Ai In Insurance Claims

Published Date: 24 January 2026 | Report Code: ai-in-insurance-claims

Ai In Insurance Claims Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the evolving role of artificial intelligence in insurance claims processing from 2024 to 2033. It provides detailed insights into market size, growth trends, segmentation, regional performance, technological innovations and future forecasts. Readers will gain an in‐depth understanding of current trends, industry challenges, and emerging opportunities in this critical domain.

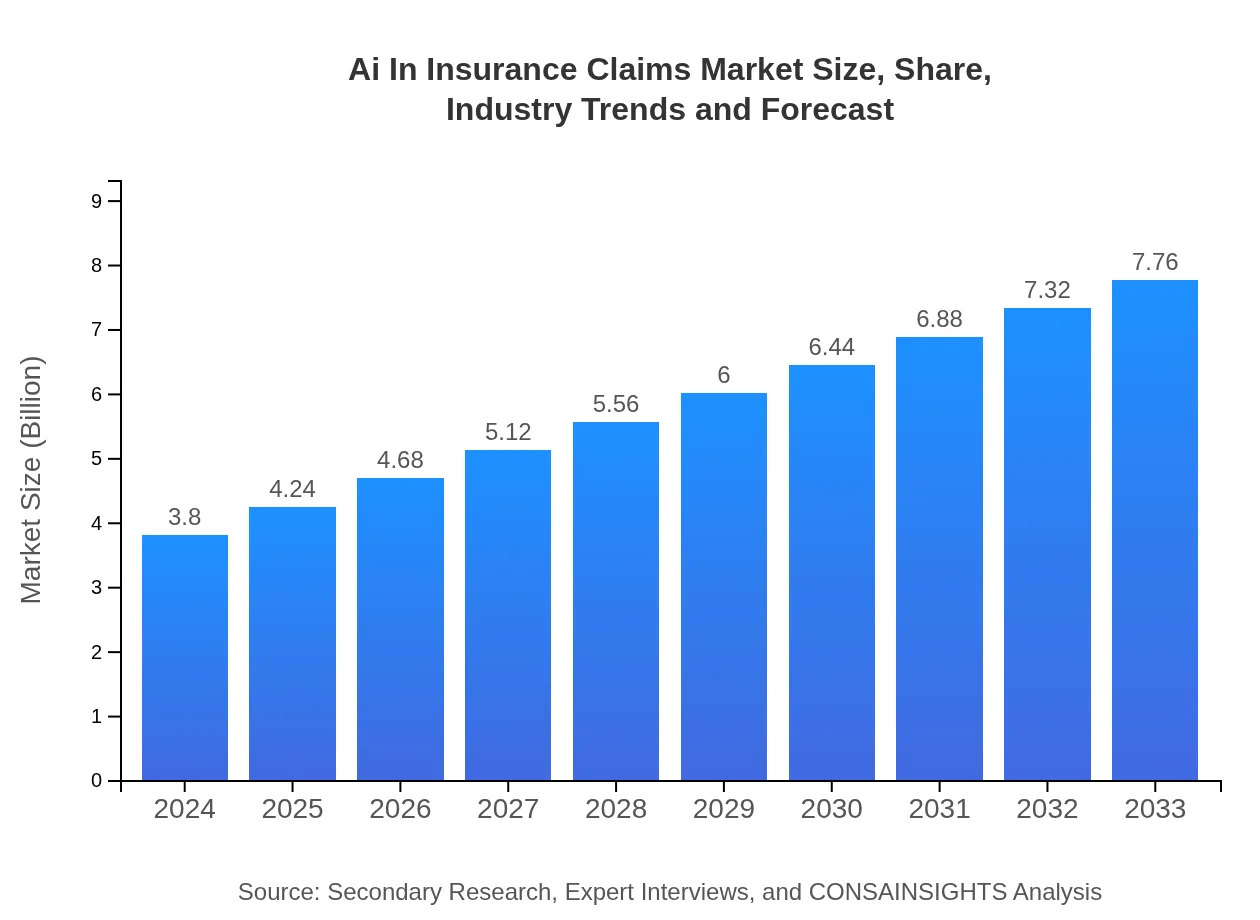

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.80 Billion |

| CAGR (2024-2033) | 8.0% |

| 2033 Market Size | $7.76 Billion |

| Top Companies | TechSure Innovations, ClaimXpert Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Insurance Claims Market Overview

Customize Ai In Insurance Claims market research report

- ✔ Get in-depth analysis of Ai In Insurance Claims market size, growth, and forecasts.

- ✔ Understand Ai In Insurance Claims's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Insurance Claims

What is the Market Size & CAGR of Ai In Insurance Claims market in 2024?

Ai In Insurance Claims Industry Analysis

Ai In Insurance Claims Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Insurance Claims Market Analysis Report by Region

Europe Ai In Insurance Claims:

Europe exhibits a mature market environment where insurance companies are progressively integrating AI tools to improve claim accuracy and reduce processing times. In 2024, the European market was estimated at 1.07 units and is projected to expand to 2.19 units by 2033. The push for enhanced operational efficiencies, coupled with increasing consumer demands for digital services, has led to robust investment in AI systems across various insurance segments in the region.Asia Pacific Ai In Insurance Claims:

Asia Pacific is witnessing rapid growth in AI adoptions due to favorable government policies, increased technological literacy, and a surge in digital insurance initiatives. In 2024, the market in this region was valued at approximately 0.79 units and is forecast to grow to 1.61 units by 2033. The region's dynamic consumer base and expanding middle-class are driving demand for efficient claims processing solutions, with insurers increasingly investing in automation and analytics to capitalize on these trends.North America Ai In Insurance Claims:

North America continues to be a prominent market for AI in insurance claims, with significant investments directed towards digital transformation and innovation. In 2024, the market was valued at around 1.35 units, with expectations to reach 2.75 units by 2033. The region benefits from high disposable incomes, advanced infrastructure, and early adoption of emerging technologies. Enhanced regulatory frameworks and a focus on customer-centric operations further support growth trends in this market.South America Ai In Insurance Claims:

South America presents a unique landscape characterized by a growing need to update outdated systems and adopt modern technological solutions. Despite a smaller base compared to other regions, the market is gradually embracing AI for claims processing. This sustained shift is fueled by the need for transparency, faster service delivery, and improved fraud detection, ensuring that insurers remain competitive in an increasingly digital marketplace.Middle East & Africa Ai In Insurance Claims:

The Middle East and Africa, though smaller in terms of current market size, are emerging as important regions for AI innovation in insurance claims. In 2024, the market stood at 0.30 units, with expectations to grow to 0.61 units by 2033. Increasing economic diversification, regulatory reforms, and a rising need for improved claims management processes are initiating a gradual yet steady adoption of AI technologies in this region.Tell us your focus area and get a customized research report.

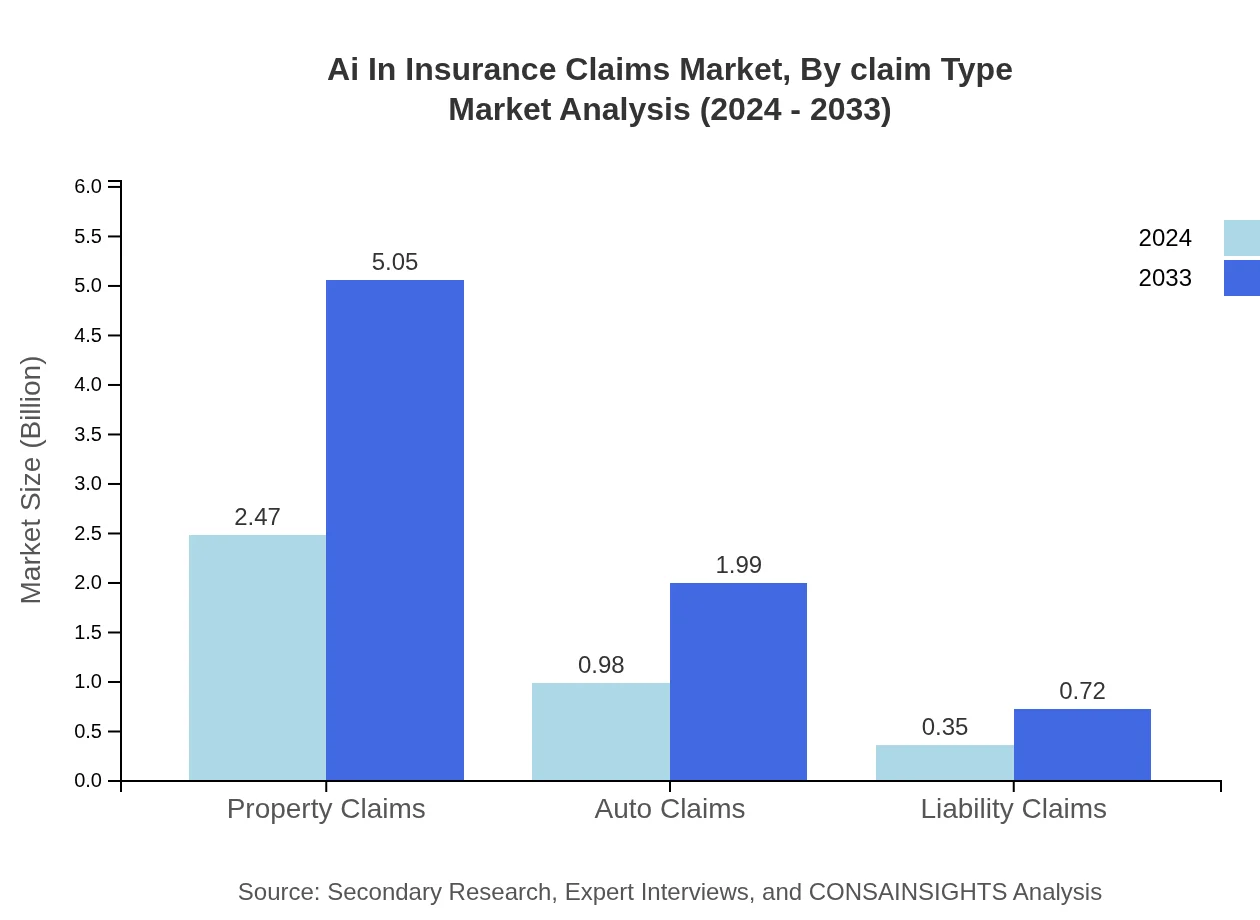

Ai In Insurance Claims Market Analysis By Claim Type

This segment evaluates the performance of different claim types including Property Claims, Auto Claims, and Liability Claims. In 2024, Property Claims were valued at 2.47 units with a constant share of 65.05%, while Auto Claims and Liability Claims contributed 0.98 and 0.35 units respectively, with shares of 25.68% and 9.27%. The growth trajectory by 2033 indicates substantial expansions in size, reflecting increased claim complexities and the necessity for automated adjudication.

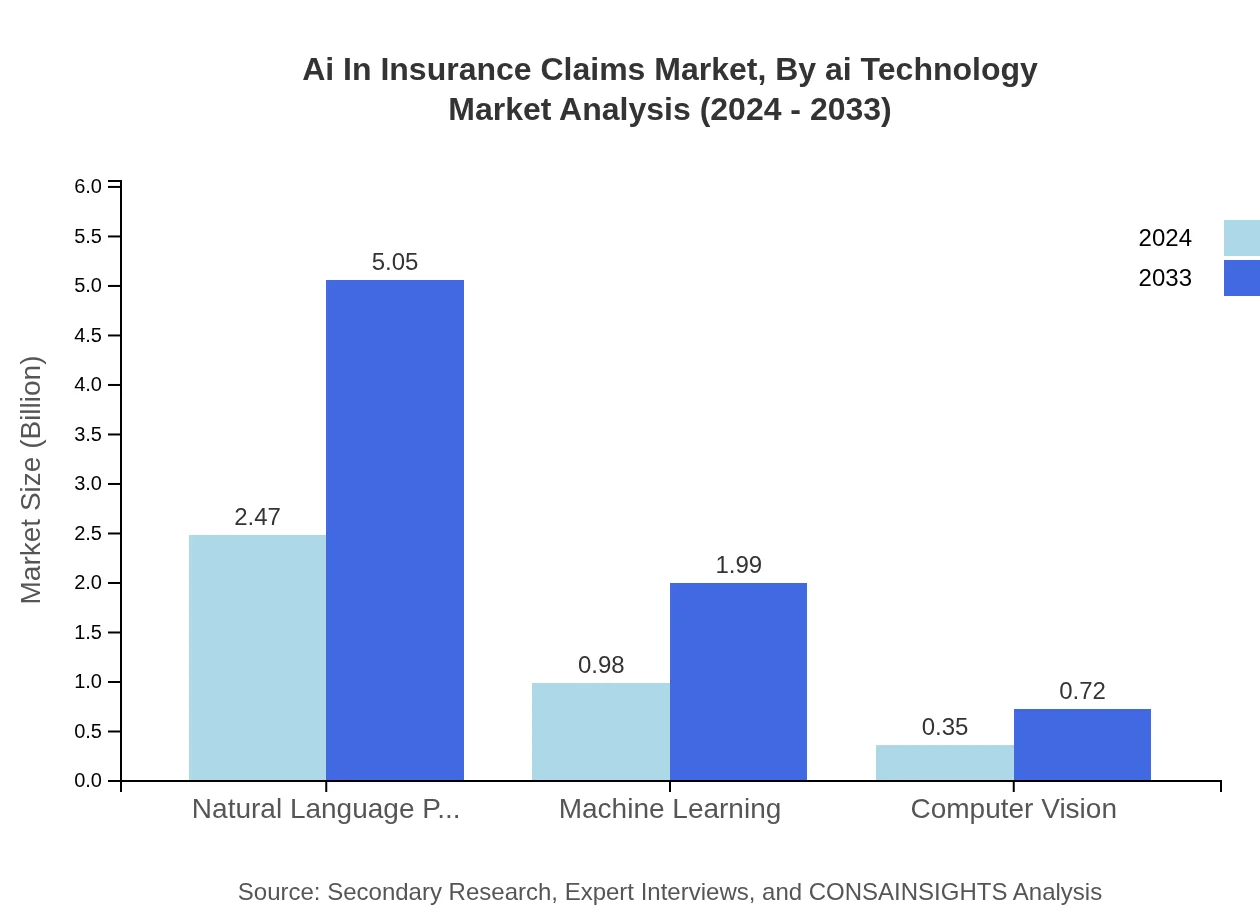

Ai In Insurance Claims Market Analysis By Ai Technology

The technological segmentation reviews advancements in Natural Language Processing, Machine Learning, and Computer Vision. In 2024, Natural Language Processing held a market size of 2.47 units with a robust share of 65.05%, while Machine Learning and Computer Vision were positioned at 0.98 and 0.35 units respectively, each maintaining shares of 25.68% and 9.27%. These technologies are critical in enhancing the accuracy of document interpretation and risk assessment, paving the way for more intelligent, responsive claims management systems.

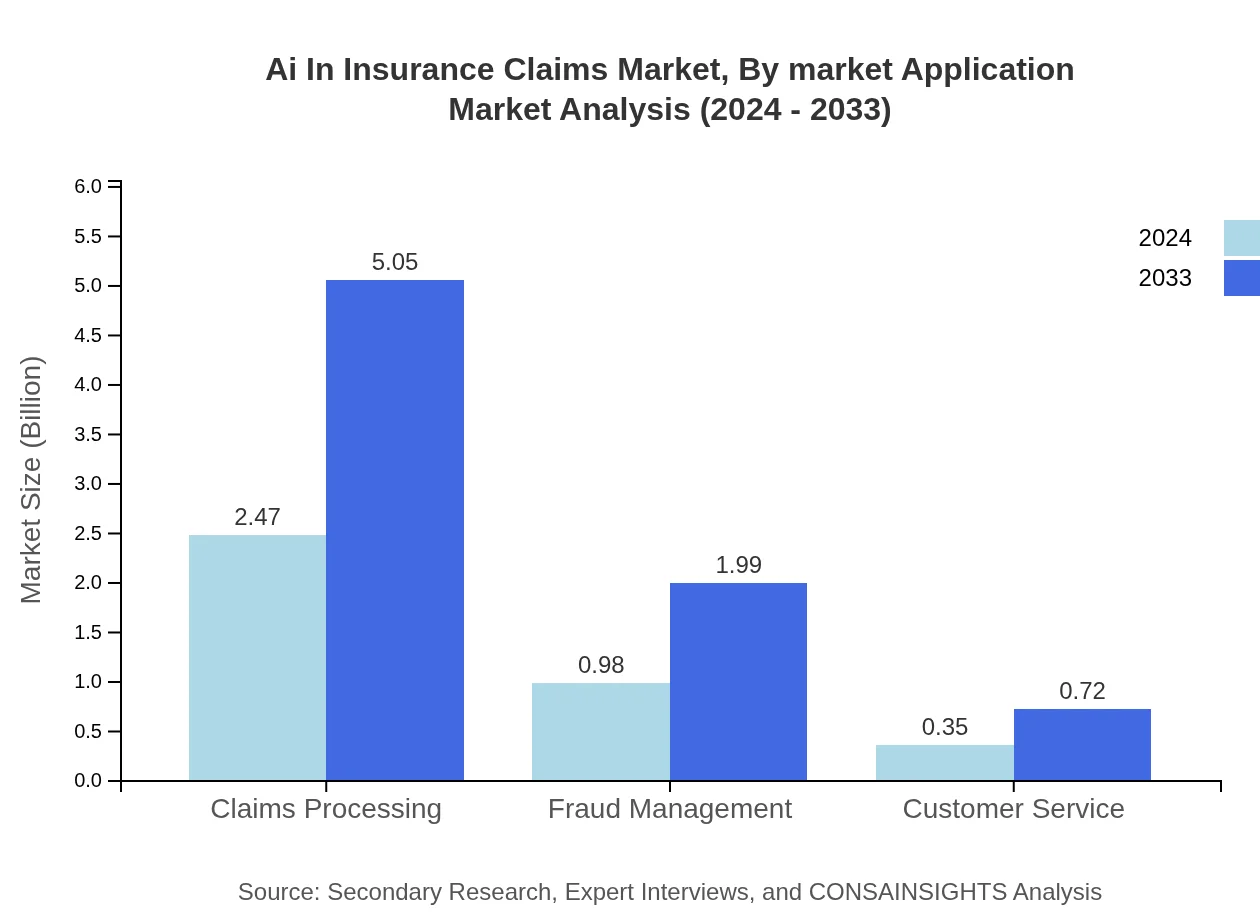

Ai In Insurance Claims Market Analysis By Market Application

Focusing on the operational applications, this segment covers Claims Processing, Fraud Management, and Customer Service. In 2024, Claims Processing accounted for 2.47 units with a dominant market share of 65.05%, whereas Fraud Management and Customer Service contributed 0.98 and 0.35 units correspondingly, each with shares of 25.68% and 9.27%. These applications not only expedite claim resolution but also substantially mitigate risks related to fraudulent activities, ensuring enhanced service delivery and trust.

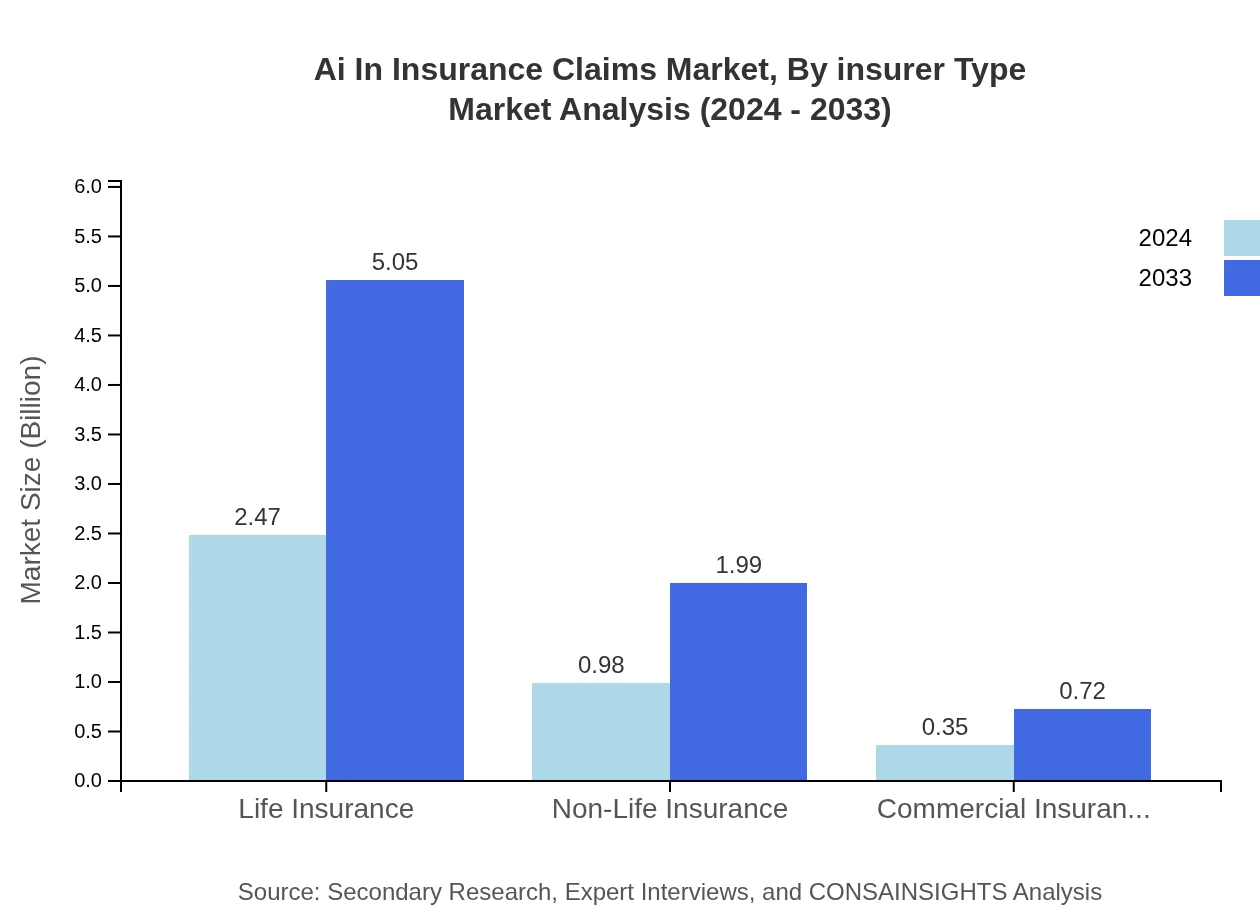

Ai In Insurance Claims Market Analysis By Insurer Type

This segment differentiates between Life Insurance, Non-Life Insurance, and Commercial Insurance. In 2024, Life Insurance and Non-Life Insurance segments were both significant, with life insurance capturing 2.47 units at a 65.05% share and non-life insurance at 0.98 units with a share of 25.68%, while Commercial Insurance was valued at 0.35 units holding a 9.27% share. This segmentation emphasizes the tailored deployment of AI solutions to meet the unique demands of each insurer type, ensuring precision and efficiency.

Ai In Insurance Claims Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Insurance Claims Industry

TechSure Innovations:

TechSure Innovations is at the forefront of AI integration in insurance claims processing, offering cutting-edge solutions that enhance fraud detection, improve claims adjudication, and streamline customer interactions. Their robust algorithms and scalable platforms have revolutionized claim handling for multiple global insurers.ClaimXpert Solutions:

ClaimXpert Solutions has garnered a strong reputation for its advanced analytical tools and AI-driven platforms that optimize the claims lifecycle. With a focus on improving operational efficiencies and reducing processing times, the company continues to be a trusted partner for insurers seeking innovative digital transformation.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Insurance Claims?

The AI in Insurance Claims market is projected to reach $3.8 billion by 2024, growing at a CAGR of 8.0% through 2033. This growth reflects the increasing adoption of AI technologies to streamline claims processing and enhance customer service.

What are the key market players or companies in this ai In Insurance Claims industry?

Key players in the AI in Insurance Claims industry include major insurance firms and technology providers that focus on AI solutions, enhancing claims processing efficiency, fraud detection, and customer engagement, establishing a competitive landscape critical for market growth.

What are the primary factors driving the growth in the ai In Insurance Claims industry?

Growth in the AI in Insurance Claims industry is driven by increasing demand for automation in claims processing, rising operational efficiencies, enhanced fraud management capabilities, consumer expectations for faster service, and technological advancements in machine learning and natural language processing.

Which region is the fastest Growing in the ai In Insurance Claims?

The fastest-growing region in the AI in Insurance Claims market is North America, with the market expected to grow from $1.35 billion in 2024 to $2.75 billion by 2033. The region leads in technological adoption and innovation in insurance technology.

Does ConsaInsights provide customized market report data for the ai In Insurance Claims industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the AI in Insurance Claims industry, ensuring relevant insights and strategic data that align with business objectives and market challenges.

What deliverables can I expect from this ai In Insurance Claims market research project?

From the AI in Insurance Claims market research project, you can expect detailed reports including market size estimates, growth projections, competitive analysis, key market trends, segment breakdowns, and insights into customer needs and technological impacts.

What are the market trends of ai In Insurance Claims?

Market trends in AI for Insurance Claims include increasing deployment of machine learning for predictive analytics, integration of natural language processing for customer engagement, growth in automated claims processing, and advancing technologies to enhance fraud detection and improve overall service quality.