructure and substantial R&D investments in AI, underpins this region’s leadership. Innovation hubs and dynamic venture capital support further reinforce North America’s position, ensuring ongoing technology upgrades and the widespread application of AI-based trading systems.South America Ai In Stock Market:

South America presents a unique market scenario where the adoption of AI in stock trading is in its nascent stages yet demonstrating significant potential. With a modest market size of 0.35 in 2024, provisional projections indicate growth to 0.72 by 2033, driven by improving digital infrastructure and the gradual introduction of innovative AI trading systems. The region’s market growth is expected to be supported by evolving regulatory landscapes and increasing investor awareness.Middle East & Africa Ai In Stock Market:

The Middle East and Africa region, though comparatively smaller with a market size of 1.17 in 2024, is projected to increase to 2.43 by 2033. Accelerated digital transformation, coupled with increasing investments in technological infrastructure, is gradually nurturing a fertile environment for AI adoption in stock market operations. Regulatory enhancements and evolving investor sentiment are expected to bolster the region's growth pace, paving the way for greater integration of AI solutions in financial trading.Tell us your focus area and get a customized research report.

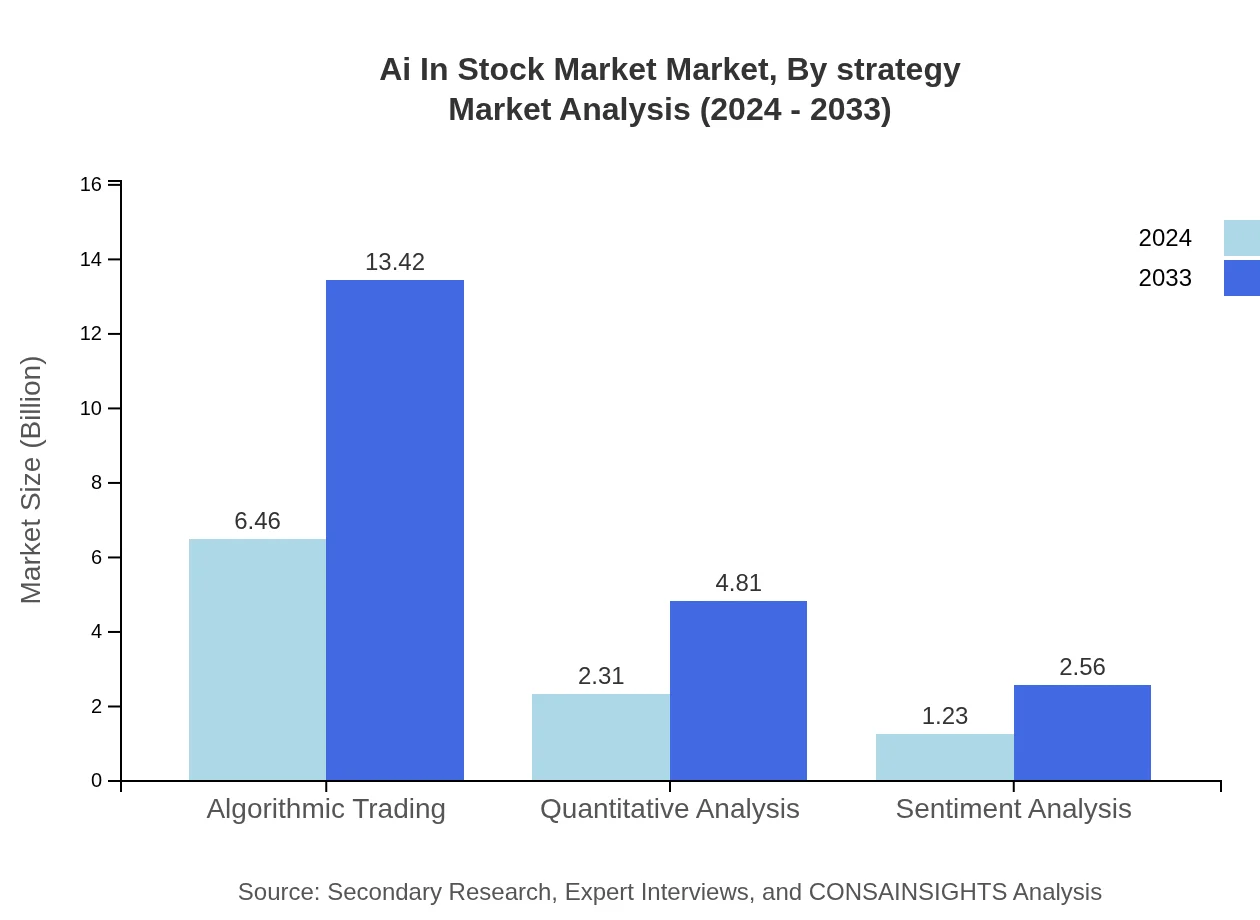

Ai In Stock Market Market Analysis By Strategy

The by-strategy segment focuses on the core trading strategies such as Algorithmic Trading, Quantitative Analysis, and Sentiment Analysis. Algorithmic Trading has shown impressive growth, with its market size increasing from 6.46 in 2024 to 13.42 in 2033, while maintaining a steady market share of 64.56%. Quantitative Analysis is another significant segment, with market sizes growing from 2.31 to 4.81 and a stable share of 23.13%. Meanwhile, Sentiment Analysis, though smaller in absolute terms, has proven essential in capturing market moods, expanding from a market size of 1.23 to 2.56 while contributing a consistent share of 12.31%. The combined effect of these strategies enhances execution speed, improves prediction accuracy, and supports high-frequency trading models.

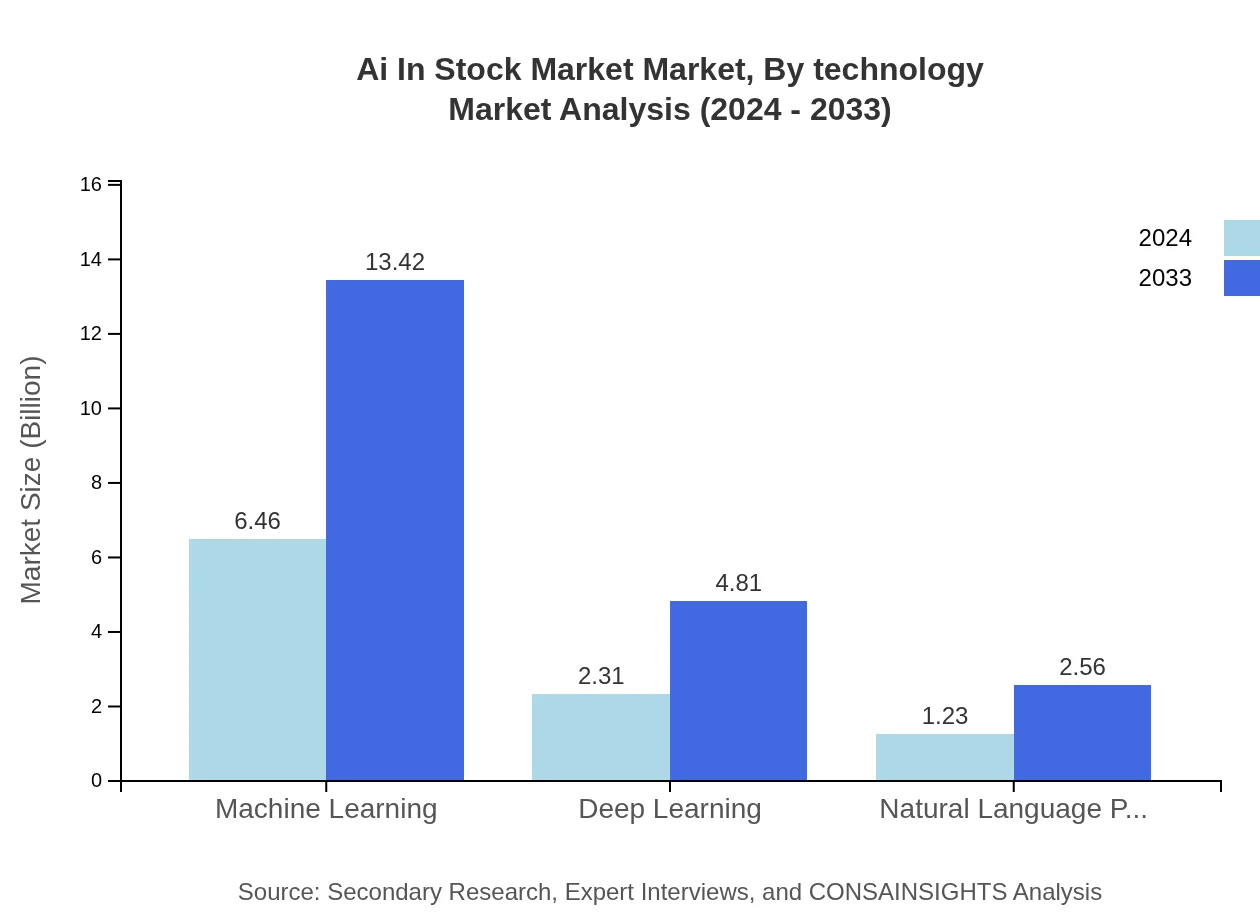

Ai In Stock Market Market Analysis By Technology

Within the technology segment, AI applications are categorized into Machine Learning, Deep Learning, and Natural Language Processing. Machine Learning leads the innovation drive with a market size growing from 6.46 in 2024 to an impressive 13.42 in 2033, maintaining a dominant share of 64.56%. Deep Learning, a subset that focuses on more complex neural network architectures, expands its market size from 2.31 to 4.81, accompanied by a consistent share of 23.13%. Natural Language Processing, critical for parsing and analyzing financial texts, however, grows from 1.23 to 2.56 with a steady contribution of 12.31% to the overall market. These technological advancements are central to the development of predictive models, risk analysis frameworks, and automated trading systems, which are integral to modern trading strategies.

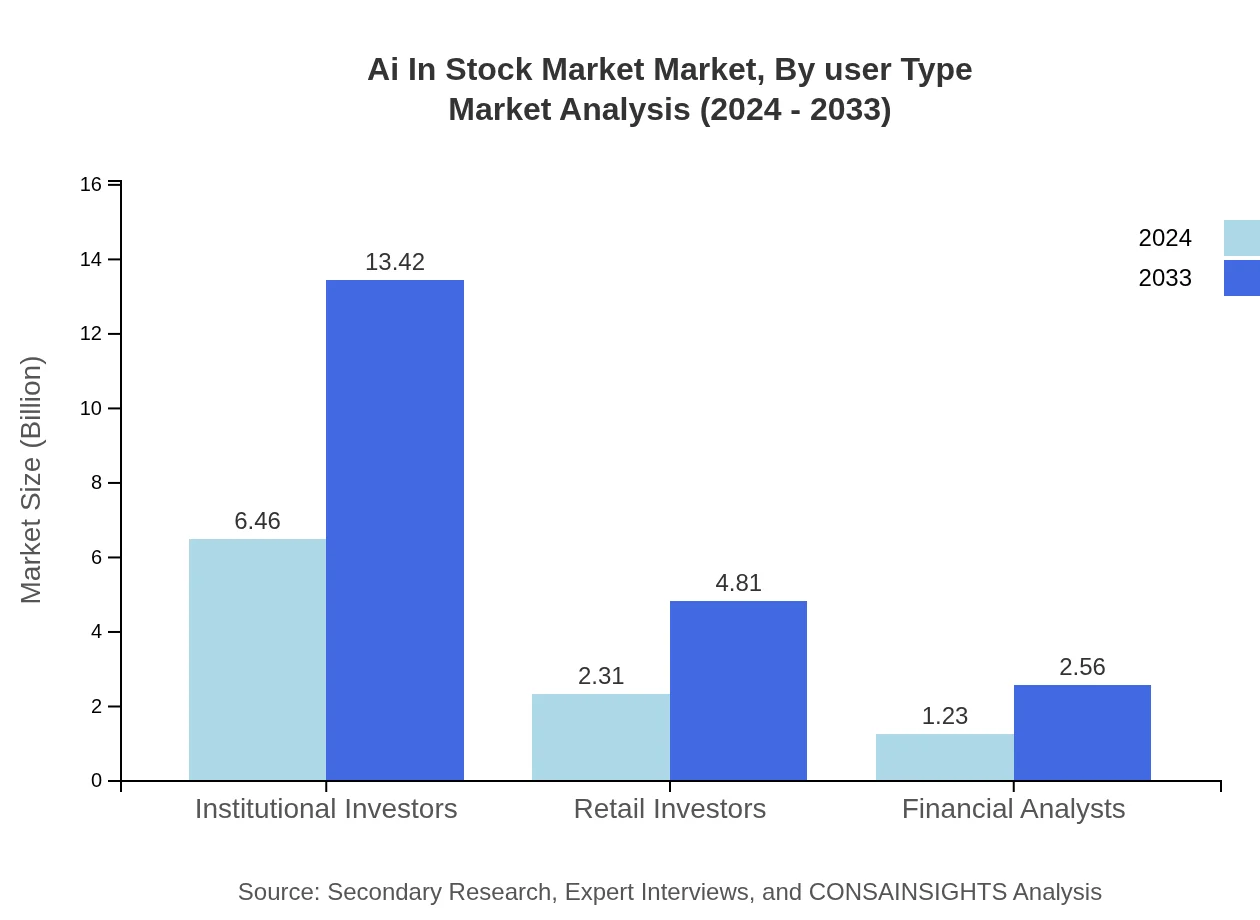

Ai In Stock Market Market Analysis By User Type

The by-user-type segment dissects the market based on different participant categories, including Institutional Investors, Retail Investors, and Financial Analysts. Institutional Investors command a significant market presence with a size growing from 6.46 to 13.42 and holding a market share of 64.56%. Retail Investors, while operating on a smaller scale, have shown steady growth from 2.31 to 4.81 and contribute 23.13% to the market share. Financial Analysts, essential for in-depth market evaluations, similarly expand from a market size of 1.23 to 2.56 and maintain a share of 12.31%. These diverse user groups collectively shape demand, foster innovation, and drive the continuous evolution of AI-driven trading platforms by emphasizing the importance of both large-scale institutional investments and agile retail participation.

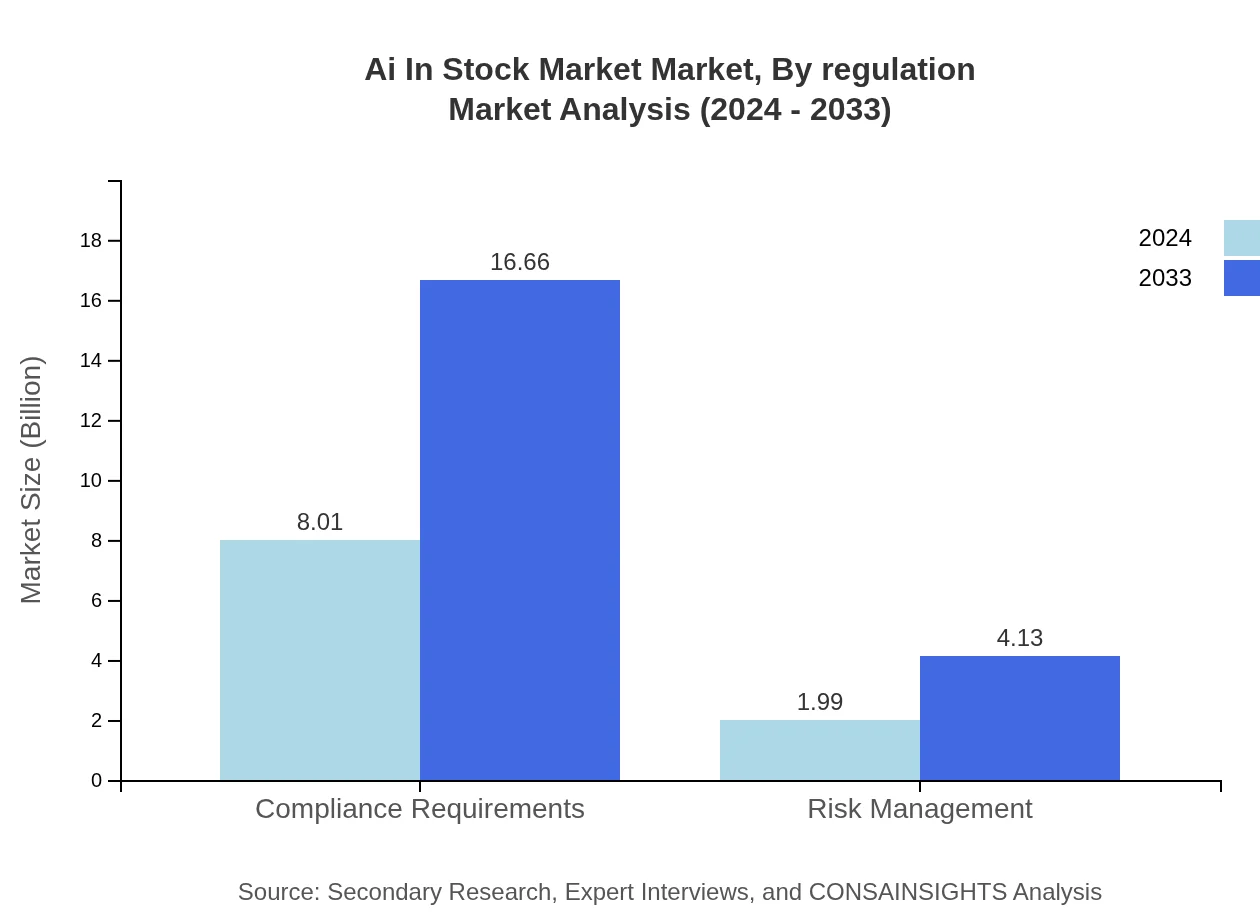

Ai In Stock Market Market Analysis By Regulation

The by-regulation segment highlights the importance of Compliance Requirements and Risk Management in ensuring sustainable growth in the Ai In Stock Market. Compliance Requirements have shown substantial market expansion, with a market size rising from 8.01 in 2024 to 16.66 in 2033 while retaining an 80.13% share, thereby underscoring the critical role of adhering to stringent regulatory standards. Risk Management has also seen meaningful growth, expanding its market size from 1.99 to 4.13 and maintaining a constant share of 19.87%. Together, these regulatory elements guarantee that financial operations adhere to best practices and help mitigate potential risks, ensuring investor confidence and the long-term viability of AI-based trading systems.

Ai In Stock Market Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Stock Market Industry

AlphaTrade Innovations:

AlphaTrade Innovations is at the forefront of integrating advanced AI algorithms with high-frequency trading. Their solutions have revolutionized market analytics by providing real-time insights and predictive models that enable smarter investment decisions.Beta Analytics Group:

Beta Analytics Group specializes in leveraging deep learning and natural language processing to enhance market sentiment analysis. Their comprehensive analytical platforms empower institutional and retail investors with actionable intelligence.Quantum FinTech Solutions:

Quantum FinTech Solutions is renowned for its cutting-edge quantitative analysis tools which merge traditional financial expertise with modern AI techniques. Their platforms support robust risk management and compliance, ensuring streamlined regulatory adherence.Neural Capital Advisors:

Neural Capital Advisors combines machine learning and algorithmic trading to offer innovative financial products. Their focus on research and development has positioned them as key industry players, driving efficiency in market operations.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Stock Market?

The AI in stock market is projected to reach $10 billion by 2033, growing at a CAGR of 8.2%. This growth indicates increasing adoption of AI technologies within financial markets, reflecting on competitive trading strategies and enhanced decision-making capabilities in investments.

What are the key market players or companies in this ai In Stock Market industry?

The AI in stock market industry features several prominent players, including large financial institutions leveraging proprietary technology, fintech startups specializing in trading algorithms, and established tech firms focusing on AI-driven market analytics and predictive modeling.

What are the primary factors driving the growth in the ai In Stock Market industry?

Key drivers include the increasing need for efficient trading strategies, enhanced data analysis capabilities provided by AI, rising investment in fintech innovations, and regulatory pressures demanding advanced compliance solutions, all contributing to rapid market expansion.

Which region is the fastest Growing in the ai In Stock Market?

North America leads the growth in the AI in stock market, expected to reach $7.95 billion by 2033, closely followed by Europe at $5.22 billion. Asia Pacific also shows notable growth, projected to reach $4.47 billion by 2033.

Does ConsaInsights provide customized market report data for the ai In Stock Market industry?

Yes, ConsaInsights offers tailored market report data to meet specific client needs within the AI in stock market sector, ensuring that insights, trends, and forecasts align perfectly with distinct business objectives and strategic planning.

What deliverables can I expect from this ai In Stock Market research project?

Deliverables include a comprehensive market analysis report, segmented insights by region and application, forecasts, competitive landscape assessments, and custom recommendations, all designed to facilitate informed decision-making for stakeholders in the industry.

What are the market trends of ai In Stock Market?

Current trends include increased integration of machine learning and algorithmic trading, heightened focus on compliance and risk management, and utilization of sentiment analysis tools, reflecting an evolving landscape that leverages technology for greater market efficiency.