Ai In Financial Planning

Published Date: 24 January 2026 | Report Code: ai-in-financial-planning

Ai In Financial Planning Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in‐depth analysis of the AI in Financial Planning market for the forecast period 2024 to 2033. It covers current market conditions, segmentation analysis, technology trends, and key regional insights. Readers will find detailed data on market size, growth rates, and industry dynamics that are critical for strategic decision-making.

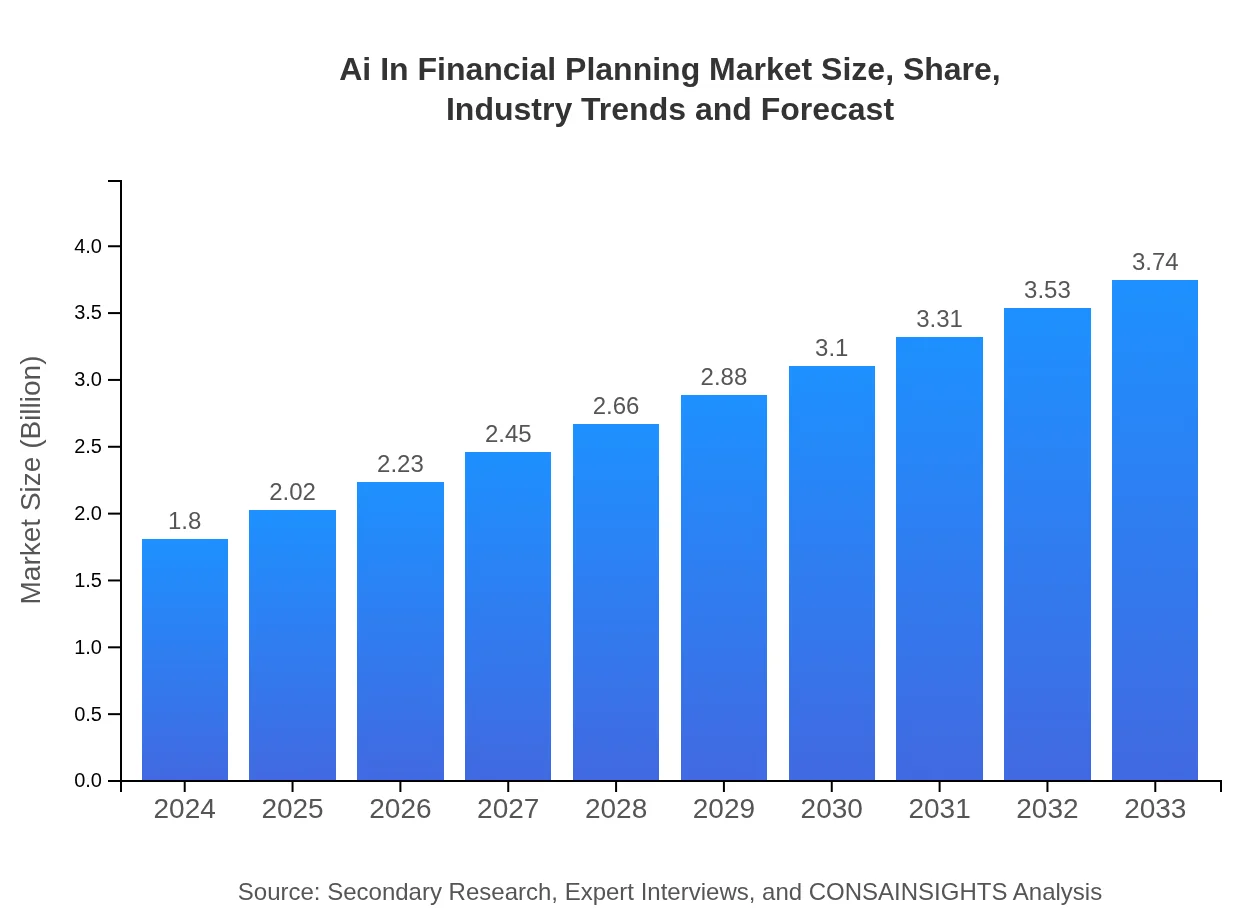

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $3.74 Billion |

| Top Companies | FinTech Innovations Inc., SmartPlan Advisors, Alpha Financial Technologies, NextGen Financial Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Financial Planning Market Overview

Customize Ai In Financial Planning market research report

- ✔ Get in-depth analysis of Ai In Financial Planning market size, growth, and forecasts.

- ✔ Understand Ai In Financial Planning's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Financial Planning

What is the Market Size & CAGR of Ai In Financial Planning market in 2024?

Ai In Financial Planning Industry Analysis

Ai In Financial Planning Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Financial Planning Market Analysis Report by Region

Europe Ai In Financial Planning:

Europe’s market reflects a significant transformation, growing from a market size of 0.49 in 2024 to an anticipated 1.01 in 2033. European countries are known for stringent regulatory frameworks and a cautious approach to AI adoption. However, this careful balance has fostered a secure and reliable environment for innovation. Financial institutions across Europe are increasingly investing in AI systems that promise improved risk management, enhanced client interaction, and streamlined financial planning processes. Collaborative efforts among technology firms and banking institutions are driving these innovations forward.Asia Pacific Ai In Financial Planning:

In the Asia Pacific region, the AI in Financial Planning market is experiencing considerable growth. With market size figures growing from 0.36 in 2024 to an anticipated 0.74 in 2033, this region is benefiting from rapid technological adoption and increased investments in fintech. Countries in this region are investing heavily in innovative technologies, and supportive government policies are encouraging the integration of AI into conventional financial systems. The region’s dynamic economic environment coupled with an increasing digitally savvy population has provided the perfect ecosystem for market expansion.North America Ai In Financial Planning:

North America remains a frontrunner in the AI in Financial Planning market with a robust expansion from a market size of 0.66 in 2024 to 1.37 in 2033. This region benefits from a well-established technological infrastructure, high levels of R&D investment, and a mature financial services sector that continuously seeks efficiency and innovation. Advanced AI tools are widely integrated into portfolio management, risk assessment, and regulatory compliance initiatives, reflecting the region’s strategic focus on leveraging technology for competitive advantage.South America Ai In Financial Planning:

South America, with a market size of 0.08 in 2024 expected to rise to 0.17 by 2033, shows promising albeit smaller growth compared to other regions. The market here is emerging at a gradual pace, driven by ongoing digital transformation initiatives and increased collaboration between local banks and technology providers. Although challenges such as economic instability and regulatory hurdles exist, there is an optimistic outlook as regional financial institutions begin to appreciate the benefits of AI in streamlining operations and enhancing client interactions.Middle East & Africa Ai In Financial Planning:

The Middle East and Africa region is gradually emerging, with market sizes growing from 0.21 in 2024 to 0.45 by 2033. This growth is fueled by intensified digital transformation across the region and an increasing reliance on technology to bridge gaps in traditional financial services. As regulatory environments evolve and infrastructure improves, financial institutions in these regions are beginning to adopt AI-driven solutions that promise efficiencies and improved service delivery, while also positioning these markets as potential hotspots for future financial innovation.Tell us your focus area and get a customized research report.

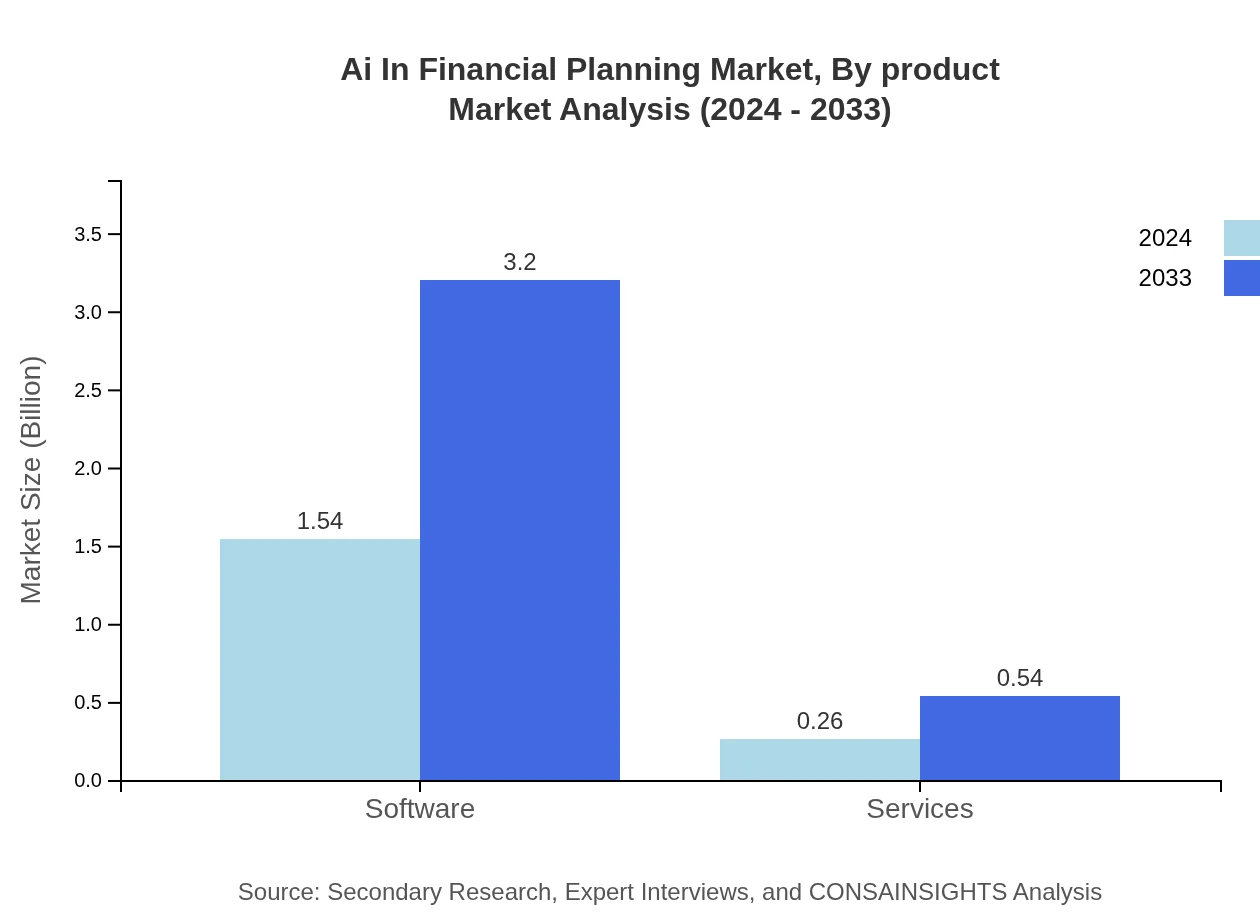

Ai In Financial Planning Market Analysis By Product

This segment focuses on the differentiation between Software and Services in AI-powered financial planning. Software solutions, which dominated the market with a substantial share of 85.58% in 2024 and maintained similar levels through 2033, are critical for automating processes, performing real-time analytics, and enabling advanced decision-support systems. In contrast, the Services segment, though smaller in scale with a share of 14.42%, provides specialized advisory functions and implementation support that complement the technological infrastructure. Together, these product types address the full spectrum of market needs from operational efficiency to strategic insights.

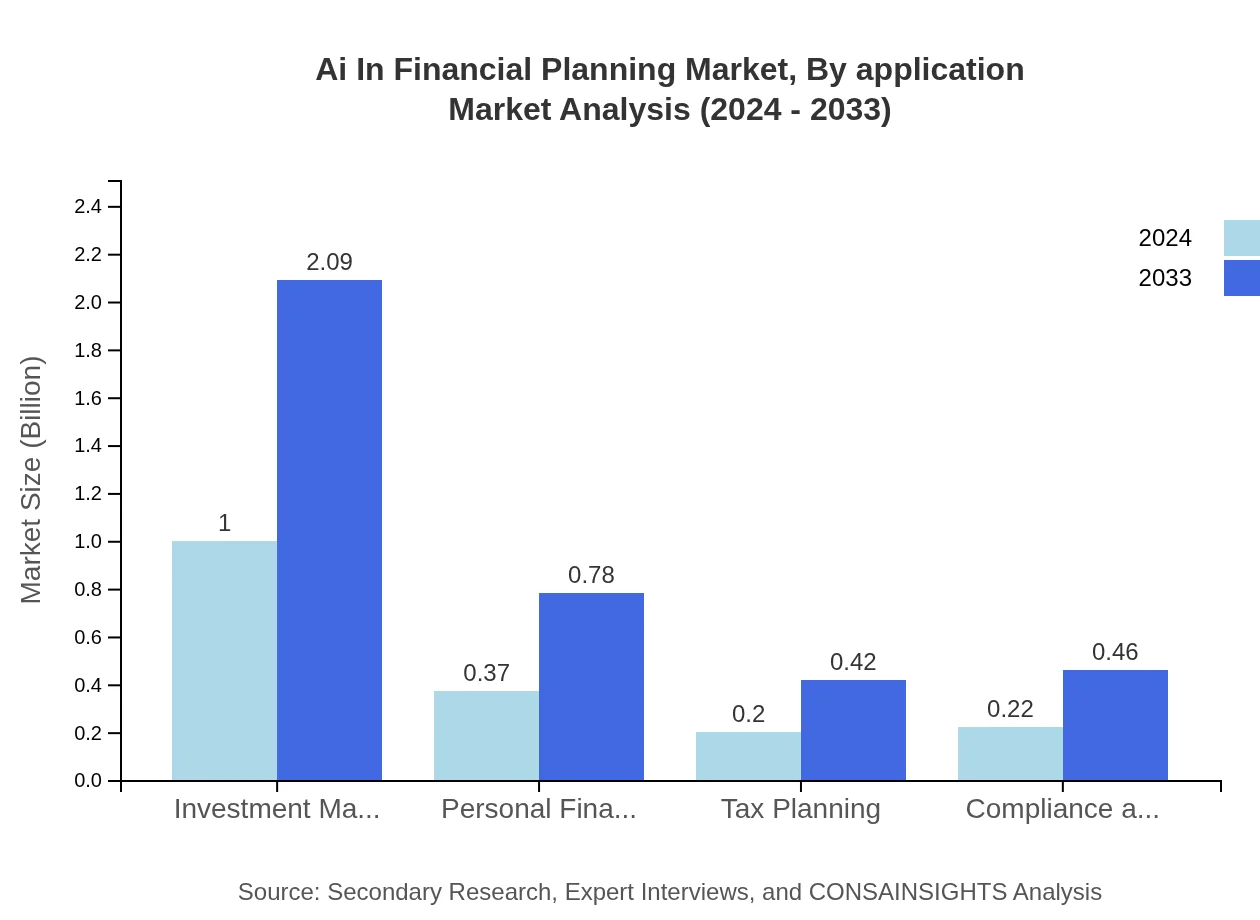

Ai In Financial Planning Market Analysis By Application

The application segmentation is designed to capture various domains within financial planning. Key applications include Investment Management, Personal Finance Management, Tax Planning, and Compliance and Regulatory Oversight. Investment Management shows dominant influence with a share of 55.83% and plays a pivotal role in portfolio optimization and risk mitigation. Personal Finance Management, Tax Planning, and Compliance segments cater to individual and group needs by ensuring compliance, reducing tax liabilities, and offering personalized financial advice. These applications are driving innovation, with each segment contributing uniquely to enhancing decision-making and operational excellence in financial planning.

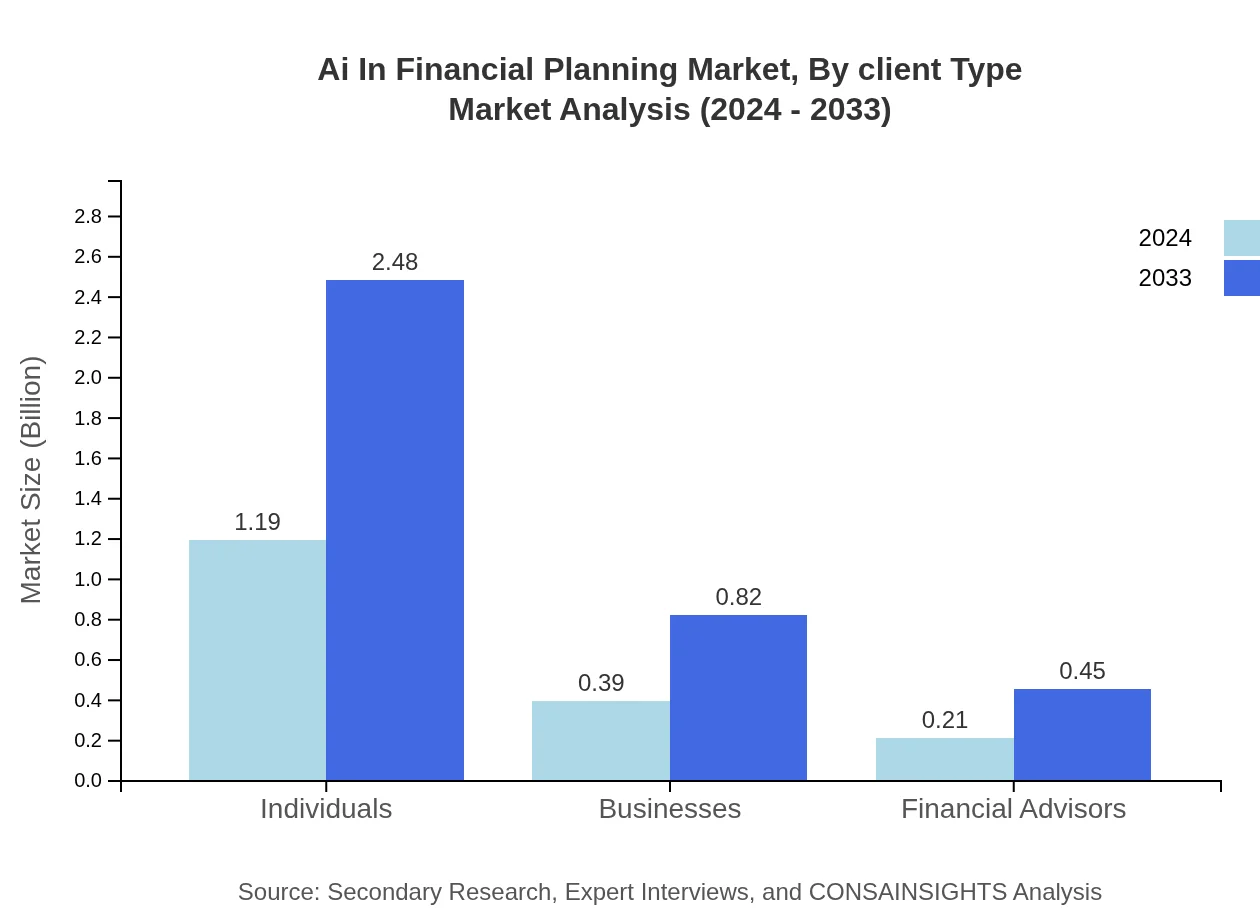

Ai In Financial Planning Market Analysis By Client Type

This segment categorizes the market based on the end users, including Individuals, Businesses, and Financial Advisors. Individuals represent the largest share with 66.18% and benefit from personalized financial planning tools that simplify complex investment decisions. Businesses and Financial Advisors, holding shares of 21.9% and 11.92% respectively, utilize AI-driven insights to streamline operations, improve advisory services, and enforce regulatory compliance. Understanding client-specific needs is crucial, as tailored solutions are key to optimizing financial decision-making and enhancing user experience across these segments.

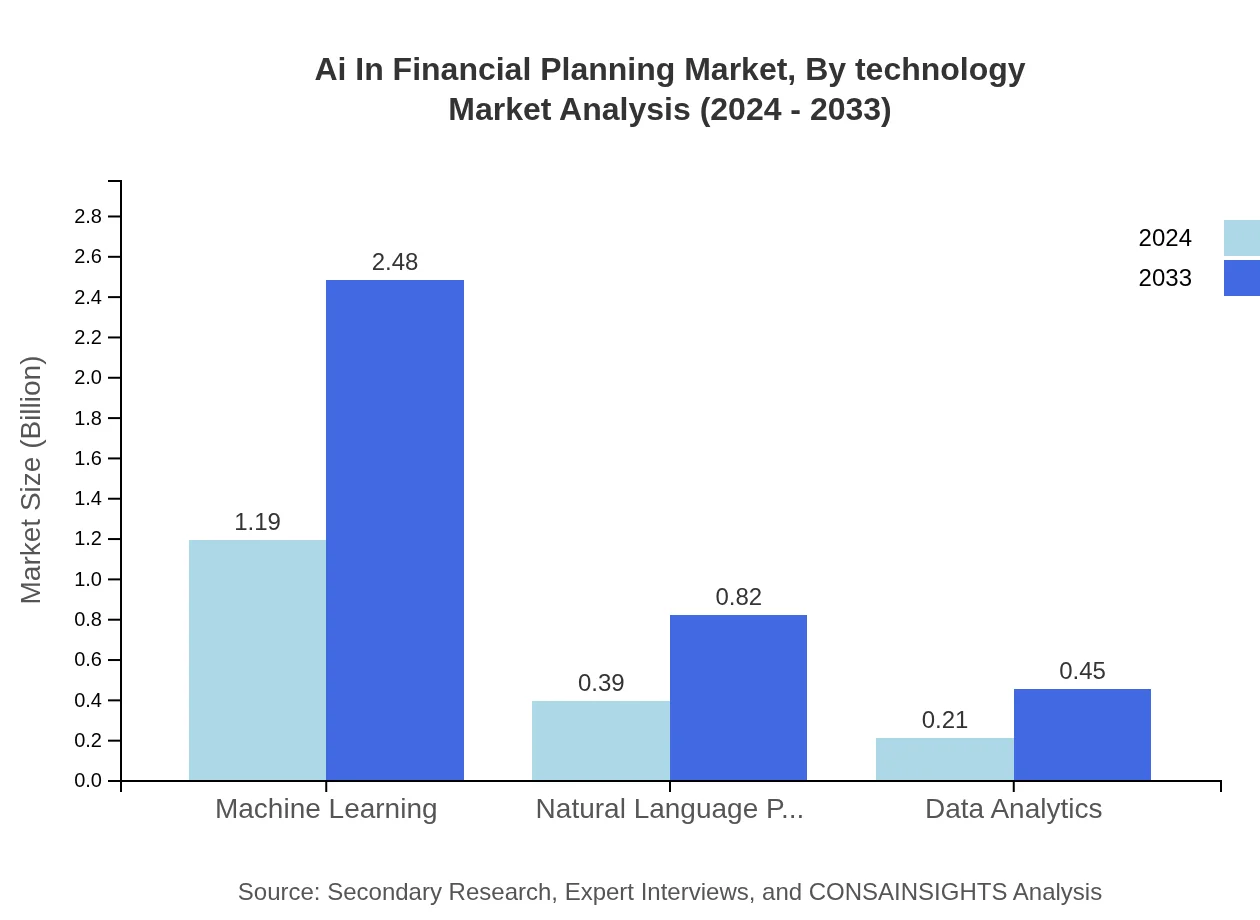

Ai In Financial Planning Market Analysis By Technology

Technological innovations form the backbone of AI in financial planning. This segment covers pioneering technologies such as Machine Learning, Natural Language Processing, and Data Analytics. Machine Learning, with a dominant market share of 66.18%, is instrumental in predictive analytics and portfolio management. Natural Language Processing, maintaining a share of 21.9%, underpins customer interaction and data mining applications, while Data Analytics, with 11.92% share, is critical for transforming massive data sets into actionable business intelligence. As these technologies continue to evolve, they are expected to deepen market penetration and spur further innovation within the financial planning arena.

Ai In Financial Planning Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Financial Planning Industry

FinTech Innovations Inc.:

A leader in integrating advanced AI solutions into financial planning, FinTech Innovations provides cutting-edge software and services that optimize investment strategies and risk management.SmartPlan Advisors:

SmartPlan Advisors leverages machine learning and data analytics to deliver personalized financial planning tools, helping both individuals and businesses achieve optimal financial outcomes.Alpha Financial Technologies:

Alpha Financial Technologies focuses on developing robust AI systems that enhance tax planning, regulatory compliance, and portfolio management, making it a key player in the market.NextGen Financial Solutions:

Combining traditional financial expertise with futuristic AI tools, NextGen Financial Solutions offers comprehensive services that span across investment management and personal finance advisory.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Financial Planning?

The AI in Financial Planning market is projected to reach $1.8 billion by 2033, growing at a CAGR of 8.2%. This growth highlights the increasing integration of AI technologies in financial services, enhancing efficiency and decision-making.

What are the key market players or companies in this AI in Financial Planning industry?

Key players in the AI in Financial Planning industry include major financial institutions, fintech startups, and technology providers focusing on AI solutions. Their collaboration shapes the landscape by introducing innovative tools that improve financial analysis and customer engagement.

What are the primary factors driving the growth in the AI in Financial Planning industry?

Factors driving growth in AI in Financial Planning include increased demand for automated financial advice, advancements in machine learning, rising customer expectations for personalized services, and regulatory pressures for enhanced compliance and reporting accuracy.

Which region is the fastest Growing in AI in Financial Planning?

The fastest-growing region in the AI in Financial Planning market is North America, projected to grow from $0.66 billion in 2024 to $1.37 billion by 2033. This growth is driven by the presence of key technology firms and a high adoption rate of AI solutions.

Does ConsaInsights provide customized market report data for the AI in Financial Planning industry?

Yes, ConsaInsights offers customized market report data for the AI in Financial Planning industry. Clients can tailor reports to focus on specific regions, segments, or trends, ensuring that insights are relevant to their strategic objectives.

What deliverables can I expect from this AI in Financial Planning market research project?

Clients can expect comprehensive deliverables including detailed market analysis, forecasts by region and segment, competitive landscape assessments, and actionable insights that guide their strategy and investment decisions in the AI in Financial Planning sector.

What are the market trends of AI in Financial Planning?

Current trends in the AI in Financial Planning market include the growing use of machine learning for predictive analytics, increasing adoption of NLP for customer engagement, and a shift towards more personalized financial solutions tailored to individual and business needs.