Ai In Stock Trading

Published Date: 24 January 2026 | Report Code: ai-in-stock-trading

Ai In Stock Trading Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the evolution and current state of the Ai In Stock Trading market, offering detailed insights and data across a range of perspectives including market size, growth rates, technology trends, regional performance, segmentation, and regulatory challenges. The forecast period under review spans from 2024 to 2033, highlighting transformative trends and future opportunities.

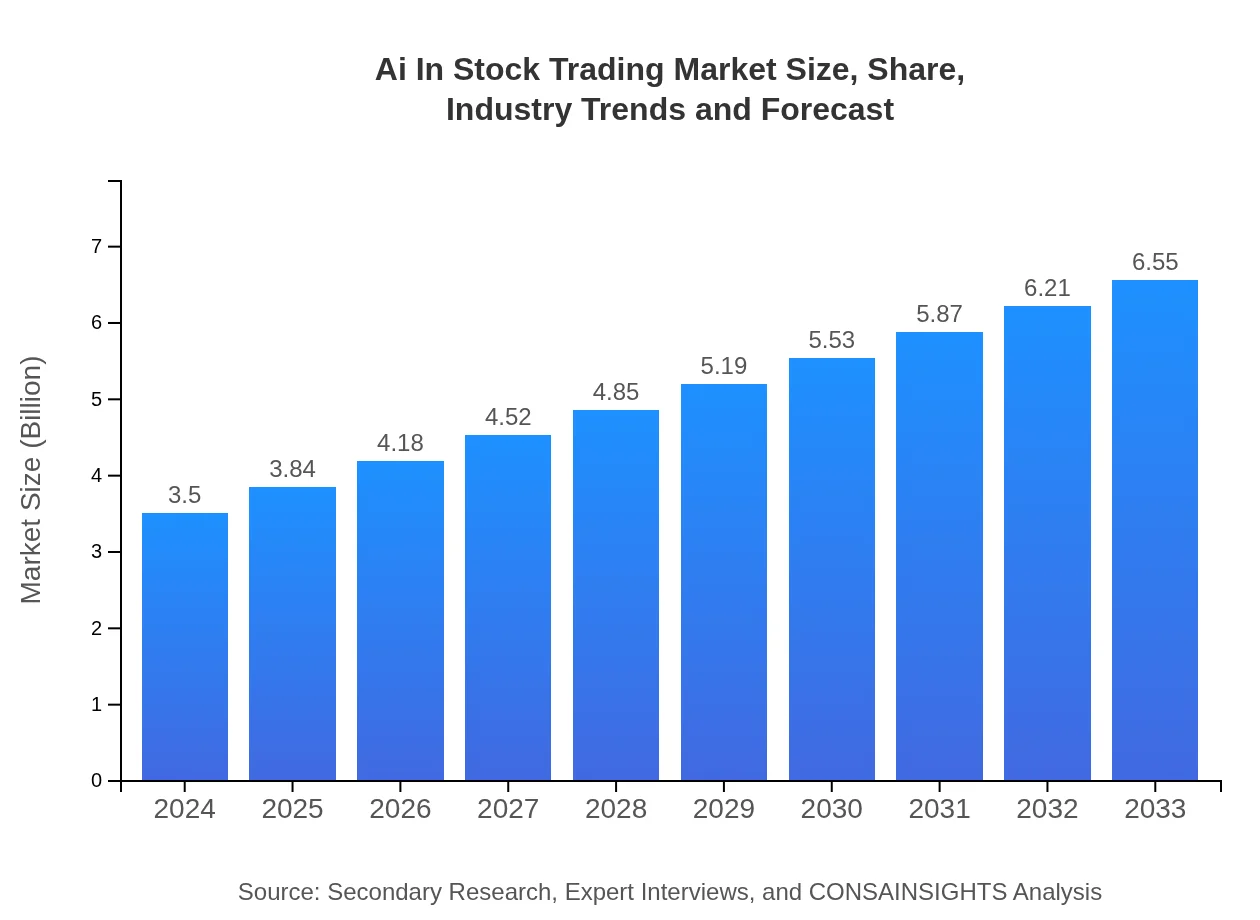

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.50 Billion |

| CAGR (2024-2033) | 7.0% |

| 2033 Market Size | $6.55 Billion |

| Top Companies | Alpha Trading Inc., Beta Trade Solutions, Gamma Financial Technologies |

| Last Modified Date | 24 January 2026 |

Ai In Stock Trading Market Overview

Customize Ai In Stock Trading market research report

- ✔ Get in-depth analysis of Ai In Stock Trading market size, growth, and forecasts.

- ✔ Understand Ai In Stock Trading's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Stock Trading

What is the Market Size & CAGR of Ai In Stock Trading market in 2024?

Ai In Stock Trading Industry Analysis

Ai In Stock Trading Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Stock Trading Market Analysis Report by Region

Europe Ai In Stock Trading:

The European Ai In Stock Trading market is poised for appreciable growth as market sizes expand from 0.95 in 2024 to 1.78 by 2033. Europe’s strong financial infrastructure, collaborative innovation ecosystem, and adaptive regulatory frameworks have contributed to the acceleration of AI adoption in trading. Investors are increasingly relying on AI solutions for enhanced precision and efficient market navigation.Asia Pacific Ai In Stock Trading:

In the Asia Pacific region, the Ai In Stock Trading market is demonstrating promising growth with a market size expansion from 0.73 in 2024 to 1.36 by 2033. This growth is driven by rapid technological adoption, increased digital infrastructure investments, and a burgeoning base of tech-savvy retail investors. Countries in this region are increasingly experimenting with AI-driven trading platforms, making it a fertile ground for future innovations and investments.North America Ai In Stock Trading:

In North America, the market for Ai In Stock Trading is robust, with market sizes rising from 1.27 in 2024 to 2.37 by 2033. This steady growth is attributed to high adoption rates of advanced technologies, a competitive financial sector, and significant investments in AI research. Regulatory bodies in North America are also progressively supporting the alignment of technological innovation with compliance standards.South America Ai In Stock Trading:

The South American market, though smaller in absolute size with values growing from 0.10 to 0.20 between 2024 and 2033, exhibits steady progress. The region benefits from increasing digitization and a gradual shift towards algorithm-supported trading systems, despite challenges such as economic volatility and slower regulatory adaptation compared to other regions.Middle East & Africa Ai In Stock Trading:

In the Middle East and Africa, the market is gradually emerging with sizes growing from 0.45 in 2024 to 0.85 by 2033. Although relatively nascent, this region is witnessing increasing interest in digital trading solutions. Strategic investments in technology and financial innovation, combined with improving regulatory oversight, are expected to stimulate further growth and integration of AI into stock trading practices.Tell us your focus area and get a customized research report.

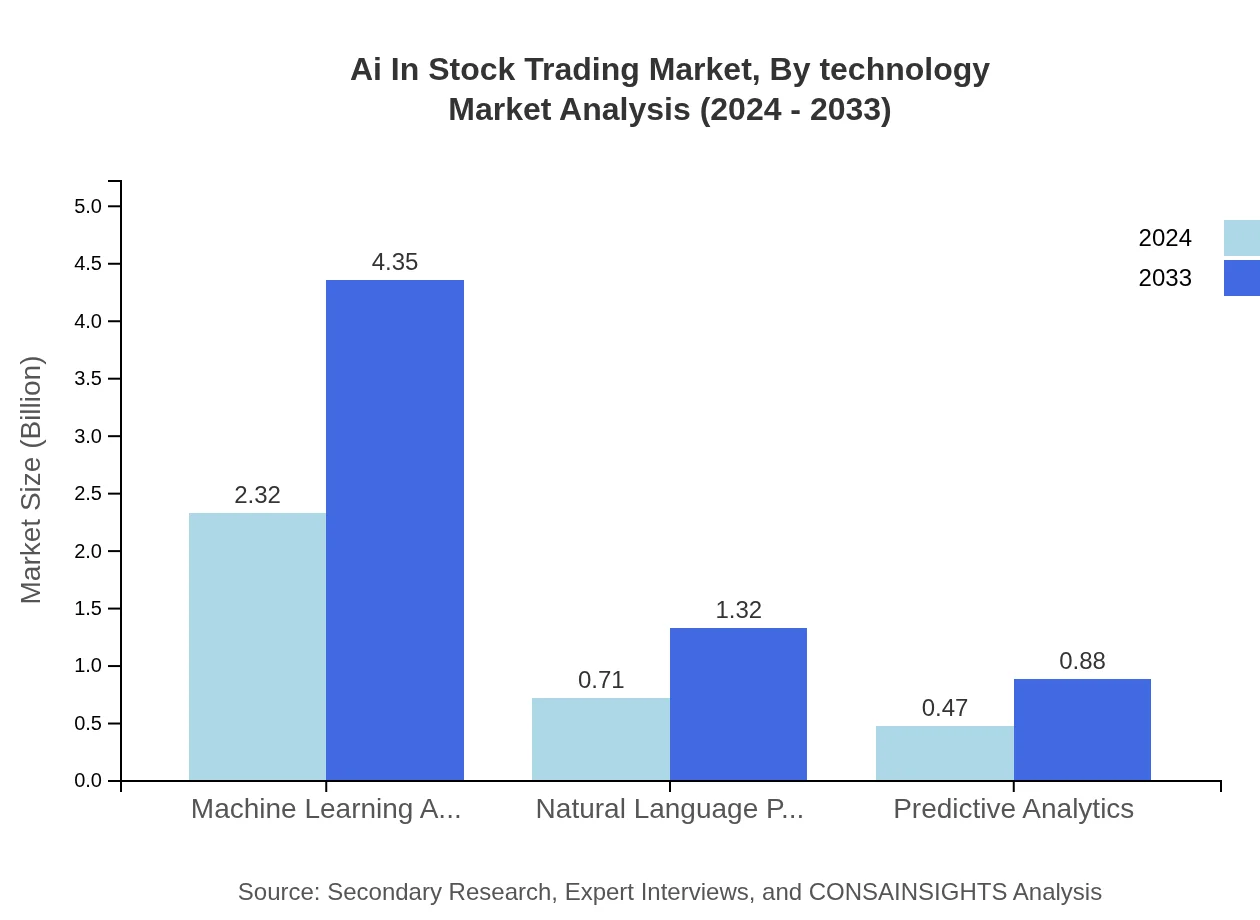

Ai In Stock Trading Market Analysis By Technology

The technology segment encompasses advancements such as algorithmic trading, machine learning algorithms, natural language processing, and predictive analytics. In this segment, the market has shown robust growth with algorithmic trading metrics indicating a rise from 2.32 in 2024 to 4.35 by 2033, maintaining a consistent share of 66.4%. Machine learning algorithms and natural language processing reflect similar trends, suggesting that continuous innovations are enabling more precise market predictions and algorithmic efficiency. This segment is driving overall market productivity by incorporating data analytics and real-time processing capabilities, which are essential in a rapidly evolving financial ecosystem.

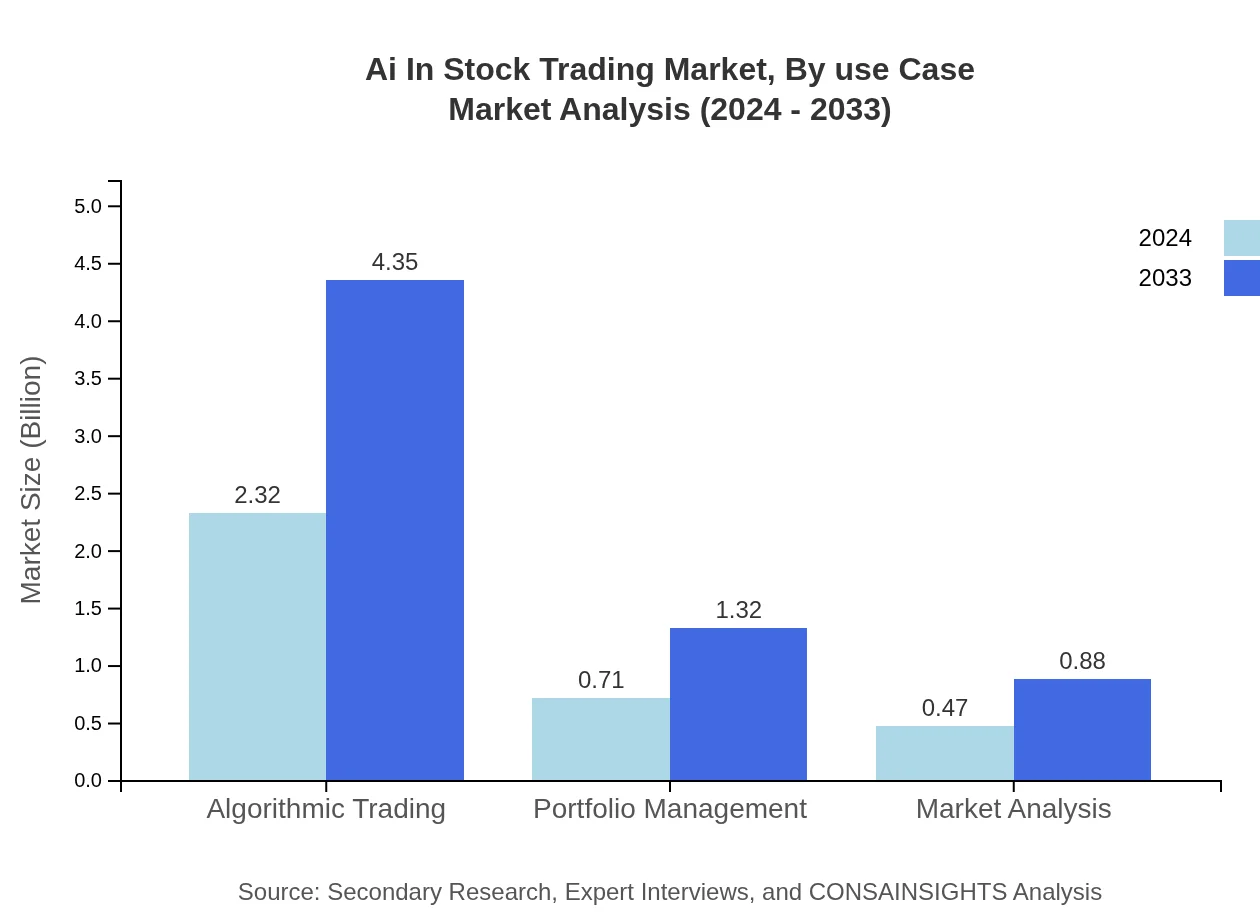

Ai In Stock Trading Market Analysis By Use Case

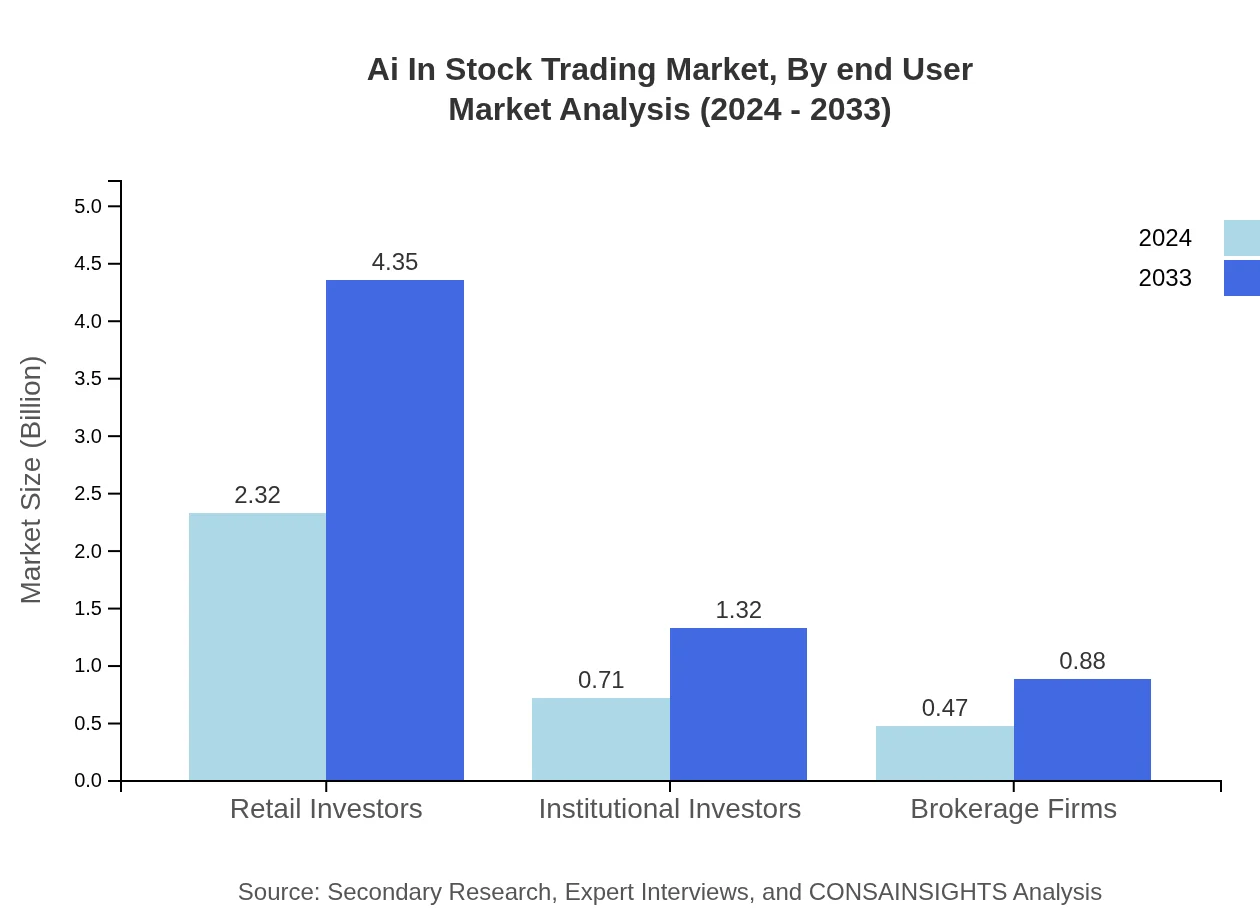

The use-case segment is segmented by the types of investors and trading needs, including retail investors, institutional investors, brokerage firms, portfolio management, and market analysis. Retail investors dominate with a size increase from 2.32 in 2024 to 4.35 by 2033, representing a stable share of 66.4% of the market. Institutional investors and brokerage firms follow, showing significant growth in absolute terms. This segmentation emphasizes how different user groups are adopting AI solutions, with tailored capabilities such as risk assessment, real-time market tracking, and enhanced decision-making tools, thereby making the market more responsive to diverse trading demands.

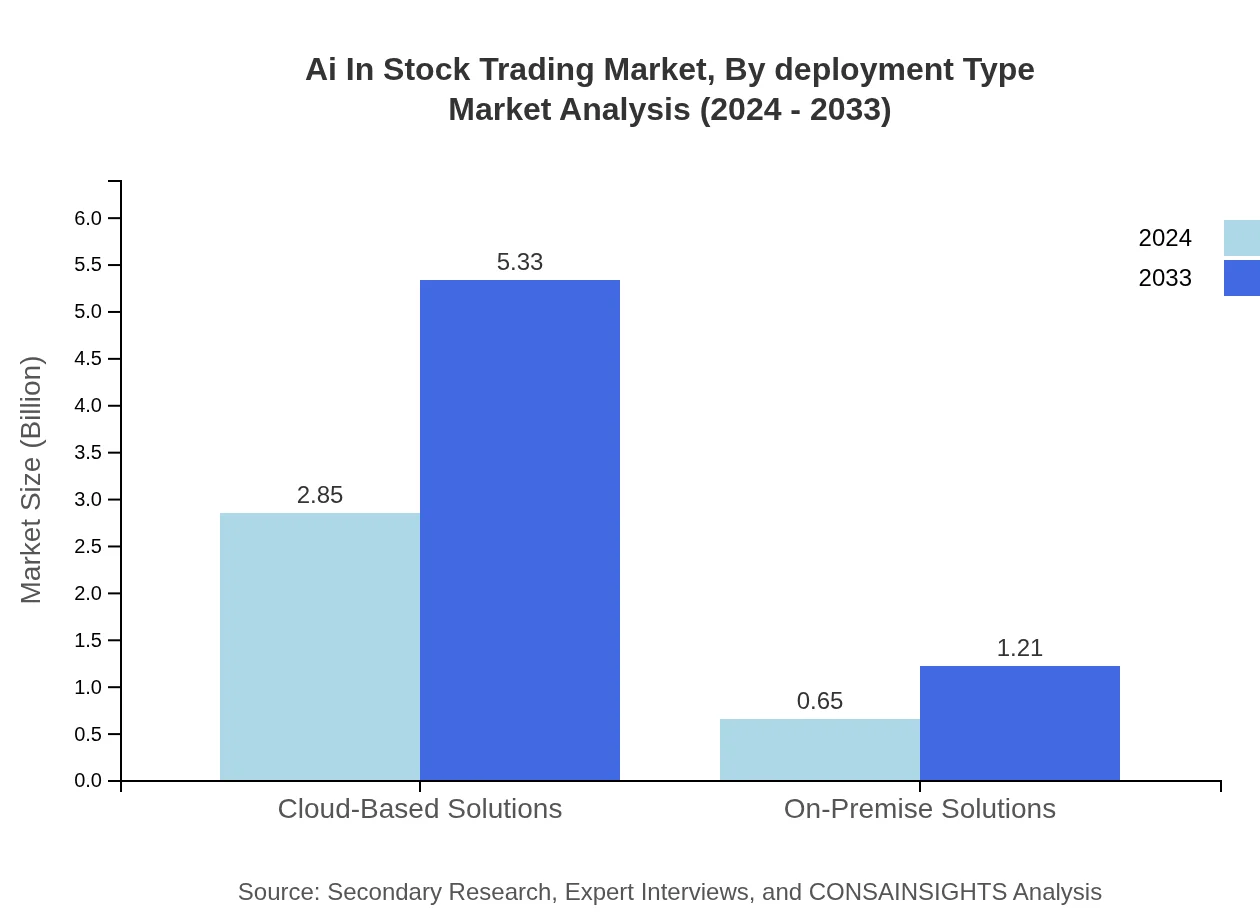

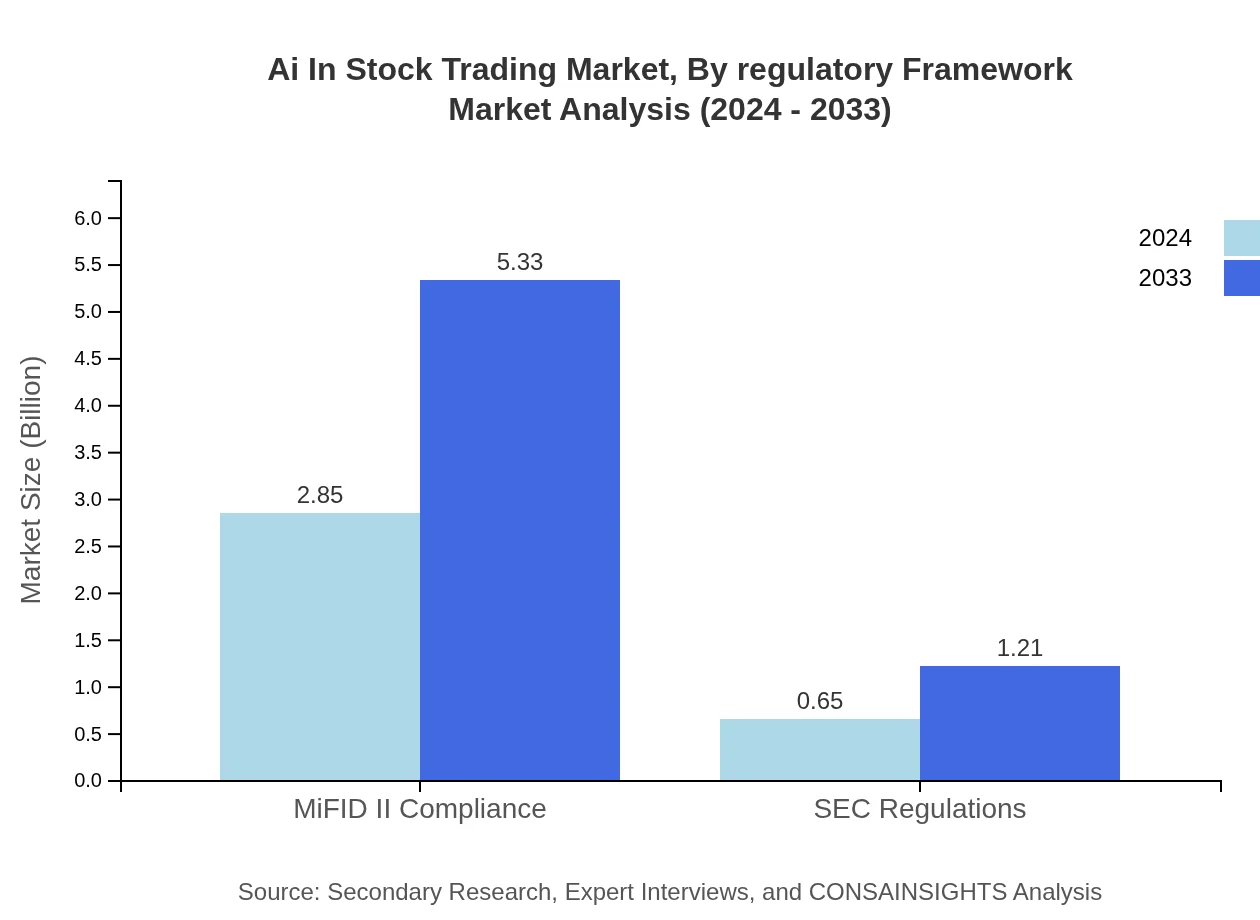

Ai In Stock Trading Market Analysis By Deployment Type

Deployment type segmentation focuses on the infrastructure supporting AI initiatives, including cloud-based and on-premise solutions. Cloud-based solutions have experienced rapid growth with market sizes increasing from 2.85 in 2024 to 5.33 by 2033, capturing a dominant share of 81.48%. On the other hand, on-premise solutions remain a vital option for firms emphasizing data security and control, with market sizes moving from 0.65 to 1.21 over the same period. This divide highlights the trade-off between scalability and control, with cloud solutions offering cost efficiency and on-premise deployments providing localized data governance.

Ai In Stock Trading Market Analysis By End User

The end-user segment delves into the distinct groups that benefit from AI in stock trading, including retail investors, institutional players, and brokerage houses. The strong growth in the retail segment, with a considerable market size and stable high market share, underscores the widespread adoption and confidence among individual investors. Institutional investors further contribute to the segment by leveraging advanced analytics for large-scale trading operations, while brokerage firms refine their service offerings using AI-based insights. This segmentation elucidates the diversification of end-user needs and the corresponding innovation in delivering tailored trading solutions.

Ai In Stock Trading Market Analysis By Regulatory Framework

The regulatory framework segment encompasses compliance standards such as MiFID II and SEC Regulations that play critical roles in shaping market operations. Both MiFID II Compliance and SEC Regulations have shown parallel growth trajectories with market sizes evolving from 2.85 to 5.33 and from 0.65 to 1.21 respectively between 2024 and 2033, along with consistent market share percentages. This underscores the importance of maintaining robust regulatory adherence to foster investor confidence and ensure the long-term sustainability of AI-driven trading. In an industry where regulatory frameworks directly impact innovation, this segment remains crucial for harmonizing technological advancement with legal and ethical standards.

Ai In Stock Trading Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Stock Trading Industry

Alpha Trading Inc.:

Alpha Trading Inc. is a pioneer in integrating AI-driven solutions into stock trading platforms. Their innovative algorithms and real-time analytics have set industry benchmarks for automated trading systems, making them a key player in the global market.Beta Trade Solutions:

Beta Trade Solutions specializes in developing cutting-edge machine learning and natural language processing tools tailored for stock market analytics. Their commitment to innovation and regulatory compliance has solidified their position as a market leader.Gamma Financial Technologies:

Gamma Financial Technologies leverages advanced predictive analytics and cloud-based infrastructures to offer comprehensive AI solutions for trading. Their blend of technology and deep financial expertise continues to drive market transformation.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Stock Trading?

The ai-in-stock-trading market is projected to grow from $3.5 billion in 2024, with a CAGR of 7.0% until 2033, indicating robust growth as this technology continues to evolve and integrate into trading practices.

What are the key market players or companies in this ai In Stock Trading industry?

Key players in the ai-in-stock-trading industry include financial technology firms, traditional brokerage companies, and AI solution providers that specialize in algorithmic trading and predictive analytics.

What are the primary factors driving the growth in the ai In Stock Trading industry?

The growth in the ai-in-stock-trading industry is driven by advancements in machine learning, the demand for real-time analytics, regulatory compliance needs, and the increasing importance of data-driven decision-making in finance.

Which region is the fastest Growing in the ai In Stock Trading?

North America is the fastest-growing region in the ai-in-stock-trading market, projected to expand from $1.27 billion in 2024 to $2.37 billion by 2033, reflecting strong demand and innovation in financial services.

Does ConsaInsights provide customized market report data for the ai In Stock Trading industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the ai-in-stock-trading industry, allowing for targeted analysis and insights.

What deliverables can I expect from this ai In Stock Trading market research project?

From this market research project, clients can expect comprehensive reports, market forecasts, trend analysis, competitor insights, and data visualizations tailored to the ai-in-stock-trading industry.

What are the market trends of ai In Stock Trading?

Current trends in the ai-in-stock-trading market include growing adoption of algorithmic trading, increased utilization of machine learning for market predictions, and a shift towards cloud-based trading solutions which streamline operations and enhance scalability.