Ai In Underwriting

Published Date: 24 January 2026 | Report Code: ai-in-underwriting

Ai In Underwriting Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in‐depth analysis of the Ai In Underwriting market, covering current market conditions, technological innovation, and strategic segmentation. It encompasses detailed insights into market sizes, regional trends, and future forecasts for the period 2024 to 2033. Readers will gain a comprehensive understanding of the market’s dynamics and growth potential.

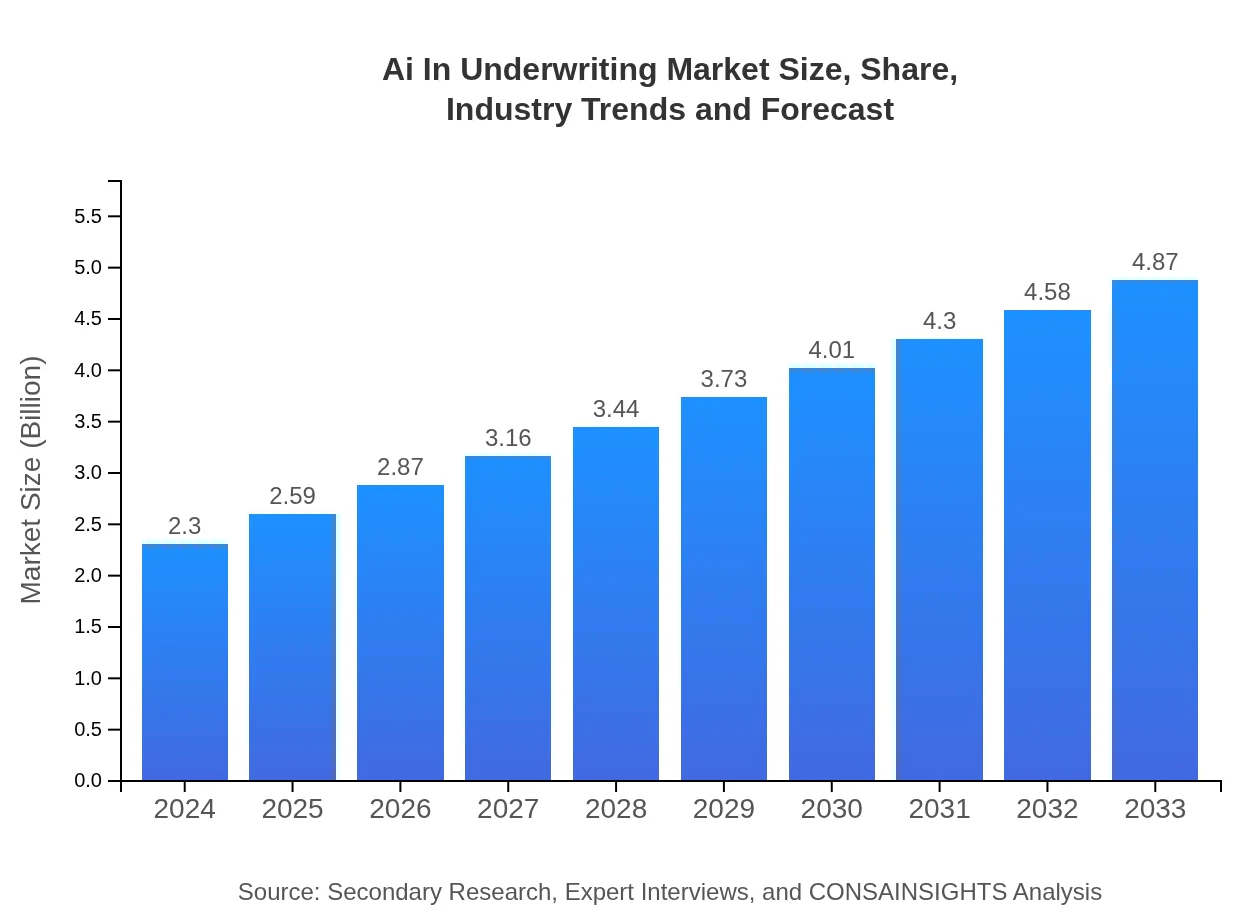

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.30 Billion |

| CAGR (2024-2033) | 8.4% |

| 2033 Market Size | $4.87 Billion |

| Top Companies | TechUnderwrite Inc., InsurTech Solutions, AIAssure Technologies, RiskSmart Innovations |

| Last Modified Date | 24 January 2026 |

Ai In Underwriting Market Overview

Customize Ai In Underwriting market research report

- ✔ Get in-depth analysis of Ai In Underwriting market size, growth, and forecasts.

- ✔ Understand Ai In Underwriting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Underwriting

What is the Market Size & CAGR of Ai In Underwriting market in {Year}?

Ai In Underwriting Industry Analysis

Ai In Underwriting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Underwriting Market Analysis Report by Region

Europe Ai In Underwriting:

Europe is another key region, with market size numbers growing from 0.76 in 2024 to an expected 1.62 by 2033. The region benefits from a highly developed regulatory environment and strong digital integration within financial services. European insurers are leveraging AI not only for risk assessment but also to enhance customer engagement, resulting in a mature market that balances innovation with compliance.Asia Pacific Ai In Underwriting:

In the Asia Pacific region, the market is emerging steadily with an estimated market size of 0.41 in 2024 and a projected expansion to 0.87 by 2033. Rapid technological adoption, increased digitalization, and supportive government initiatives have been instrumental in driving growth in this region. Local insurers are progressively adopting AI to overcome challenges presented by large and diverse customer bases, while startups are innovating at a brisk pace.North America Ai In Underwriting:

North America remains one of the most mature markets for Ai In Underwriting, with a market size estimated at 0.79 in 2024 and forecasts predicting expansion to 1.68 by 2033. This growth is driven by strong technological ecosystems, high penetration of digital technologies, and a competitive insurance market which continuously seeks to optimize risk analysis and streamline underwriting processes.South America Ai In Underwriting:

South America showcases promising growth with initial market size figures around 0.21 in 2024, expected to rise to 0.45 by 2033. This growth is fueled by improving digital infrastructure and increased investments in technology-driven insurance solutions. As economic conditions stabilize and regulatory frameworks mature, AI in underwriting is becoming a viable strategy to enhance operational efficiencies across regional carriers.Middle East & Africa Ai In Underwriting:

The Middle East and Africa region, though relatively nascent, displays significant potential with market values anticipated to increase from 0.12 in 2024 to 0.26 by 2033. Investments in digital infrastructure and heightened focus on financial inclusion are driving this growth. Insurers in the region are gradually adopting AI-driven underwriting to cater to a growing and increasingly tech-savvy customer base.Tell us your focus area and get a customized research report.

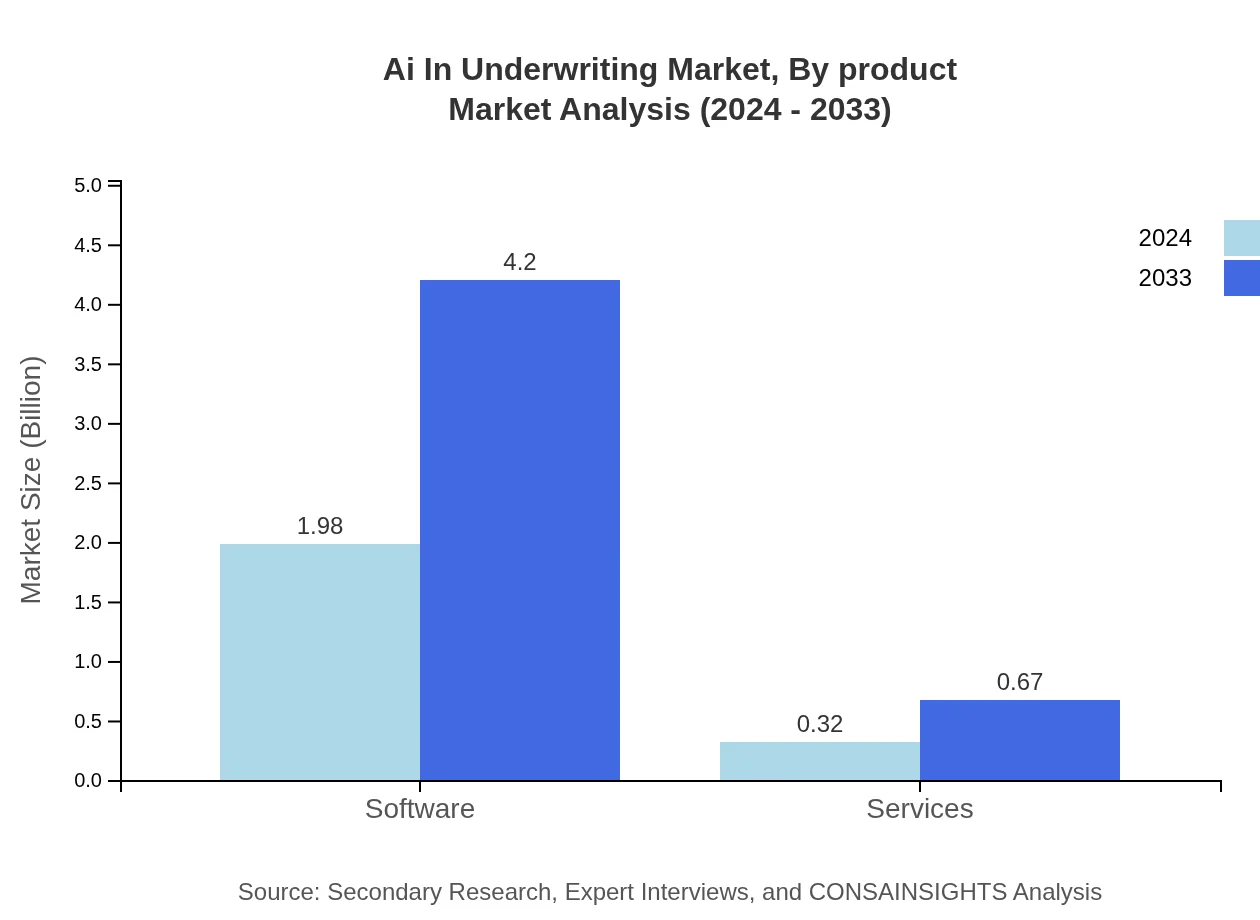

Ai In Underwriting Market Analysis By Product

The by-product segment primarily encompasses software and associated services that facilitate AI integration. In 2024, the software component is valued at 1.98 with a dominant share of 86.25%, while services represent a smaller yet significant segment at 0.32 with 13.75% share. By 2033, these figures are expected to grow substantially to 4.20 and 0.67, respectively. This segmentation underscores the market’s focus on product maturity, highlighting continuous improvements in algorithm performance, user experience, and integrated support services.

Ai In Underwriting Market Analysis By Application

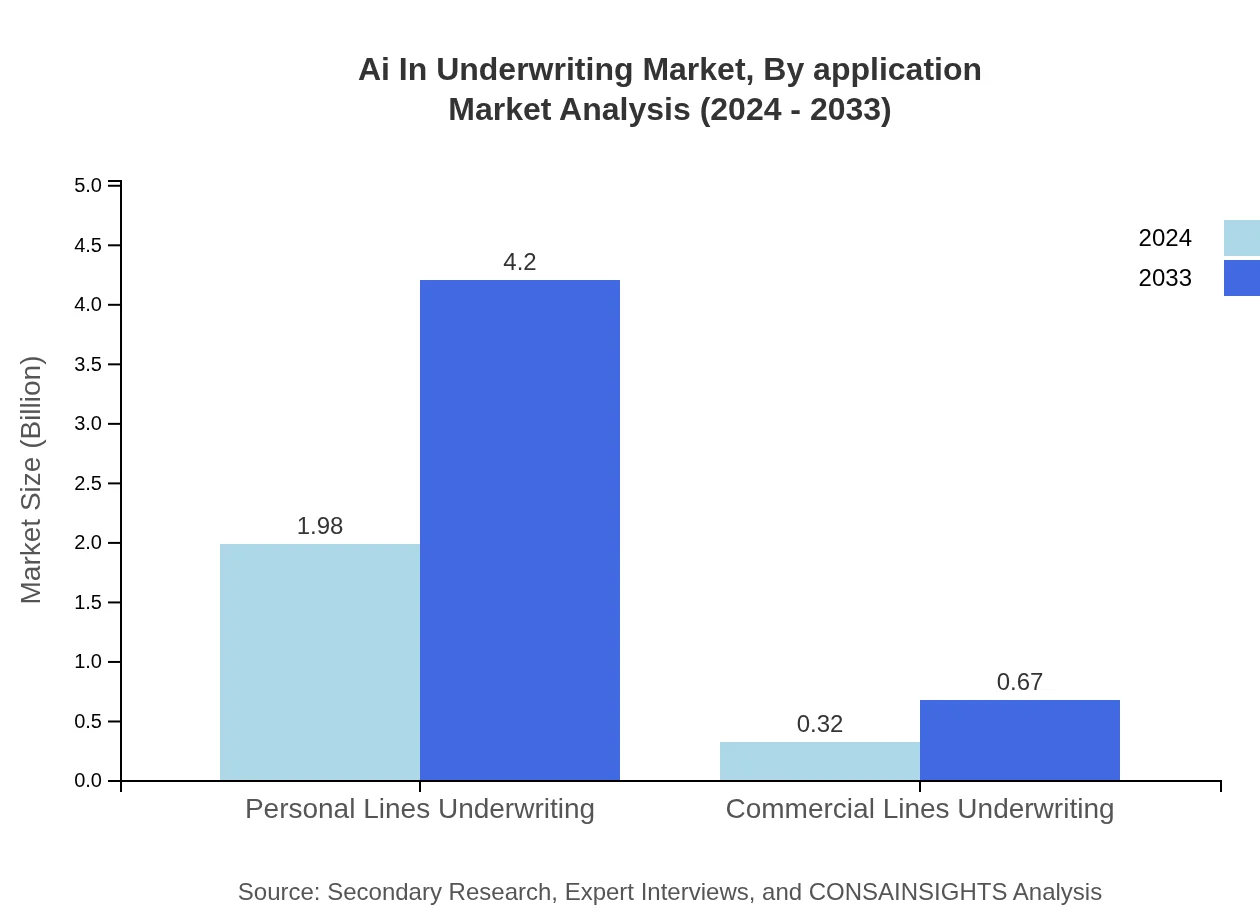

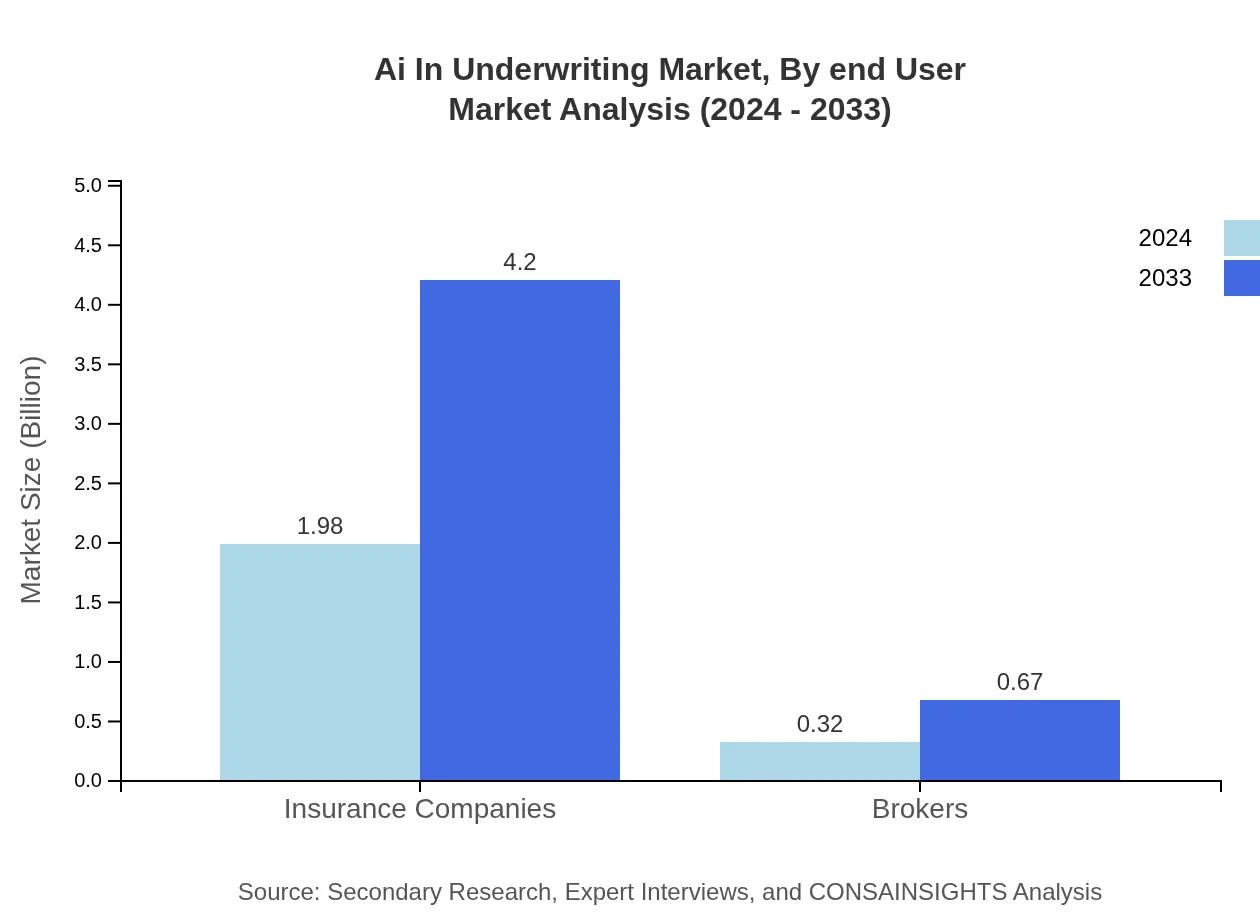

The by-application segment is segmented between insurance companies and brokers. In 2024, insurance companies command a market size of 1.98 (86.25% share) while brokers contribute 0.32 (13.75% share). These ratios persist into 2033 with growth to similar proportional figures, indicating that both traditional insurers and intermediaries are leveraging AI to optimize underwriting and risk assessment processes. This consistent share distribution reflects the balanced demand for AI-driven solutions across different application areas within the insurance domain.

Ai In Underwriting Market Analysis By Technology

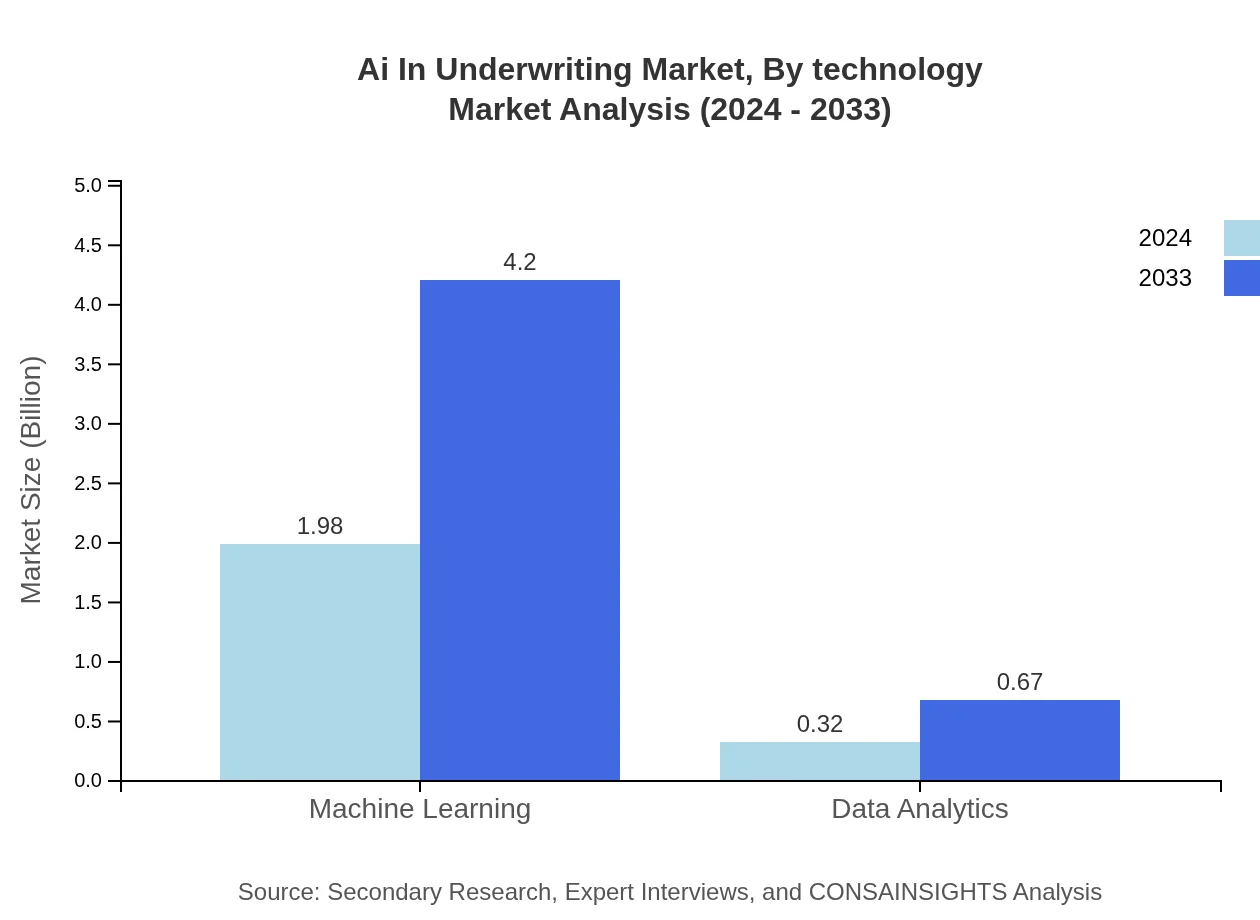

The technology segment disaggregates into machine learning and data analytics. In 2024, machine learning solutions lead with a market size of 1.98 and an 86.25% share, while data analytics contributes with a size of 0.32 and a 13.75% share. By 2033, both segments are anticipated to exhibit significant growth. This evolution highlights the indispensable role of advanced algorithms and analytical tools in transforming underwriting processes, as organizations increasingly rely on real-time data insights to fine-tune risk assessment and policy pricing.

Ai In Underwriting Market Analysis By End User

End-user segmentation divides the market into personal lines and commercial lines underwriting. In 2024, personal lines register a market size of 1.98 (86.25% share), while commercial lines account for 0.32 (13.75% share). This trend is expected to continue through 2033, indicating that while individual consumer policies dominate in volume, commercial insurance remains a vital niche. The differentiation in underwriting practices between personal and commercial lines drives targeted strategy developments, with tailored AI solutions designed to meet the distinct needs of each customer segment.

Ai In Underwriting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Underwriting Industry

TechUnderwrite Inc.:

A pioneer known for its innovative AI platforms that enhance underwriting precision and speed. The company harnesses advanced analytics to deliver comprehensive risk assessments.InsurTech Solutions:

Focuses on integrating state-of-the-art machine learning and data analytics to optimize underwriting processes. Renowned for its robust, scalable solutions in diverse insurance segments.AIAssure Technologies:

Recognized for implementing cutting-edge AI solutions that streamline underwriting and improve decision accuracy. Their platforms are widely adopted across various insurance lines.RiskSmart Innovations:

Leverages deep learning and predictive analytics to redefine underwriting strategies. Their innovative approach supports insurers in mitigating risks while boosting operational efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Underwriting?

The AI in underwriting market is projected to reach $2.3 billion by 2024, with a robust CAGR of 8.4%. This growth is indicative of increasing adoption of AI technologies in underwriting processes across various segments.

What are the key market players or companies in this ai In Underwriting industry?

Key players in the AI in underwriting industry include large insurance companies that are investing heavily in AI technologies to enhance underwriting efficiency. Additionally, tech companies specializing in machine learning and data analytics also play a crucial role in this ecosystem.

What are the primary factors driving the growth in the ai In Underwriting industry?

The growth in the AI in underwriting industry is primarily driven by the need for automation in underwriting processes, the increasing volume of data requiring analysis, and the demand for improved predictive analytics in risk assessment. Cost efficiency and enhanced decision-making capabilities also fuel this trend.

Which region is the fastest Growing in the ai In Underwriting?

North America is the fastest-growing region in the AI in underwriting market, projected to grow from $0.79 billion in 2024 to $1.68 billion by 2033. Europe and Asia Pacific also show significant growth, emphasizing regional investments in AI technologies.

Does ConsaInsights provide customized market report data for the ai In Underwriting industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the AI in underwriting sector. Clients can request detailed analyses that align with their business strategies and operational goals.

What deliverables can I expect from this ai In Underwriting market research project?

Expect comprehensive deliverables including detailed market analysis reports, segmentation insights, growth forecasts, competitive landscape studies, and tailored recommendations for strategic decision-making in the AI in underwriting sector.

What are the market trends of ai In Underwriting?

Current trends in the AI in underwriting market include increased integration of machine learning algorithms, growing focus on data integration and analytics, and a shift towards personalizing underwriting processes, which collectively enhance efficiency and accuracy.