Ai In Private Equity

Published Date: 24 January 2026 | Report Code: ai-in-private-equity

Ai In Private Equity Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Ai In Private Equity provides an in-depth analysis of market dynamics, investment strategies, technological innovation, and future growth prospects from 2024 to 2033. It outlines key market trends, regional insights, segmentation details, and profiles of global market leaders, enabling stakeholders to make informed decisions in this transformative industry.

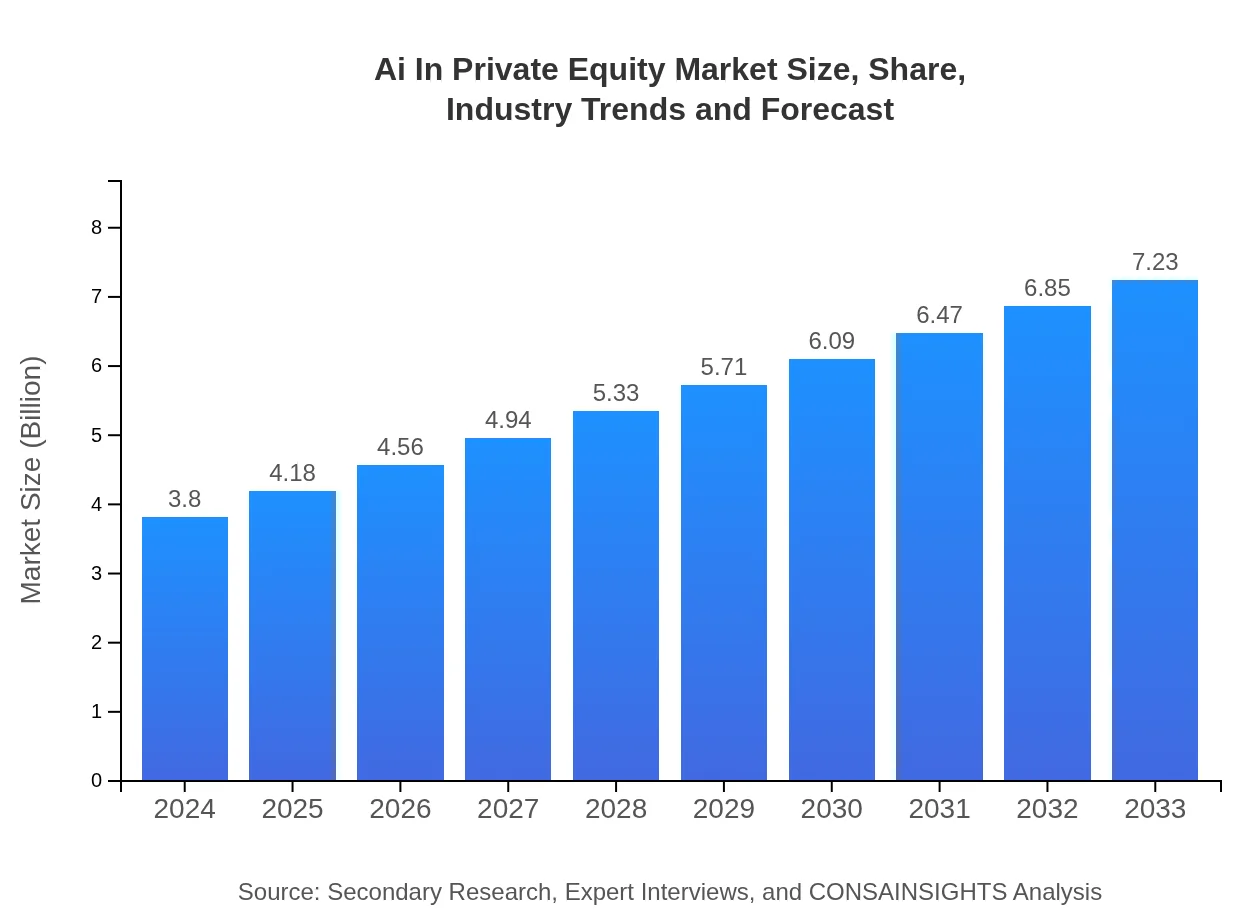

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.80 Billion |

| CAGR (2024-2033) | 7.2% |

| 2033 Market Size | $7.23 Billion |

| Top Companies | Alpha Capital, Beta Investments |

| Last Modified Date | 24 January 2026 |

Ai In Private Equity Market Overview

Customize Ai In Private Equity market research report

- ✔ Get in-depth analysis of Ai In Private Equity market size, growth, and forecasts.

- ✔ Understand Ai In Private Equity's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Private Equity

What is the Market Size & CAGR of Ai In Private Equity market in {Year}?

Ai In Private Equity Industry Analysis

Ai In Private Equity Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Private Equity Market Analysis Report by Region

Europe Ai In Private Equity:

Europe shows steady growth with market values rising from 1.39 Billion in 2024 to nearly 2.64 Billion by 2033. A mature regulatory framework and significant investments in technological upgrades have enhanced investor confidence and facilitated the integration of AI solutions into traditional private equity models.Asia Pacific Ai In Private Equity:

In Asia Pacific, the market is propelled by rapid digital transformation and strong governmental support. Market values are projected to climb from approximately 0.61 Billion in 2024 to an estimated 1.17 Billion by 2033. With a young, technology-embracing investor base and continuous innovations in local tech infrastructure, the region is expected to be a significant driver of growth.North America Ai In Private Equity:

North America remains a powerhouse with an established financial ecosystem and a strong emphasis on innovation. The region is forecasted to grow from 1.27 Billion in 2024 to 2.42 Billion by 2033, as it continues to harness AI technologies to reinforce its competitive edge in deal sourcing and portfolio management.South America Ai In Private Equity:

South America, though starting from a smaller base of around 0.05 Billion in 2024, is witnessing a doubling in market size by 2033. Emerging economies in the region are gradually integrating AI-driven investment strategies, paving the way for improved operational efficiencies and attracting more capital investment despite infrastructure challenges.Middle East & Africa Ai In Private Equity:

In the Middle East and Africa, the market begins at approximately 0.48 Billion in 2024 and is projected to reach 0.91 Billion by 2033. The region faces unique challenges such as infrastructural disparities, yet it also presents untapped opportunities as digital adoption and economic diversification efforts gain momentum.Tell us your focus area and get a customized research report.

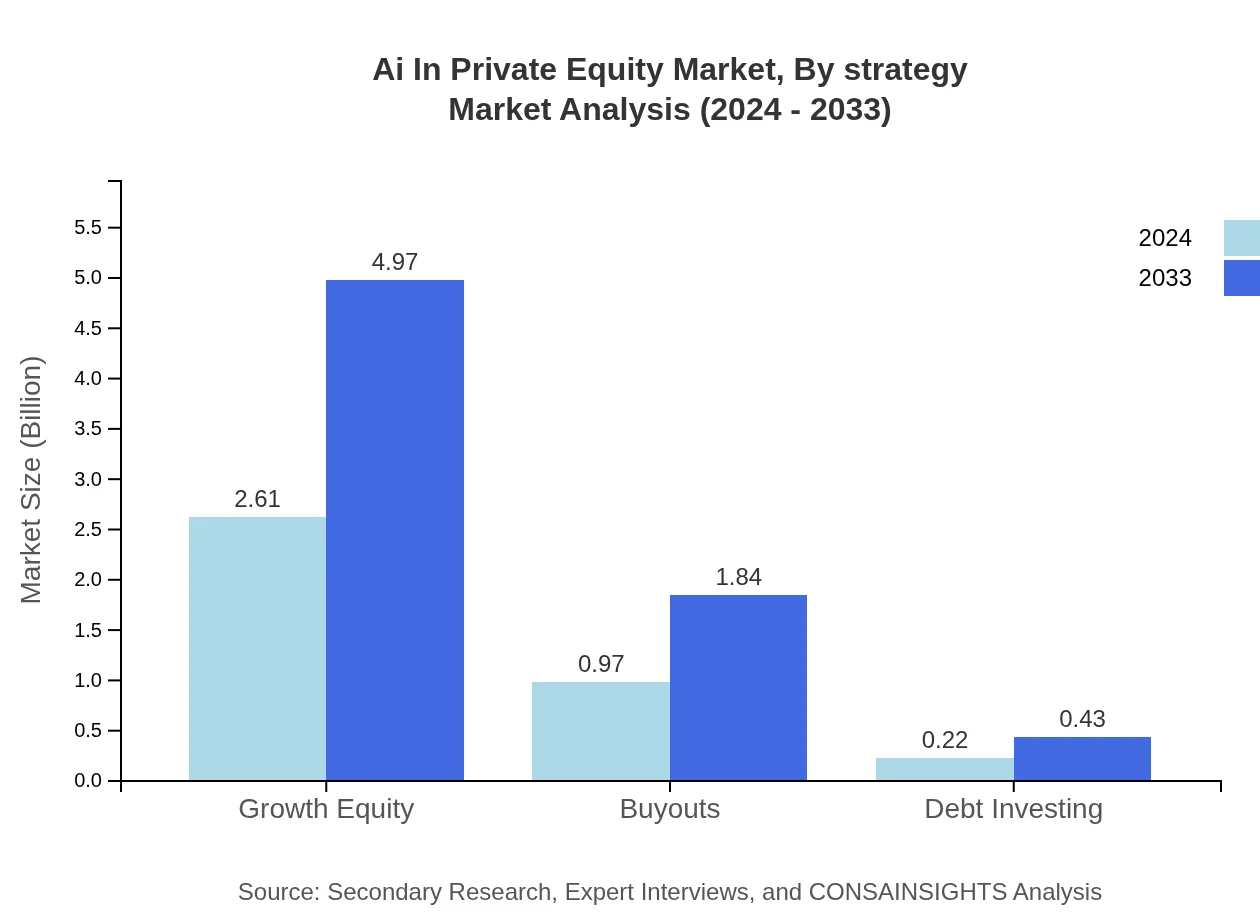

Ai In Private Equity Market Analysis By Strategy

The analysis of investment strategies within the Ai In Private Equity market reveals key segments such as Growth Equity, Buyouts, and Debt Investing. Growth Equity leads with a market size of 2.61 Billion in 2024, anticipating an increase to 4.97 Billion by 2033, and maintains a dominant share of 68.69%. Buyouts and Debt Investing further complement the market by balancing risk profiles and capital allocation. This segmentation highlights how leveraging advanced AI capabilities optimizes deal sourcing, enhances risk assessment, and drives portfolio performance.

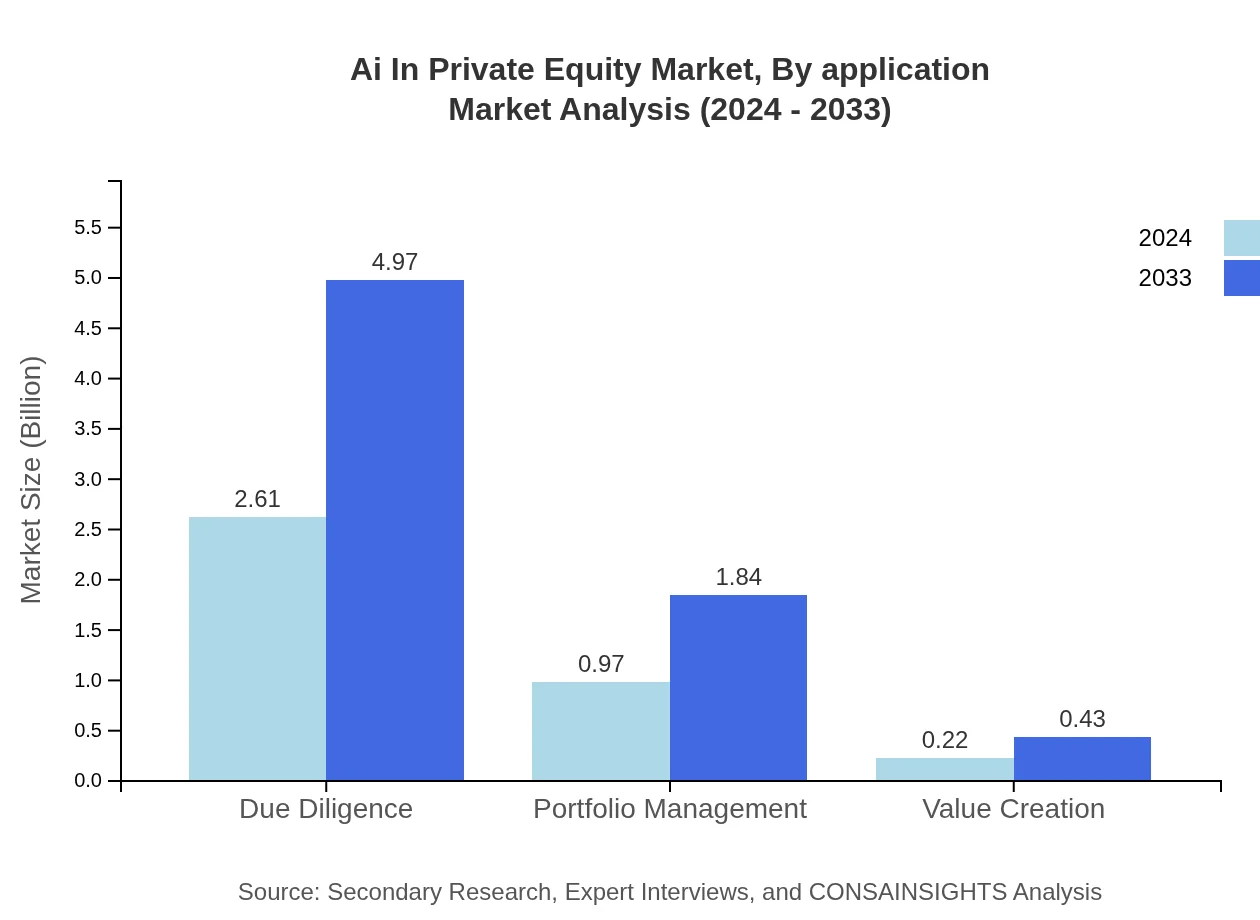

Ai In Private Equity Market Analysis By Application

The application segment plays a crucial role in driving the efficiency of private equity operations through AI. Key applications such as Due Diligence, Portfolio Management, and Value Creation are transforming traditional practices by enabling more accurate and faster data analysis. The robust performance across these applications, with consistent market shares, underscores the broad adoption of AI tools. Firms are increasingly relying on these applications to mitigate risks, streamline operations, and ultimately bolster investment returns.

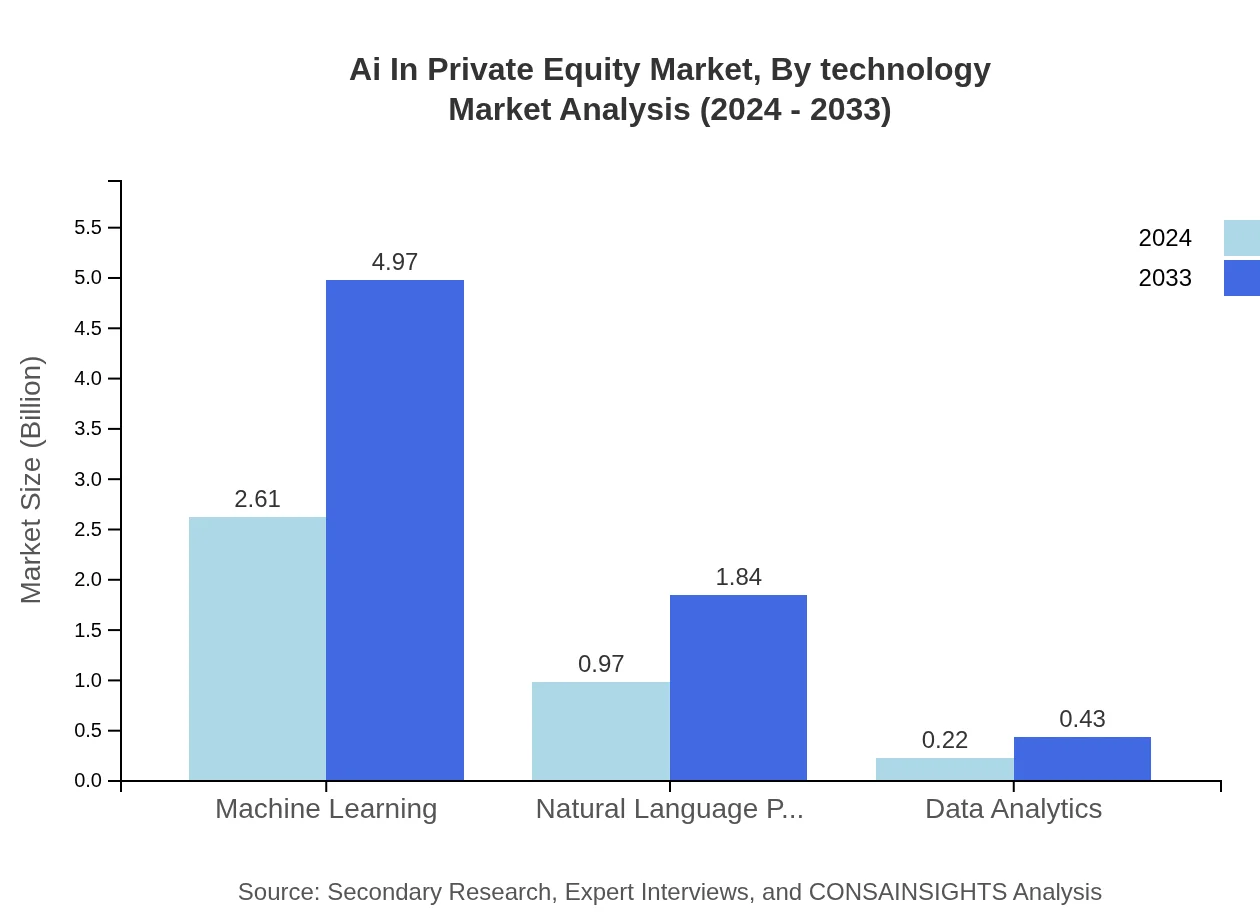

Ai In Private Equity Market Analysis By Technology

Technological innovation forms the backbone of the modern Ai In Private Equity market. Advanced tools including Machine Learning, Natural Language Processing, and Data Analytics are revolutionizing data interpretation and decision-making processes. Machine Learning and Natural Language Processing, in particular, stand out by enabling predictive analytics and automating routine tasks, thereby accelerating investment cycles. As these technologies advance, their adoption is expected to deepen, further integrating AI into critical aspects of investment management and operational efficiency.

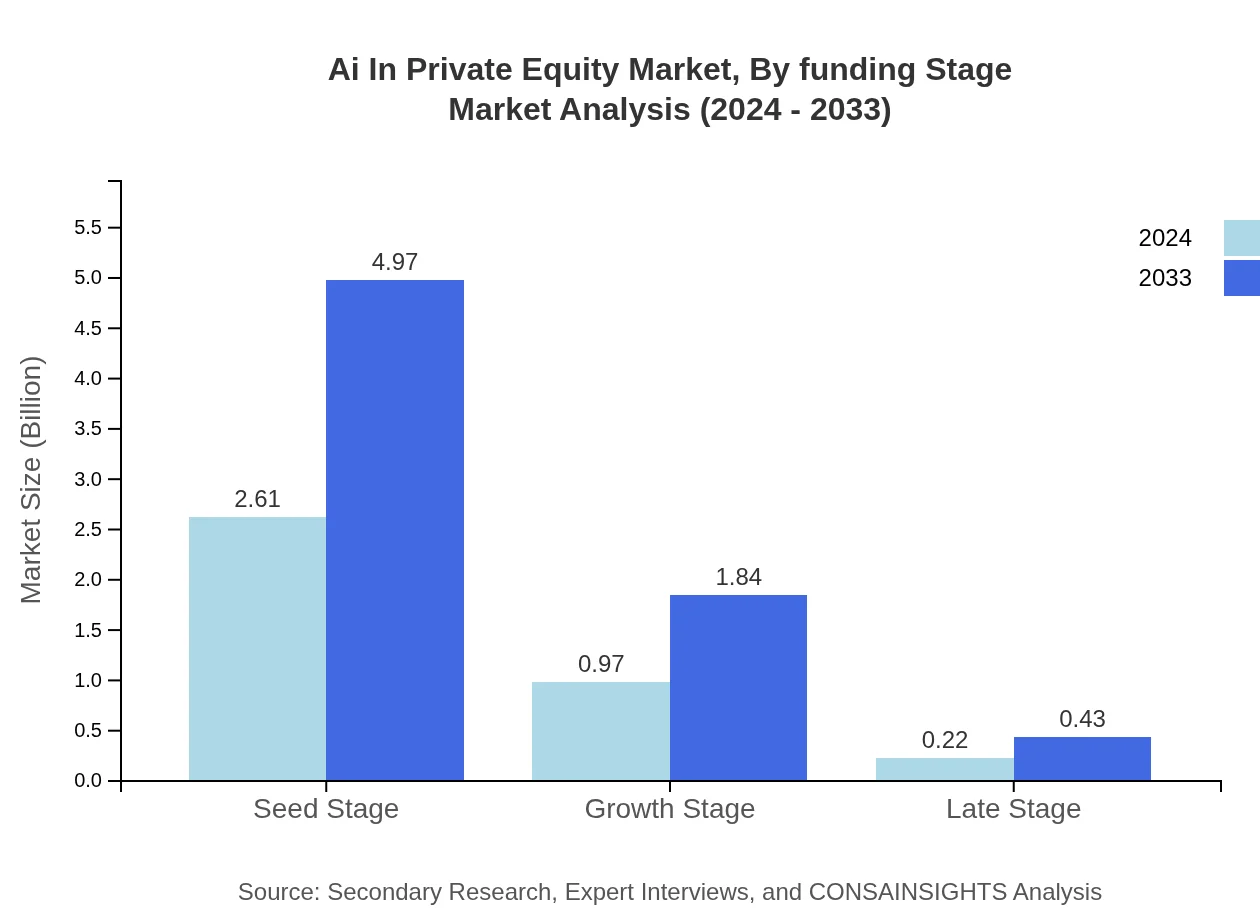

Ai In Private Equity Market Analysis By Funding Stage

Funding stage segmentation breaks down the market into Seed, Growth, and Late stages, each representing distinct phases of investment maturity. The Seed Stage, characterized by early investment opportunities, boasts a significant market size and high share, fostering innovation. Growth Stage investments offer balanced risk and steady expansion, while Late Stage deals typically signal market stabilization and maturity. This segmentation provides investors with clear insights into market evolution, facilitating strategy adjustments based on the risk-return profile at each stage.

Ai In Private Equity Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Private Equity Industry

Alpha Capital:

Alpha Capital is a pioneering firm leveraging advanced AI analytics to drive value creation in private equity portfolios. Their robust platform combines cutting-edge data intelligence with market expertise, positioning them at the forefront of innovation and operational excellence.Beta Investments:

Beta Investments utilizes state-of-the-art AI solutions to transform deal sourcing and risk management. Through strategic integration of technology, they have set industry benchmarks and continue to lead the market in adopting AI-driven investment strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Private Equity?

The AI in Private Equity market is projected to grow from $3.8 billion in 2024 to significant heights by 2033, with a compound annual growth rate (CAGR) of 7.2%. This growth reflects increasing investment in AI technologies within the private equity sector.

What are the key market players or companies in the AI in Private Equity industry?

Key players in the AI in Private Equity industry include technology and financial services firms. These firms leverage AI for better investment decisions, portfolio management, and operational efficiency, thereby gaining a competitive edge in the market.

What are the primary factors driving the growth in the AI in Private Equity industry?

Growth in the AI in Private Equity sector is driven by the increasing adoption of AI technologies, the need for enhanced data analytics, rising operational efficiency demands, and a growing emphasis on effective portfolio management to maximize returns.

Which region is the fastest Growing in the AI in Private Equity?

The fastest-growing region in the AI in Private Equity market is Europe, expected to expand from $1.39 billion in 2024 to $2.64 billion by 2033. This is followed by North America, which is also experiencing substantial growth.

Does ConsaInsights provide customized market report data for the AI in Private Equity industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the AI in Private Equity industry. This customization ensures clients receive insights specific to their strategic interests and operational goals.

What deliverables can I expect from this AI in Private Equity market research project?

Deliverables from the AI in Private Equity market research project include detailed reports, market analysis, growth forecasts, competitive landscape assessments, and actionable insights, allowing businesses to make informed decisions.

What are the market trends of AI in Private Equity?

Current trends in the AI in Private Equity market include increased reliance on machine learning for predictive analytics, growing use of natural language processing for data analysis, and a focus on data-driven decision-making for strategic investments.