Ai In Financial

Published Date: 24 January 2026 | Report Code: ai-in-financial

Ai In Financial Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Ai In Financial offers a deep dive into the market’s current status and future potential over the forecast period 2024 to 2033. It provides critical insights into market size, growth drivers, segmentation, regional analysis, technological innovations, product performance, and the strategic landscape of key global players.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

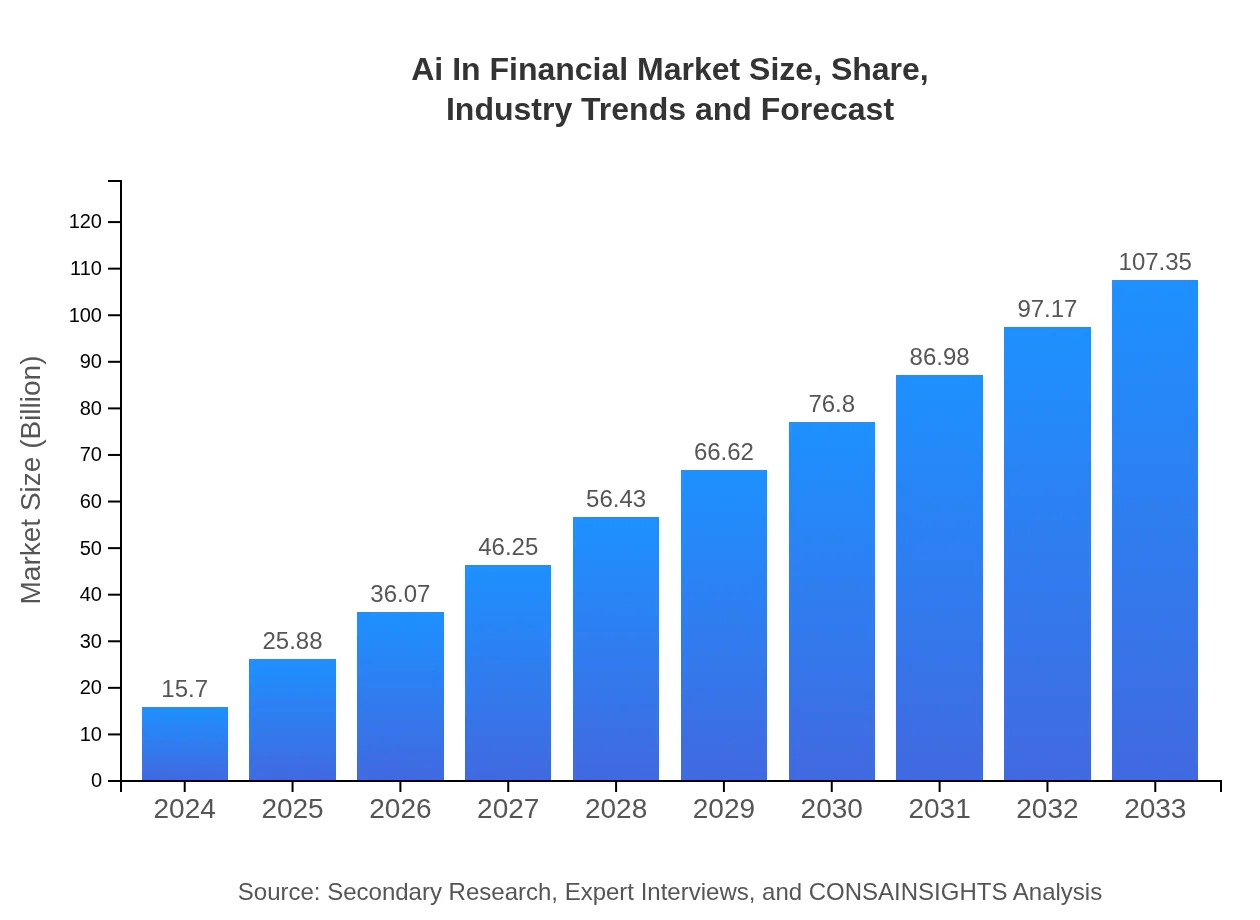

| 2024 Market Size | $15.70 Billion |

| CAGR (2024-2033) | 22.3% |

| 2033 Market Size | $107.35 Billion |

| Top Companies | FinTech Innovations Inc., Global AI Financial Solutions, Innovative Finance Technologies |

| Last Modified Date | 24 January 2026 |

Ai In Financial Market Overview

Customize Ai In Financial market research report

- ✔ Get in-depth analysis of Ai In Financial market size, growth, and forecasts.

- ✔ Understand Ai In Financial's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Financial

What is the Market Size & CAGR of Ai In Financial market in 2024?

Ai In Financial Industry Analysis

Ai In Financial Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Financial Market Analysis Report by Region

Europe Ai In Financial:

Europe shows aggressive growth trends, with markets expanding from 5.18 in 2024 to 35.43 by 2033. The continent demonstrates strong synergy between established financial institutions and innovative fintech startups. Progressive regulatory policies and a highly skilled workforce further contribute to the rapid adoption and integration of AI technologies in finance.Asia Pacific Ai In Financial:

In the Asia Pacific region, the Ai In Financial market is expected to witness substantial growth, with market size increasing from 2.98 in 2024 to 20.36 in 2033. This growth is driven by rapid technology adoption, favorable regulatory reforms, and a burgeoning digital economy. Countries in the region are investing heavily in fintech innovations and infrastructural upgrades to meet the growing demand for AI-powered financial solutions.North America Ai In Financial:

North America maintains its position as a global leader in the integration of AI in finance, with market size expected to grow from 5.20 in 2024 to 35.55 by 2033. The region benefits from a robust technological infrastructure, high digital literacy, and substantial investments in research and development. These factors underpin its strategic advantage in adopting cutting-edge AI applications.South America Ai In Financial:

South America, though modest in current market size at 0.61 in 2024, is positioned for significant expansion reaching 4.19 by 2033. The market dynamics in this region are influenced by an increasing appetite for digital banking solutions and the gradual modernization of the financial sector. Local innovations and supportive governmental policies are contributing factors to this emerging trend.Middle East & Africa Ai In Financial:

The Middle East and Africa region, while starting at 1.73 in 2024, is forecasted to see its market size surge to 11.82 by 2033. This transformation is facilitated by efforts to diversify economies beyond oil and gas, along with increased investments in digital infrastructure and smart financial services. These regions are rapidly becoming hubs for AI adoption in relatively underpenetrated financial markets.Tell us your focus area and get a customized research report.

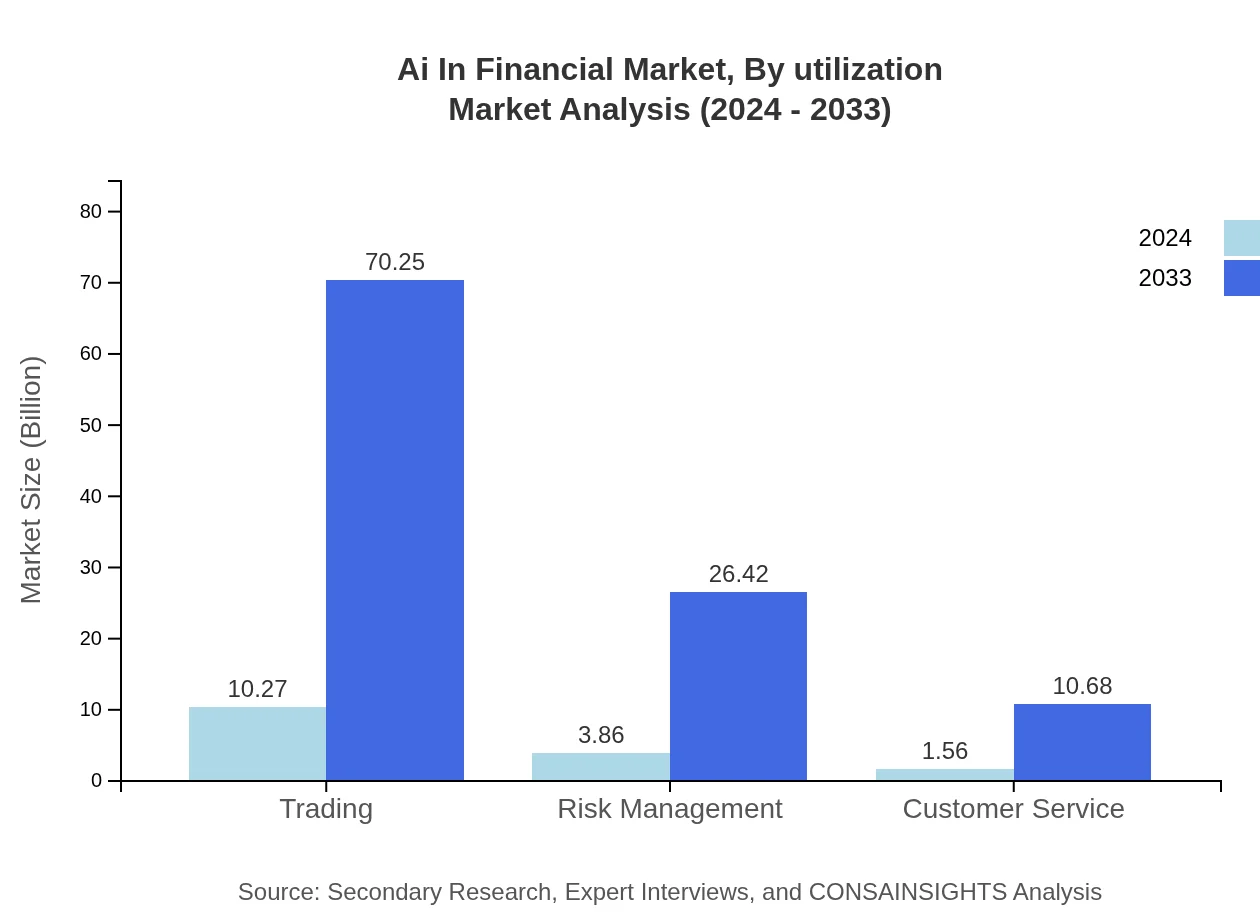

Ai In Financial Market Analysis By Utilization

The by-utilization segment of the Ai In Financial market encompasses critical applications such as trading, risk management, and customer service. Trading systems within this segment have shown impressive growth, with market sizes expanding significantly over the forecast period. Risk management applications have become indispensable as financial institutions seek to mitigate potential losses through predictive analytics and real-time monitoring. In customer service, AI has revolutionized operational efficiency, reducing response times and personalizing user experiences. Each of these utilization areas contributes uniquely to overall market growth, combining traditional financial expertise with advanced predictive technologies. The high adoption rate of these solutions is driven by their proven ability to enhance operational agility and deliver measurable cost savings, thereby solidifying their position as key investment targets.

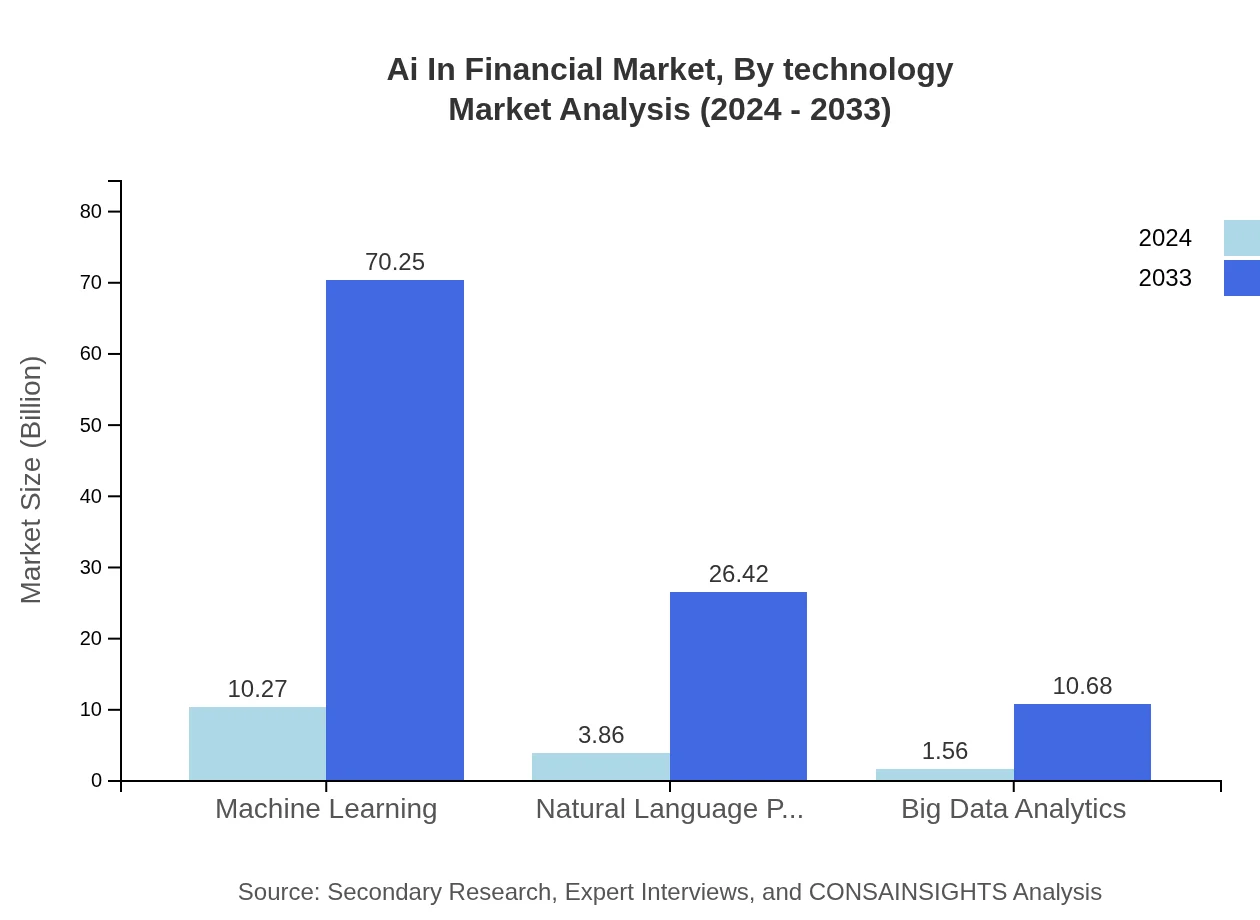

Ai In Financial Market Analysis By Technology

This segment focuses on the technological underpinnings that drive AI innovations in finance. Machine learning and natural language processing are at the forefront, providing the backbone for predictive analytics and customer interaction systems. Machine learning’s market size is forecasted to surge dramatically from 10.27 in 2024 to 70.25 by 2033, maintaining a stable share throughout, while natural language processing is set to expand its capabilities, supporting nuanced client communications in an increasingly digital landscape. Alongside these, big data analytics continues to evolve, ensuring that large, unstructured data is transformed into actionable insights. The synergies between these technologies facilitate the development of comprehensive AI solutions that cater to the diverse needs of the financial sector.

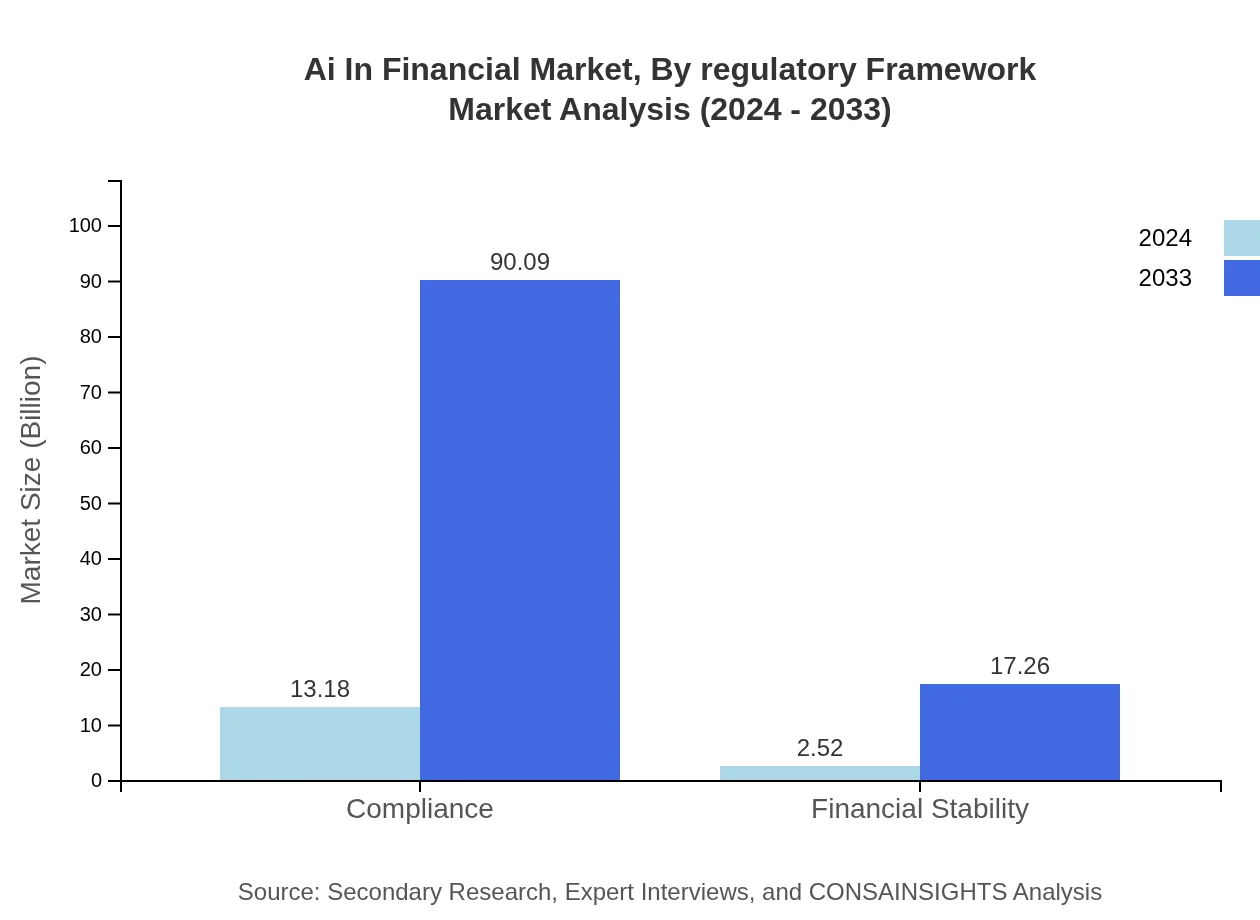

Ai In Financial Market Analysis By Regulatory Framework

Regulatory frameworks play a vital role in shaping the evolution and adoption of AI in the financial sector. This segment delves into compliance, oversight mechanisms, and risk mitigation protocols that are crucial for maintaining market integrity. With compliance market sizes growing from 13.18 in 2024 to an impressive 90.09 by 2033, and a consistent share of 83.92, there is a clear emphasis on creating robust guidelines to control technological risks. Furthermore, the focus on financial stability, which is integral to regulatory oversight, has seen market size expansions that underscore the necessity of aligning innovation with regulatory caution. The ongoing development of these frameworks is essential to ensure safe, scalable, and sustainable growth in the burgeoning AI financial landscape.

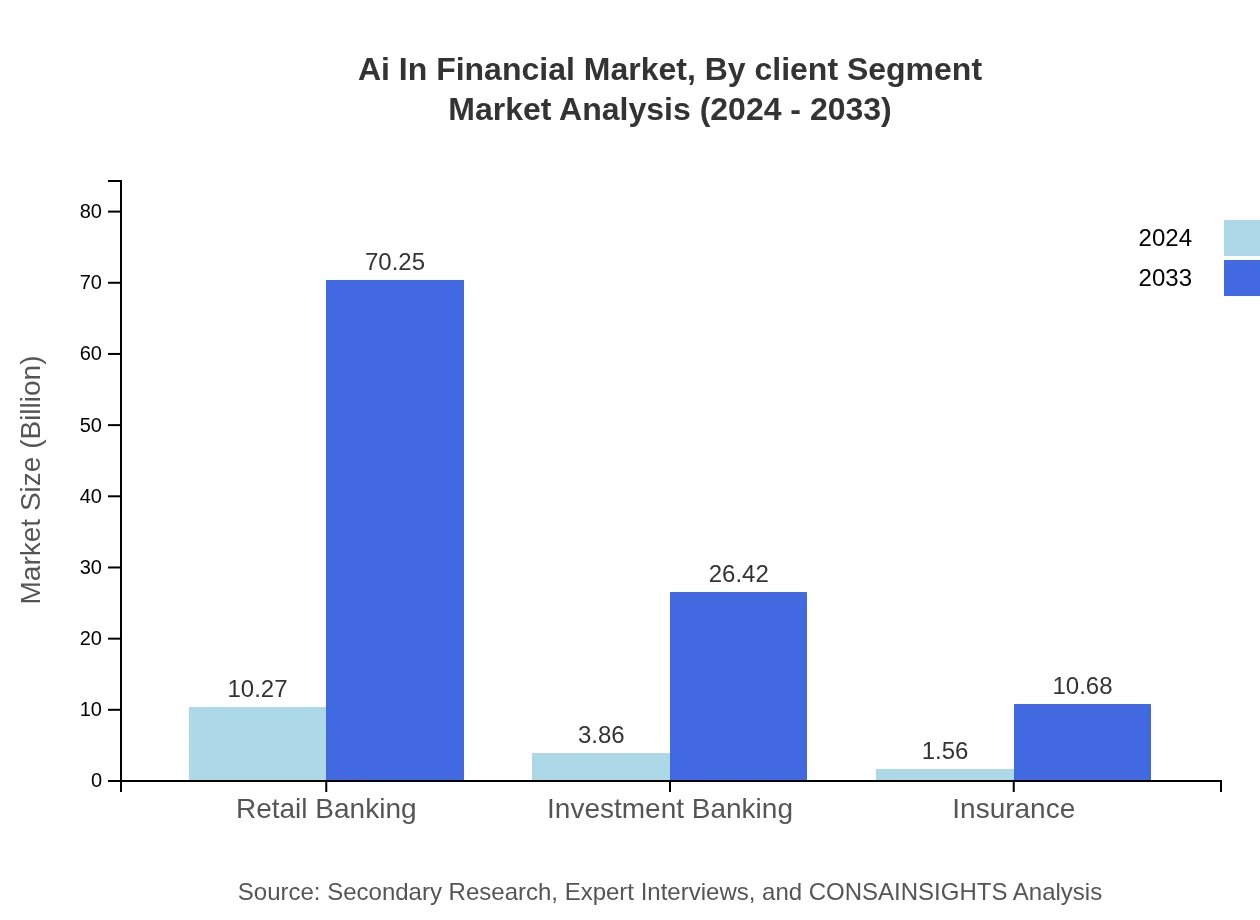

Ai In Financial Market Analysis By Client Segment

The client segment analysis categorizes the market into sub-segments such as retail banking, investment banking, and insurance. Retail banking utilizes AI primarily for enhancing customer interfaces and operational workflows, benefiting from increased service personalization and automation. Investment banking, on the other hand, leverages AI for advanced predictive modeling and market analysis to drive informed decision-making. Insurance applications of AI focus on risk assessment and policy management, helping to streamline claims processing and fraud detection. Each client segment shows strong performance metrics with notable growth figures, reflecting tailored AI implementations that meet distinct financial service demands. Collectively, these client-centric solutions are pivotal in promoting an adaptive and resilient financial ecosystem, driven by customized technological applications.

Ai In Financial Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Financial Industry

FinTech Innovations Inc.:

FinTech Innovations Inc. is a leading player known for its cutting-edge AI solutions that revolutionize risk management and trading operations. Their suite of products integrates advanced machine learning and natural language processing tools, setting industry benchmarks for efficiency and reliability in financial services.Global AI Financial Solutions:

Global AI Financial Solutions has established itself as a pivotal force in digital transformation. By harnessing big data analytics and robust regulatory technologies, the company delivers scalable AI platforms that empower banks and financial institutions to streamline operations and enhance customer engagements.Innovative Finance Technologies:

Innovative Finance Technologies excels in integrating advanced AI algorithms within traditional financial frameworks. Their strategic focus on compliance and risk mitigation has earned them a reputation as a trusted partner for financial institutions navigating complex regulatory landscapes.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Financial?

The AI in financial market is valued at approximately $15.7 billion in 2024, with expectations to grow at a compound annual growth rate (CAGR) of 22.3% through to 2033, reflecting significant advancements in AI technology.

Who are the key market players or companies in this ai In Financial industry?

Key players include major financial institutions, fintech companies, and technology providers such as IBM, Microsoft, Palantir Technologies, and numerous startups focusing on specialized AI solutions for finance.

What are the primary factors driving the growth in the ai In Financial industry?

Factors driving growth include increasing demand for automation, enhanced risk management capabilities, and the need for personalized financial services fueled by artificial intelligence and machine learning innovations.

Which region is the fastest Growing in the ai In Financial market?

The Asia-Pacific region is poised for rapid growth, projected to escalate from a market size of $2.98 billion in 2024 to approximately $20.36 billion by 2033, indicating an expanding adoption of AI technologies in finance.

Does ConsaInsights provide customized market report data for the ai In Financial industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the AI in financial sector, ensuring businesses have relevant insights for strategic decision-making and competitive advantage.

What deliverables can I expect from this ai In Financial market research project?

Deliverables typically include comprehensive reports, market forecasts, segment analyses, competitive landscape insights, and data visualizations to aid in strategic planning and evidence-based decision-making.

What are the market trends of ai In Financial?

Current trends include the increased utilization of machine learning for trading and risk management, the rise of AI-driven compliance solutions, and enhancing customer service interactions through AI-enhanced technologies.