Ai In Financial Forecasting

Published Date: 24 January 2026 | Report Code: ai-in-financial-forecasting

Ai In Financial Forecasting Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Ai In Financial Forecasting provides an in‐depth analysis of the market dynamics, growth factors, segmentation, and regional performance. Covering the forecast period from 2024 to 2033, the report presents detailed insights into technological advancements, deployment models, and user segments while offering data-driven forecasts and analysis of market trends.

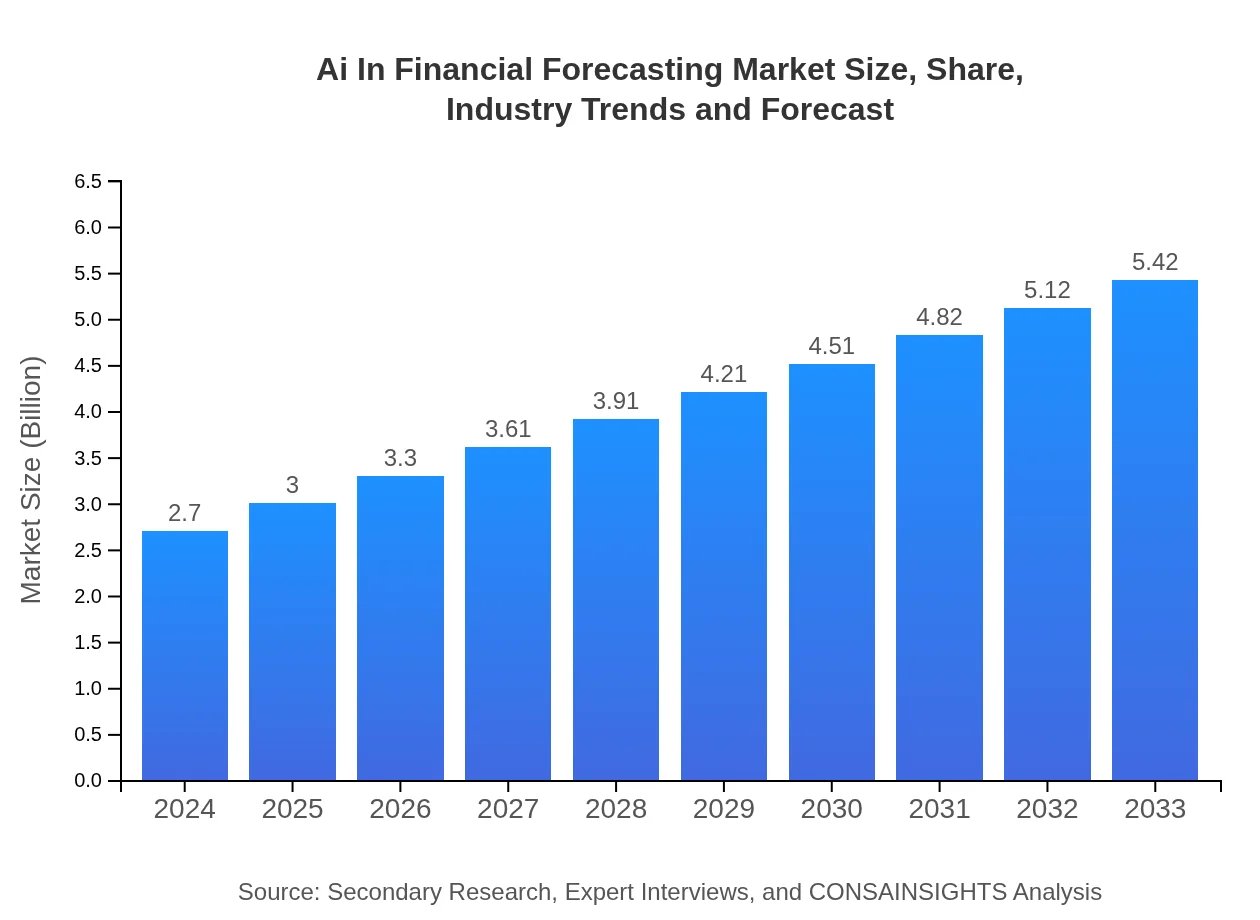

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.70 Billion |

| CAGR (2024-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | FinTech Innovations Inc., AI Forecast Solutions LLC, Predictive Analytics Group |

| Last Modified Date | 24 January 2026 |

Ai In Financial Forecasting Market Overview

Customize Ai In Financial Forecasting market research report

- ✔ Get in-depth analysis of Ai In Financial Forecasting market size, growth, and forecasts.

- ✔ Understand Ai In Financial Forecasting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Financial Forecasting

What is the Market Size & CAGR of Ai In Financial Forecasting market in 2024?

Ai In Financial Forecasting Industry Analysis

Ai In Financial Forecasting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Financial Forecasting Market Analysis Report by Region

Europe Ai In Financial Forecasting:

Europe shows significant promise in the adoption of AI for financial forecasting. The market size is projected to grow from 0.90 in 2024 to 1.81 by 2033. This growth is fueled by progressive regulatory frameworks, high investments in digital transformation, and a focus on enhancing operational efficiency in financial institutions. European markets are witnessing increased partnerships between technology providers and financial firms to leverage AI in forecasting.Asia Pacific Ai In Financial Forecasting:

In the Asia Pacific region, market adoption is accelerating as nations invest heavily in digital transformation initiatives. The region recorded a market size of 0.52 in 2024, growing steadily to 1.03 by 2033. Rapid technological adoption, a burgeoning startup ecosystem and government support for fintech innovations are major contributors to this growth. Key markets such as China, India, and Southeast Asian economies are embracing AI-driven solutions to enhance financial planning processes.North America Ai In Financial Forecasting:

North America remains a dominant player in the Ai In Financial Forecasting market, with a market size expanding from 0.86 in 2024 to 1.74 by 2033. The region’s advanced technological landscape, coupled with substantial research and development expenditure in AI, supports its continued leadership. The strong presence of major financial institutions and a mature fintech ecosystem further enhance the application and innovation of AI-powered forecasting tools.South America Ai In Financial Forecasting:

South America is witnessing a gradual yet significant uptake in AI-driven financial forecasting. With a market size of 0.21 in 2024 and an expected increase to 0.42 by 2033, the region benefits from economic reforms and improved digital infrastructure. Financial institutions and fintech companies are increasingly investing in AI technologies to better manage economic volatility and forecast financial trends.Middle East & Africa Ai In Financial Forecasting:

In the Middle East and Africa region, the market is in an early but promising stage, with a size growing from 0.21 in 2024 to 0.42 by 2033. Rapid urbanization, digitization initiatives, and increasing investments in financial technology are driving the adoption of AI forecasting solutions. Challenges such as infrastructural limitations remain, yet strategic initiatives and government support forecast a gradual uplift in market dynamics.Tell us your focus area and get a customized research report.

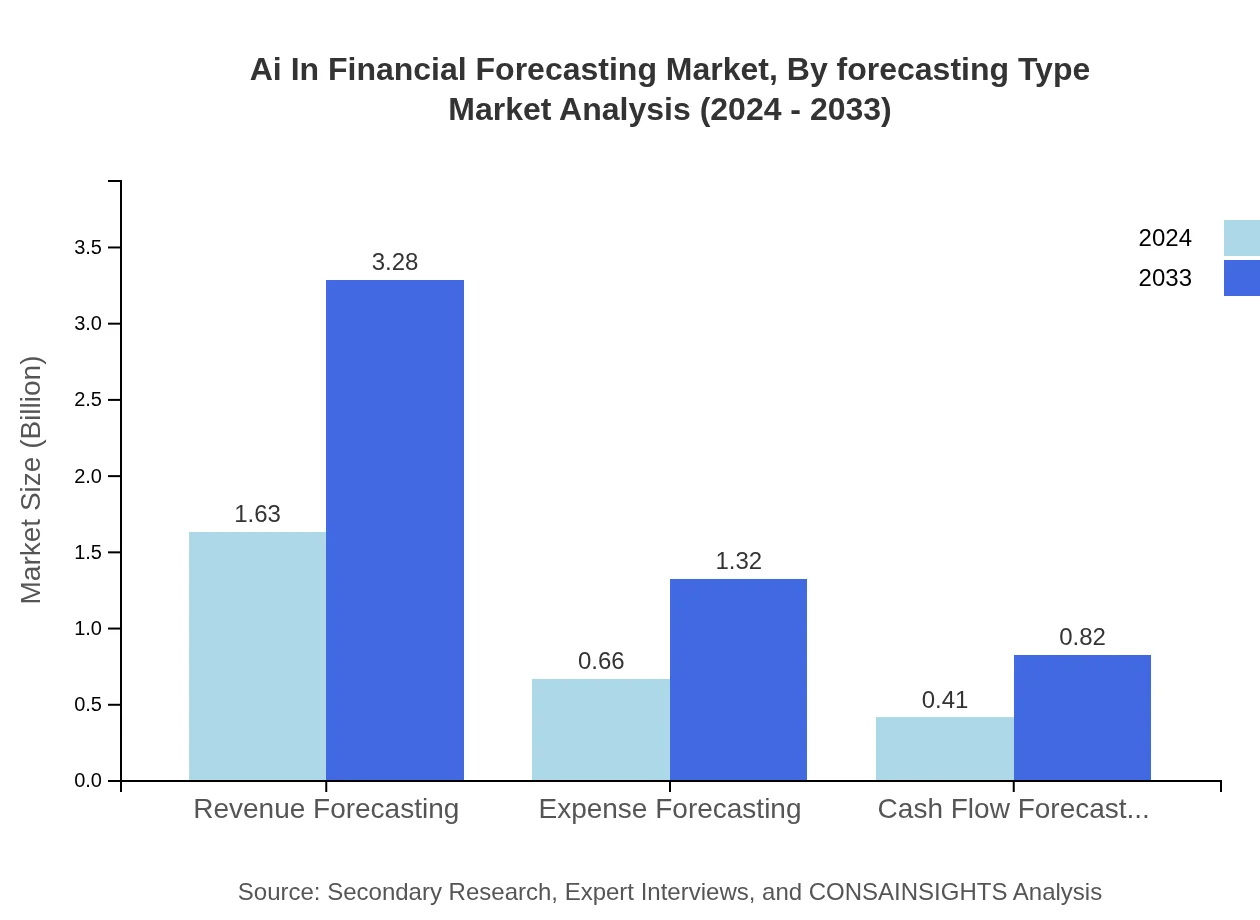

Ai In Financial Forecasting Market Analysis By Forecasting Type

The forecasting type segmentation divides the market into revenue forecasting, expense forecasting, and cash flow forecasting categories. Revenue forecasting, with a market size growing from 1.63 in 2024 to 3.28 in 2033, is gaining traction as firms strive for accuracy in predicting future earnings. Expense forecasting and cash flow forecasting, each showing consistent growth from 0.66 to 1.32 and 0.41 to 0.82 respectively, also play critical roles in comprehensive financial planning. The steady performance of these segments emphasizes the importance of predictive analytics in budgeting and financial management, reinforcing the market’s potential to drive efficiency and profitability in both established institutions and emerging businesses.

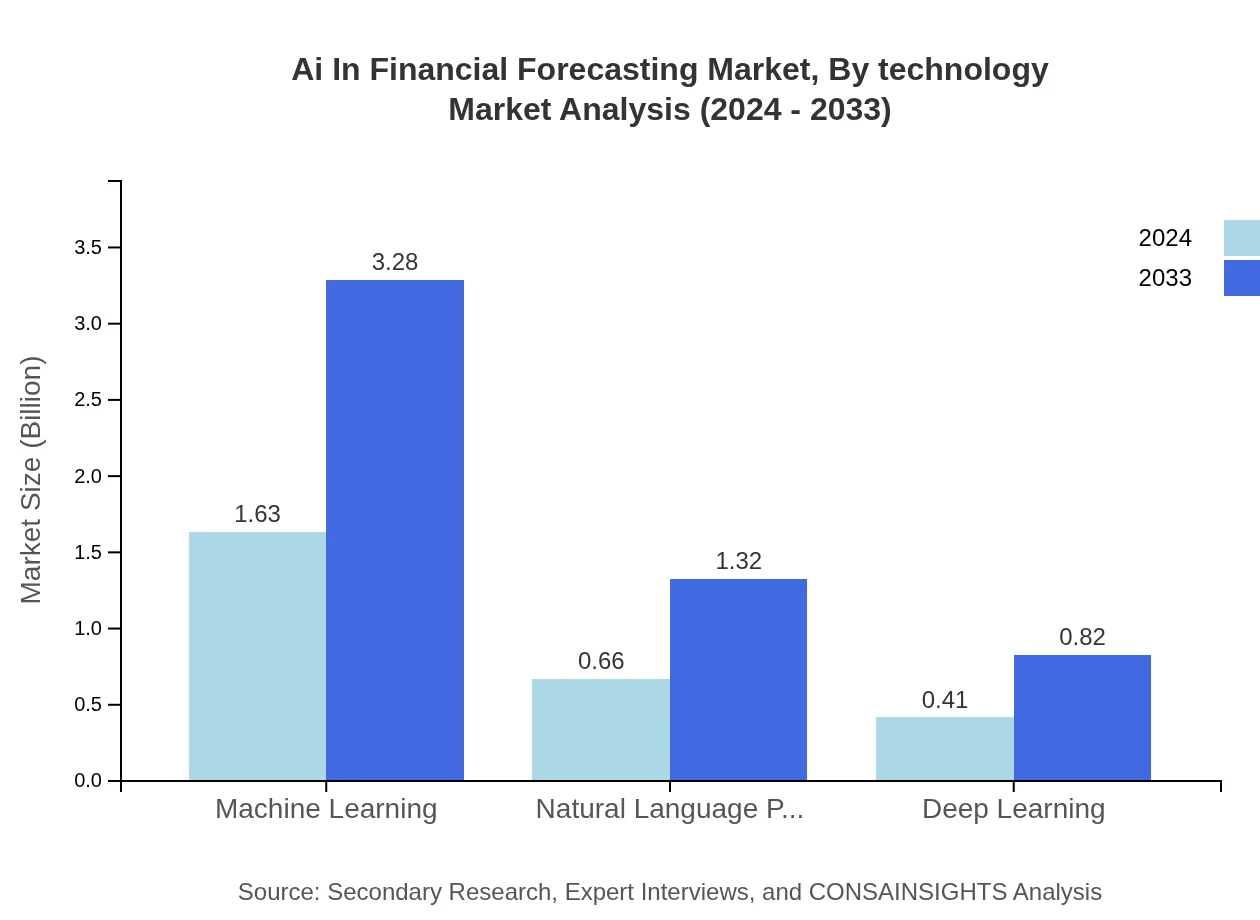

Ai In Financial Forecasting Market Analysis By Technology

The technology segmentation examines the role of machine learning, natural language processing, and deep learning in advancing financial forecasting solutions. Machine learning is the dominant player with its market size nearly doubling from 1.63 in 2024 to 3.28 in 2033, and a consistent market share of 60.55%. Natural language processing and deep learning, with market sizes increasing from 0.66 to 1.32 and 0.41 to 0.82 respectively, contribute substantially to the development of intelligent systems that understand and process complex datasets. These technologies not only enhance forecasting accuracy but also enable the automation of routine financial operations, making them indispensable for modern financial management.

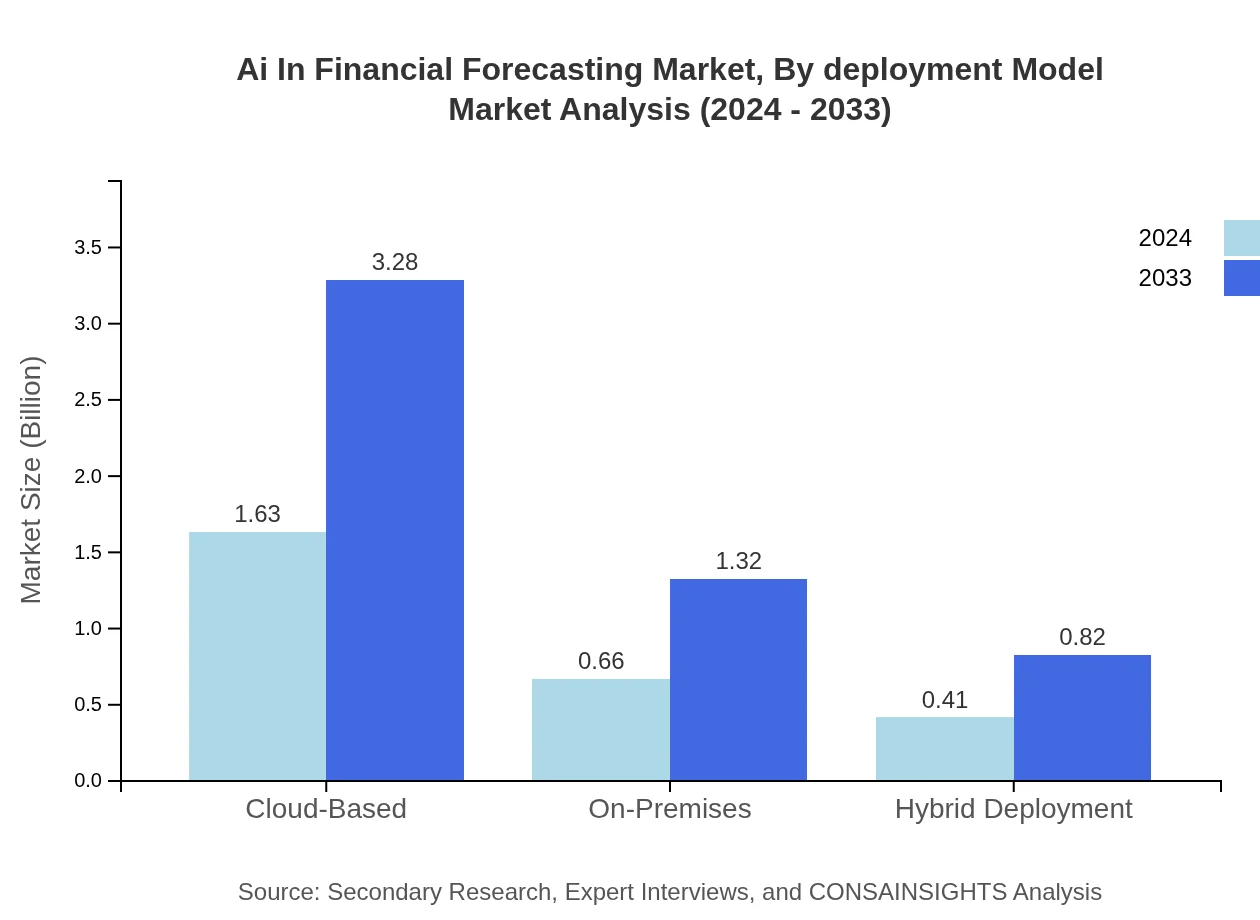

Ai In Financial Forecasting Market Analysis By Deployment Model

Deployment models in the market include cloud-based, on-premises, and hybrid deployment options, each tailored to different organizational needs. Cloud-based platforms, with a market size moving from 1.63 in 2024 to 3.28 in 2033, offer scalability and cost efficiency for businesses of all sizes. On-premises solutions, growing from 0.66 to 1.32, provide enhanced security and greater control over data, which is important for highly regulated industries. Hybrid deployments, meanwhile, present a balanced approach by combining the benefits of both models and are projected to grow from 0.41 to 0.82. This segmentation ensures that companies can choose the most appropriate and flexible solution to meet their specific security and performance requirements.

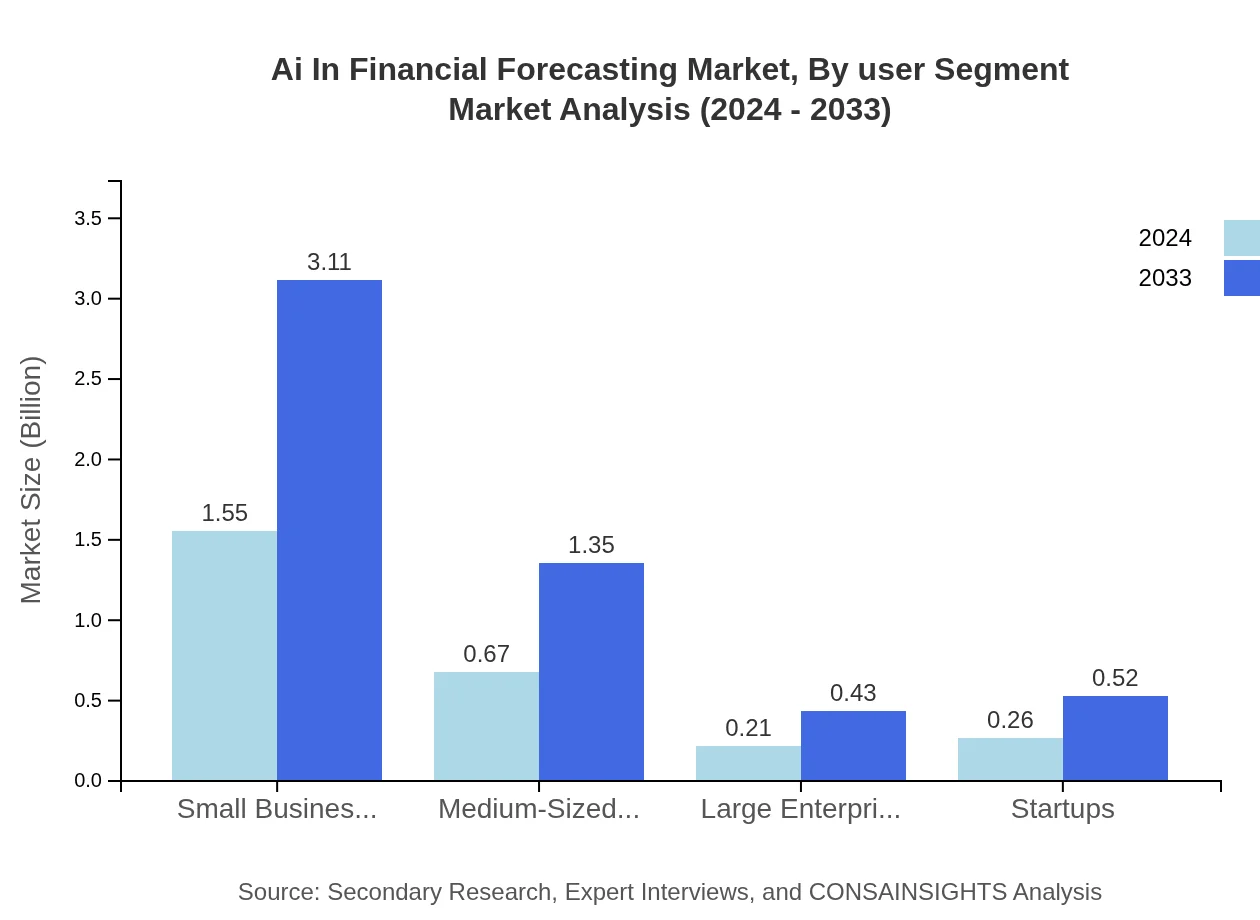

Ai In Financial Forecasting Market Analysis By User Segment

User segment analysis categorizes the market into small businesses, medium-sized enterprises, large enterprises, and startups. Small businesses lead the market with a significant share, growing from 1.55 in 2024 to 3.11 in 2033, reflecting their agility and rapid adoption of innovative technologies. Medium-sized enterprises, which show growth from 0.67 to 1.35, and large enterprises, expanding from 0.21 to 0.43, are also embracing AI solutions to streamline operations and enhance decision-making. Startups, while smaller in absolute terms with an increase from 0.26 to 0.52, are pivotal in driving innovation and disrupting traditional forecasting practices. Overall, this segmentation highlights the varied adoption rates and specific needs of different business sizes within the financial forecasting realm.

Ai In Financial Forecasting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Financial Forecasting Industry

FinTech Innovations Inc.:

A pioneer in integrating artificial intelligence with financial analytics, FinTech Innovations Inc. leverages state-of-the-art machine learning algorithms to offer predictive insights and robust forecasting tools, thus enabling organizations to streamline their financial operations.AI Forecast Solutions LLC:

AI Forecast Solutions LLC specializes in advanced AI-driven forecasting solutions, combining cloud-based analytics and real-time data processing to empower businesses with accurate revenue, expense, and cash flow predictions. Their innovative approach has set industry benchmarks.Predictive Analytics Group:

Recognized for its deep expertise in machine learning and natural language processing, Predictive Analytics Group delivers forecasting models that are both precise and scalable, ensuring that businesses can adapt to fast-changing market dynamics.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Financial Forecasting?

The AI in Financial Forecasting market is sized at approximately $2.7 Billion with a projected CAGR of 7.8% from 2024 to 2033, indicating robust growth in leveraging AI technologies for financial predictions.

What are the key market players or companies in this ai In Financial Forecasting industry?

Key players in the AI in Financial Forecasting industry include established tech giants like IBM and Microsoft, alongside financial analytics firms such as FICO and ZestFinance, who leverage AI to provide enhanced forecasting analytics.

What are the primary factors driving the growth in the ai In Financial Forecasting industry?

Growth drivers include the rising adoption of AI for improved accuracy in financial forecasting, enhanced data processing capabilities, increased demand for risk management solutions, and the need for real-time financial analyses across sectors.

Which region is the fastest Growing in the ai In Financial Forecasting?

The fastest-growing region is projected to be Asia-Pacific, with the market expected to grow from $0.52 billion in 2024 to $1.03 billion by 2033, driven by expanding financial services and technological adoption.

Does ConsaInsights provide customized market report data for the ai In Financial Forecasting industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the AI in Financial Forecasting industry, allowing clients to gain insights that meet their unique business requirements.

What deliverables can I expect from this ai In Financial Forecasting market research project?

Deliverables from this market research project typically include comprehensive reports, data analytics, market insights, industry trends, and forecasts segmented by region and application for informed decision-making.

What are the market trends of ai In Financial Forecasting?

Current trends include increased integration of machine learning and deep learning, a shift towards cloud-based solutions, and an emphasis on enhancing customer experiences through predictive analytics in various financial sectors.