Ai In Capital Markets

Published Date: 24 January 2026 | Report Code: ai-in-capital-markets

Ai In Capital Markets Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on AI in Capital Markets offers an insightful overview of market dynamics, including size, technological advancements, segmentation specifics, and regional performance. Covering the forecast period 2024 to 2033, the report provides key data and detailed predictive insights essential for investors, industry professionals, and stakeholders navigating the evolving integration of artificial intelligence in capital markets.

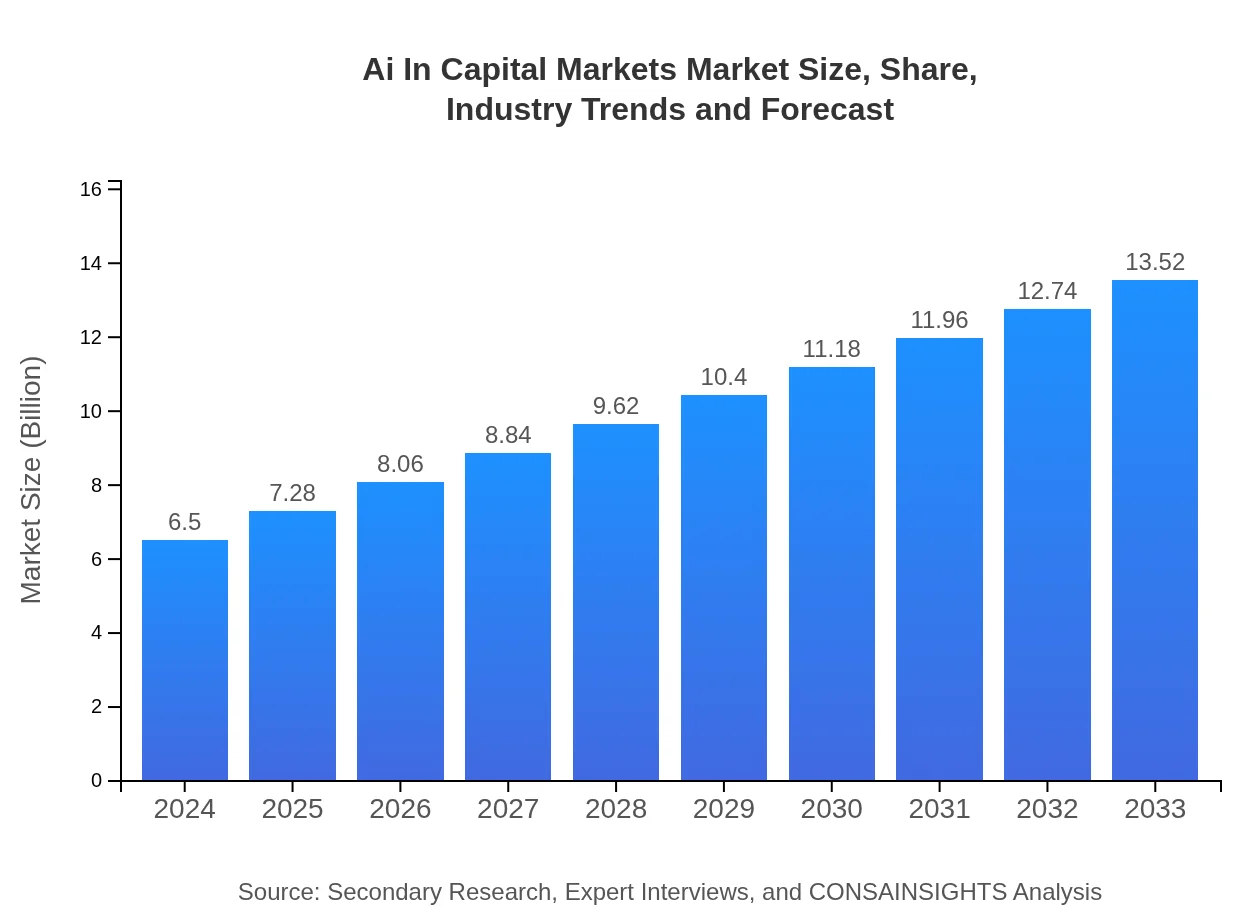

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $6.50 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $13.52 Billion |

| Top Companies | TechFin Solutions, CapitalAI Inc. |

| Last Modified Date | 24 January 2026 |

Ai In Capital Markets Market Overview

Customize Ai In Capital Markets market research report

- ✔ Get in-depth analysis of Ai In Capital Markets market size, growth, and forecasts.

- ✔ Understand Ai In Capital Markets's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Capital Markets

What is the Market Size & CAGR of Ai In Capital Markets market in 2024?

Ai In Capital Markets Industry Analysis

Ai In Capital Markets Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Capital Markets Market Analysis Report by Region

Europe Ai In Capital Markets:

Europe shows promising potential, with its market expected to grow from 1.70 in 2024 to 3.55 in 2033. Emphasis on regulatory adherence and digital innovation, coupled with collaborative fintech initiatives, drives strong regional performance.Asia Pacific Ai In Capital Markets:

In the Asia Pacific region, the market is anticipated to grow from a size of 1.29 in 2024 to 2.69 by 2033. Robust economic growth, rapid digital adoption, and supportive government policies are key drivers for expansion, fostering a fertile environment for AI integration.North America Ai In Capital Markets:

North America remains a dominant force with market size expanding from 2.48 in 2024 to an estimated 5.15 by 2033. High investment in R&D, technological infrastructure, and a mature financial ecosystem support these advances.South America Ai In Capital Markets:

South America is experiencing gradual adoption with market figures increasing from 0.28 in 2024 to 0.59 in 2033. Despite economic volatility, opportunities in emerging markets and focused technological investments are propelling steady growth.Middle East & Africa Ai In Capital Markets:

The Middle East and Africa region is predicted to see market growth from 0.74 in 2024 to 1.54 by 2033. Although emerging, increased technological investments and a focus on modernizing financial services are gradually fueling sector expansion.Tell us your focus area and get a customized research report.

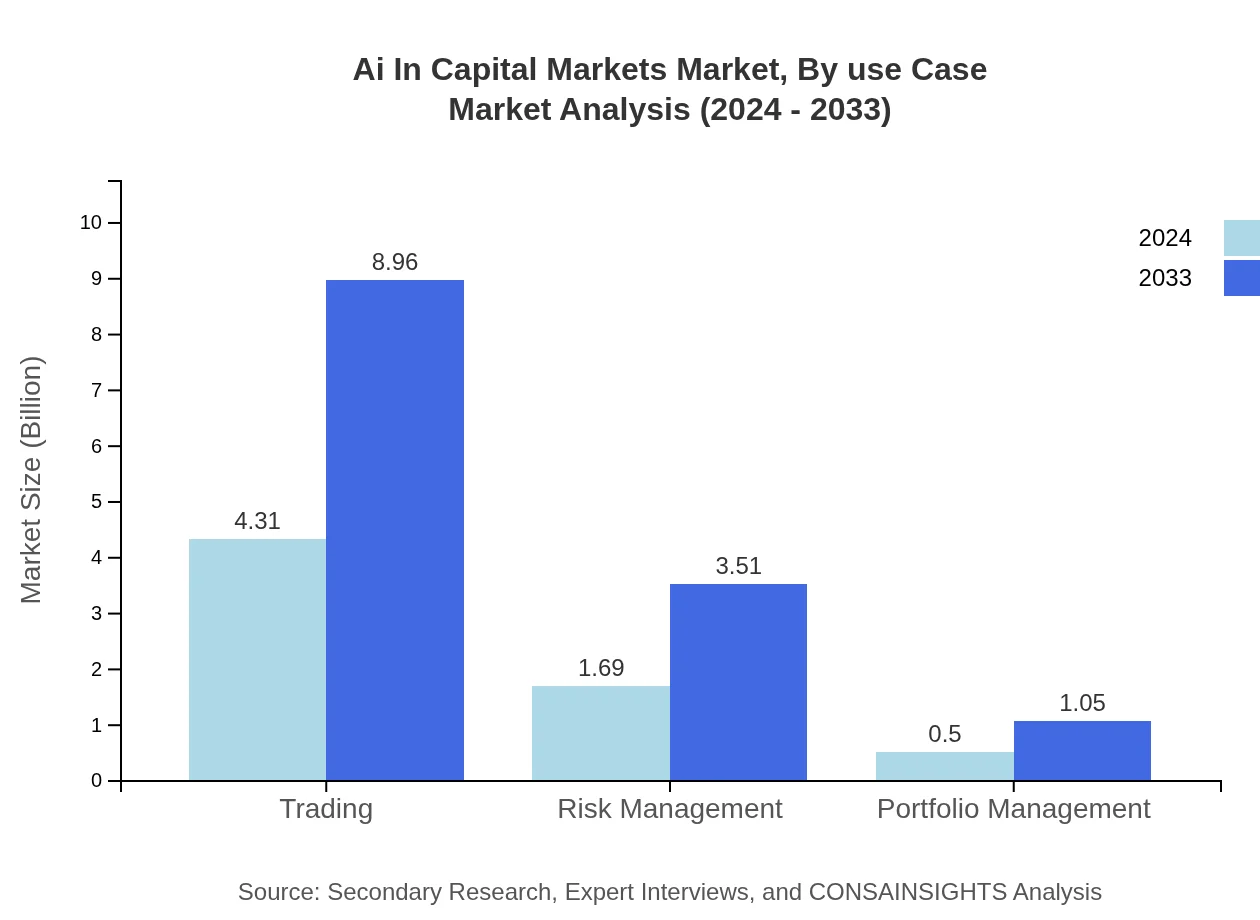

Ai In Capital Markets Market Analysis By Use Case

The by-use-case segment predominantly covers trading, risk management, and portfolio management applications. Trading has consistently dominated the landscape with substantial market sizes recorded at 4.31 in 2024, scaling to 8.96 by 2033, and maintaining a constant share of 66.3%. Risk management follows closely, with both market size and share growing proportionally, demonstrating a robust need for improved algorithmic risk controls. Portfolio management, though relatively smaller, shows promising growth potential, reflecting a trend towards automated investment strategies. This segmentation emphasizes the role of practical applications in transforming traditional operations.

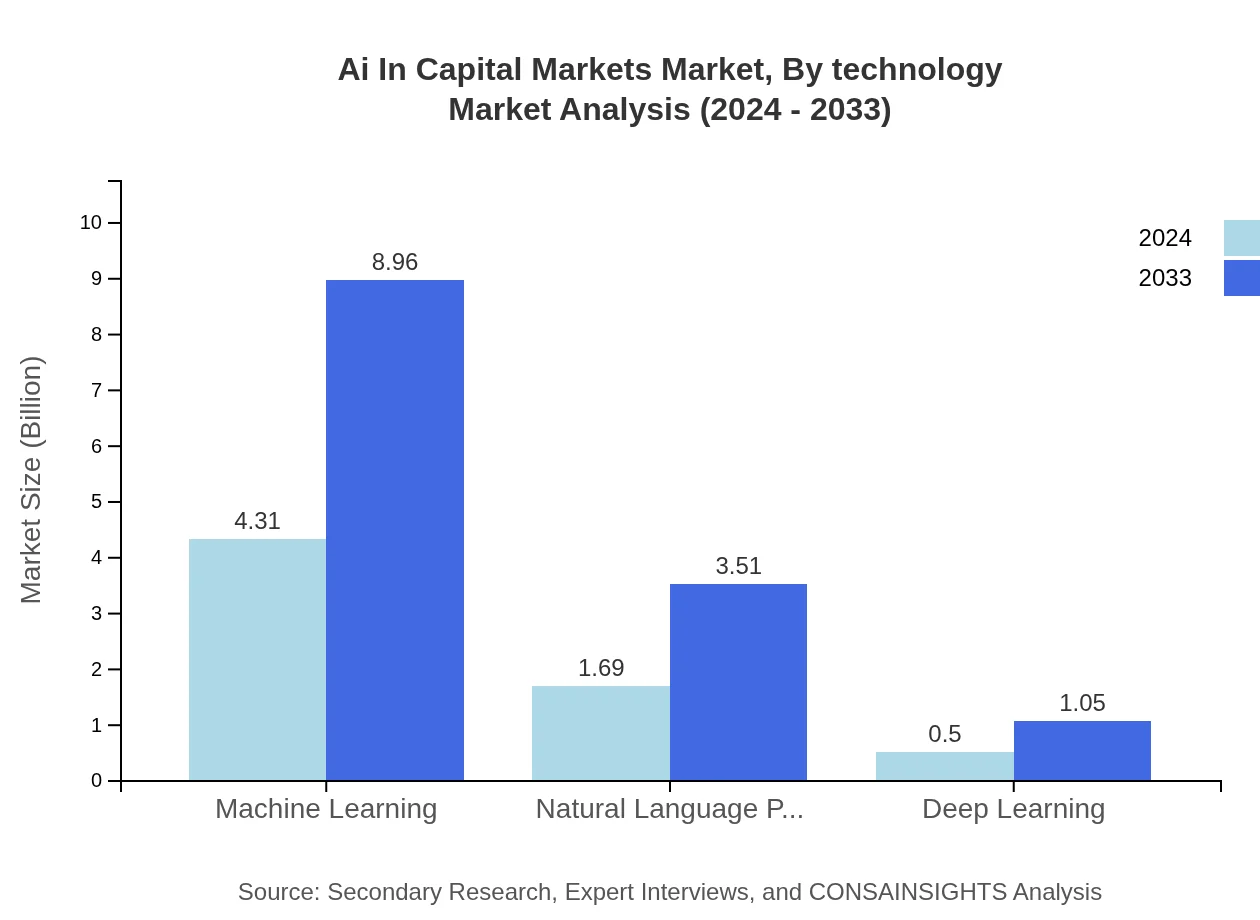

Ai In Capital Markets Market Analysis By Technology

Advanced technologies such as machine learning, natural language processing, and deep learning form the backbone of AI applications in capital markets. Machine learning drives significant innovation, with market sizes rising notably from 4.31 in 2024 to 8.96 in 2033, while maintaining a steady share. Similarly, natural language processing is crucial in parsing financial data and informing decision making, with its market performance echoing risk management trends. Deep learning, too, is gaining momentum, particularly in analyzing complex datasets to predict market movements. This technological segmentation highlights the importance of diverse AI methodologies in enhancing market efficiency and predictive accuracy.

Ai In Capital Markets Market Analysis By Investment Type

The by-investment-type segment distinguishes between retail and institutional investors, each adopting AI strategies tailored to distinct investment paradigms. Retail investors have shown considerable reliance on data analytics for informed trading, as highlighted by market data where their share remains robust over the forecast period. Institutional investors, benefiting from advanced risk modeling and automation, achieve similar consistency in market share growth. Key metrics indicate that both groups are instrumental in scaling AI adoption, driven by the need for enhanced market insights and improved transaction efficiency. This division not only illustrates market heterogeneity but also underlines the complementary nature of diverse investor profiles in the AI ecosystem.

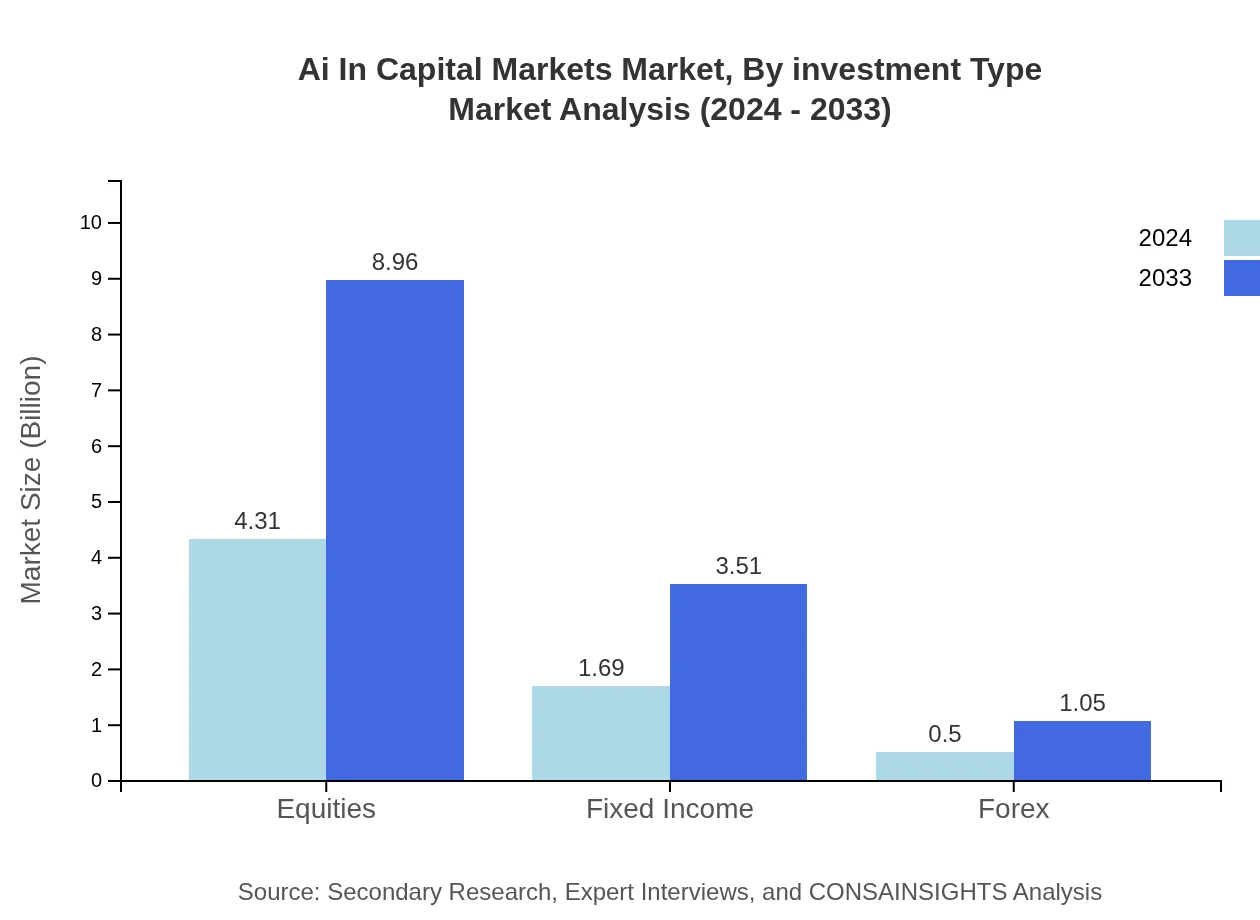

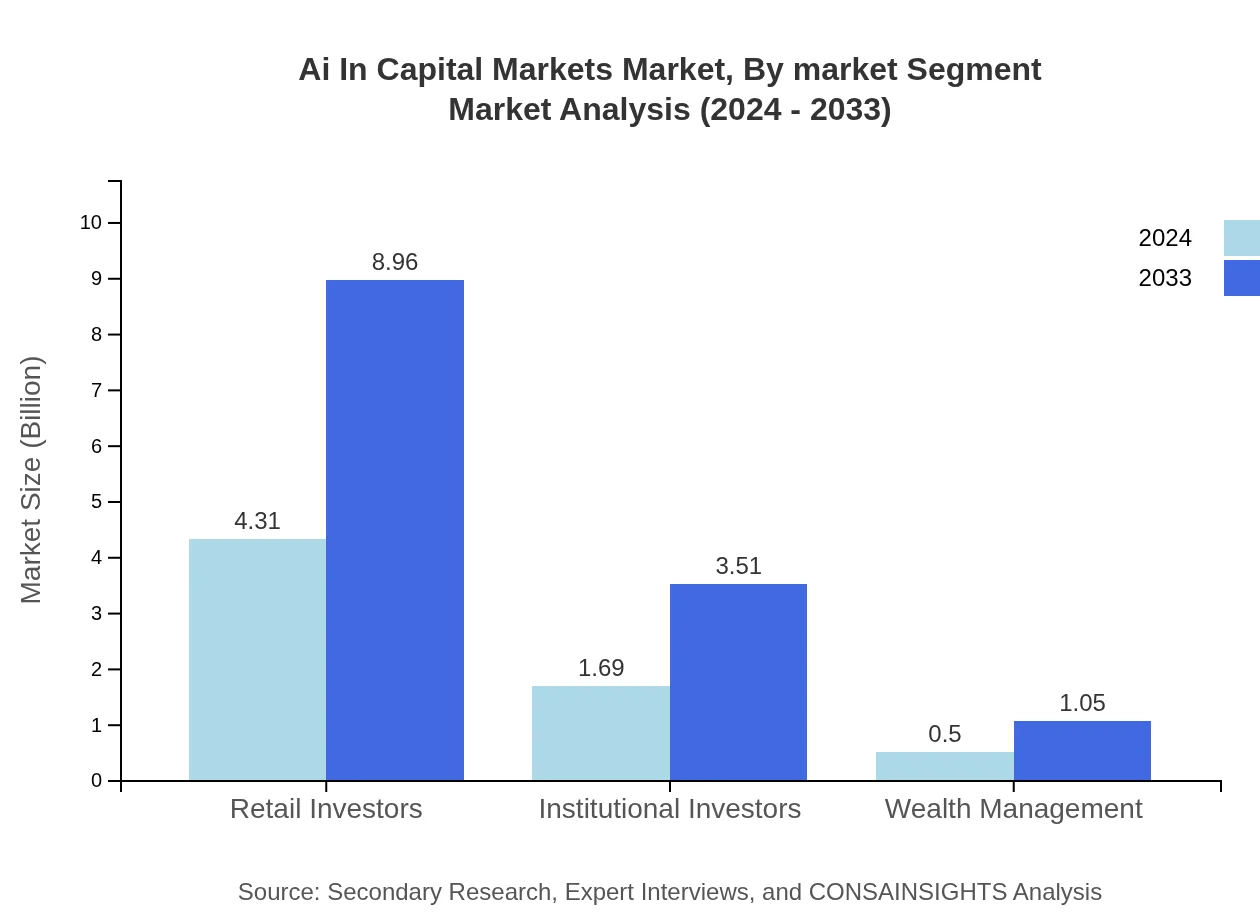

Ai In Capital Markets Market Analysis By Market Segment

The by-market-segment analysis encompasses asset classes including equities, fixed income, and forex. Equities represent the largest segment by size, with substantial market activity and a dominant share that mirrors global trading volumes. Fixed income, though smaller, benefits from AI-driven risk assessments and portfolio optimization, thus maintaining consistent growth figures. Forex trading harnesses AI technologies to respond to rapid market fluctuations with precision. Overall, companies operating across these market segments are investing heavily in AI integrations to boost liquidity, enhance portfolio diversification, and improve overall market transparency. This comprehensive approach underlines the transformative impact of AI across varied asset classes in capital markets.

Ai In Capital Markets Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Capital Markets Industry

TechFin Solutions:

TechFin Solutions is renowned for its state-of-the-art AI-powered trading platforms and risk management tools. Their innovative approach has set industry benchmarks, enabling financial institutions to streamline operations and enhance decision-making through advanced analytics and machine learning algorithms.CapitalAI Inc.:

CapitalAI Inc. delivers comprehensive AI integration services focused on transforming traditional capital markets. With robust solutions in algorithmic trading, portfolio management, and regulatory compliance, the company has become a trusted partner for major global financial institutions.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Capital Markets?

The AI in Capital Markets market is valued at $6.5 billion in 2024, with a projected compound annual growth rate (CAGR) of 8.2% through 2033. This growth indicates significant investment and development in AI technologies within capital markets.

What are the key market players or companies in this ai In Capital Markets industry?

Key players in the AI in Capital Markets industry include tech giants and financial institutions that are integrating AI solutions into trading, risk management, and portfolio management. Companies are focusing on enhancing efficiency and decision-making processes through advanced analytics.

What are the primary factors driving the growth in the ai In Capital Markets industry?

Growth in the AI in Capital Markets sector is driven by increasing data volumes, the need for real-time trading analysis, enhanced decision-making capabilities, and regulatory requirements. AI technologies streamline processes, optimize portfolios, and mitigate risks which fuels market expansion.

Which region is the fastest Growing in the ai In Capital Markets?

North America is the fastest-growing region in the AI in Capital Markets industry, projected to grow from $2.48 billion in 2024 to $5.15 billion by 2033. Europe and Asia Pacific also show strong growth, driven by technological adoption and investments in financial innovations.

Does ConsaInsights provide customized market report data for the ai In Capital Markets industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the AI in Capital Markets industry. Clients can request in-depth analysis, segment-specific insights, and other valuable data to support strategic decision-making.

What deliverables can I expect from this ai In Capital Markets market research project?

Deliverables from the AI in Capital Markets market research project include detailed reports, market size data, segment analysis, competitive landscape evaluations, growth forecasts, and actionable insights for strategic planning and investment purposes.

What are the market trends of ai In Capital Markets?

Current trends in the AI in Capital Markets sector include increased integration of machine learning and natural language processing, growth in algorithmic trading, and rising demand for AI-driven risk management tools. Firms are leveraging AI to enhance client services and operational efficiency.